Credit Card Holders in Canada More Satisfied with Non-Traditional Issuers, J.D. Power Finds

Tangerine Ranks Highest in Overall Credit Card Customer Satisfaction

TORONTO: 19 Sept. 2019 — Canada’s non-traditional credit card issuers are winning the hearts of customers with more compelling rewards, benefits and services as consumer preferences, lifestyle and expectations shift. According to the J.D. Power 2019 Canada Credit Card Satisfaction Study,SM the top four credit card issuers collectively have significantly higher customer satisfaction than other issuers included in the study (799 vs. 754, respectively, on a 1,000-point scale), and significantly outperform them in rewards (835 vs. 757); benefits and services (743 vs. 689); and credit card terms (768 vs. 718).

“Non-traditional credit card issuers are making significant headway, differentiating themselves with rewards and benefits that better resonate with consumers,” says John Cabell, Director, Wealth and Lending Intelligence at

J.D. Power. “This differentiation, especially when it comes to customer understanding of benefits and redeeming rewards, has significant ramifications on issuers’ ability to attract or retain customers, as well as their revenue potential and ability to hedge against possible future market disruptors such as Apple Card.”

According to the study, customers who fully understand the benefits offered by their credit card issuer have significantly higher satisfaction levels compared with those who do not completely understand the benefits (840 vs. 736, respectively) and are nearly twice as likely (66% vs. 38%) to recommend their card to others. Furthermore, the fully knowledgeable client group is less likely to switch their current card issuer for better benefits (38% vs. 46%, respectively).

The top four credit card issuers do a better job in meeting key performance indicators (KPIs) than other issuers in the study, especially when it comes to their customers completely understanding how to redeem rewards (78% vs. 63%, respectively) and ease of finding information about benefits (40% vs. 30%). As a contributing result, these top four issuers have a more positive brand image since they are perceived as more customer-driven (5.08 vs. 4.64 on a 7-point scale); more proactive (5.57 vs. 5.29); and friendlier (5.70 vs. 5.45).

Following are additional key findings of the 2019 study:

- Cash rewards most popular: Cash rewards/cash-backs are the most popular rewards (30%), followed by airline tickets (23%). Customers who highly value the amount of rewards earned per dollar spent (rating of 9 or 10 on a 10-point scale) are significantly more likely to recommend their card and to spend an additional $277, on average, than those who rated the amount of rewards earned per dollar spent 5 or lower. Relatedly, the relaunch of Aeroplan Loyalty miles for Air Canada customers is an important milestone in the credit card industry.

- Hotels drive higher satisfaction among benefits: Benefits that have the most influence on satisfaction when used by credit card holders are hotel (814); shopping (799); and other travel-related benefits (774). However, while these benefits provide the greatest effect on benefits and services satisfaction, they are not frequently used. Utilization among card holders is only 2% for hotel benefits, 9% for shopping benefits and 6% for other travel-related benefits.

- “Less is more” with customer communications: Surprisingly—and counter to customers in the United States—customers in Canada have higher satisfaction when they are contacted only once or twice annually by their issuer. By comparison, satisfaction among U.S. customers is higher when they receive three or four communications per year. Interestingly, satisfaction with communications among customers in Canada declines as the number of communications increases (806 for communicating once vs. 772 when contacted seven or more times). Email is the most preferred method of communications by customers across all age groups, although it is not used by issuers as often as customers would like.

- Canadian cardholders continue to embrace digital channels: Usage of issuers’ digital channels has been on the rise in Canada during the past year among all age groups. In fact, 44% of customers age 40 and older have been using their credit card company’s mobile website and 29% have been using the mobile app. This represents a year-over-year increase of 8 percentage points for mobile websites and 5 percentage points for mobile apps. Issuers should look beyond the “must-have features” and incorporate additional functionalities into these digital channels that positively affect satisfaction. Some of these add-value features include the ability to check credit bureau score; credit line increase request; biometric login; and pre-login balance display.

Study Rankings

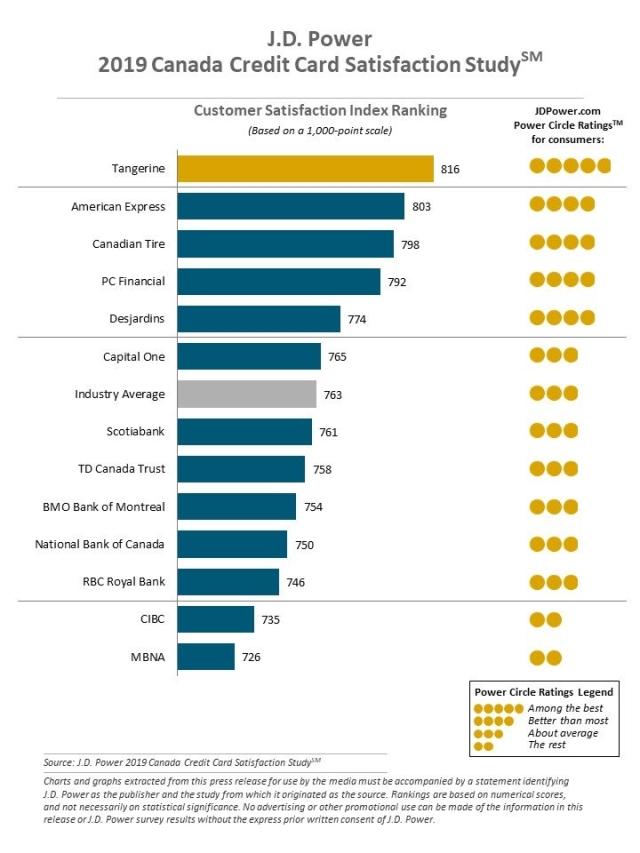

Tangerine ranks highest in overall customer satisfaction among credit card issuers in Canada with a score of 816, which is 53 points higher than the industry average (763). American Express (803) ranks second and Canadian Tire (798) ranks third.

The Canada Credit Card Satisfaction Study measures satisfaction of card holders’ primary credit card issuer. The study measures performance in six factors critical to the customer experience (in alphabetical order): Benefits and Services; Communication; Credit Card Terms; Customer Interaction; Key Moments; and Rewards. The study was fielded between May and June 2019 and includes responses from 6,617 card holders who used a major credit card in the past three months.

For more information about the Canada Credit Card Satisfaction Study, visit

https://canada.jdpower.com/business/resource/canada-credit-card-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; 647-259-3288: sandy.caetano@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info