Digital Divide among Retail Bank Customers Drags Satisfaction Level, J.D. Power Finds

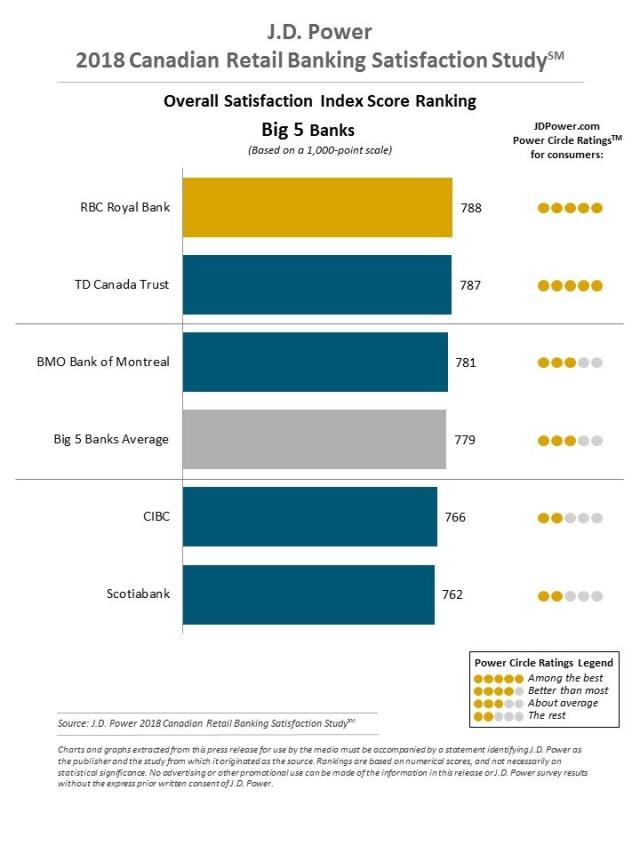

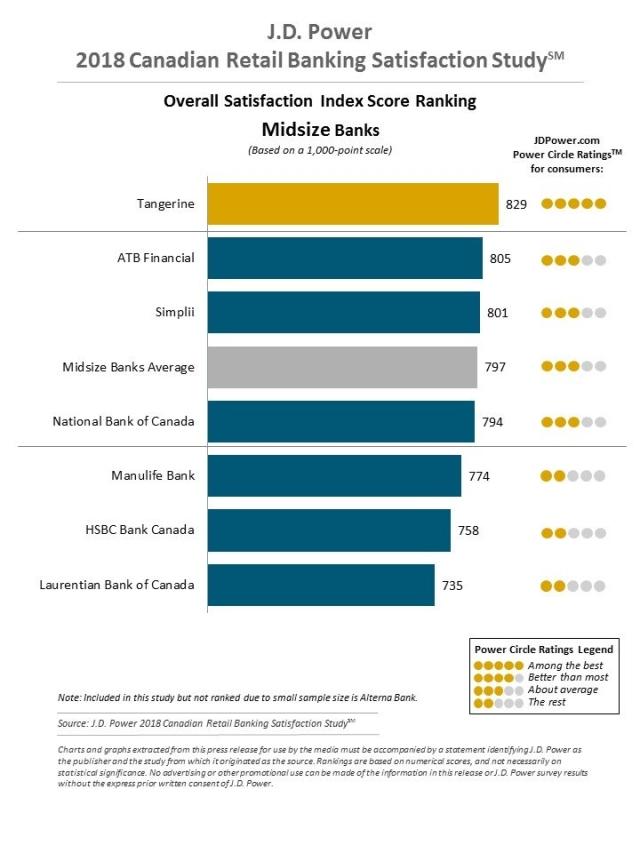

RBC Royal Bank and Tangerine Rank Highest in Respective Segments

TORONTO: 3 May 2018 — Canadian banks’ significant investment into technology is paying off in shifting more people to leverage digital channels, with 47% of retail banks customers now categorized as “digital-centric.” In fact, 32% of customers who use retail banking are digital-only customers who opt to do their banking solely online or with a mobile device, according to the J.D. Power 2018 Canadian Retail Banking Satisfaction Study,SM released today.

While utilization of digital tools increases satisfaction among customers who use branches, satisfaction with the banking relationship is lowest among customers in the digital-only segment. Satisfaction among digital-only customers is 22 points lower than among digital-centric customers who occasionally use branches (766 vs. 788 on a 1,000-point scale).

“Canadian banks have made significant commitments to technological investments by digitizing their services and channels in recent years,” said Bob Neuhaus, Financial Services Consultant at J.D. Power. “Digital channels give banks an enormous opportunity to reduce costs, but the risk is that those cost savings come with lower levels of customer engagement. Once banks address the growing digital divide within customer segments, customer satisfaction can improve.”

Following are some key findings of the 2018 study:

- Communication misalignment: While banks still rely heavily on phone calls to proactively communicate, digital-centric and branch-dependent customers show clear preference for other forms of communication. Email is considered the most preferred channel of communication by digital-centric and branch-dependent customers (42% and 33%, respectively), yet only about 1 in 5 customers indicate their most recent bank communication was delivered via email. As banks push further into digital transformation, they need to move in lockstep with their customers beyond the email era and incorporate a full range of digital communication options such as mobile texting, in-app messaging and social media.

- Millennials[1] embrace mobile banking more than anyone: The adoption of mobile banking is on the rise, with Millennials leading the charge. More than three-fourths (77%) of Millennial retail bank customers have used mobile banking over the past three months. While balance checking and bill payments are the most common mobile banking functions, banks are missing out on other mobile-enabled service opportunities that lift satisfaction levels, such as special promotions, biometric log-ins and balance display prior to logging in.

“In comparison to their U.S. counterparts, customers in Canada are more self-service-oriented, which presents even greater opportunities for retail banks to push further on the digital transformation front,” Neuhaus noted. “But to be successful, banks should put emphases on best practices for highly personalized digital interactions along with branch transformation efforts that serve the needs of both digital-centric and branch-dependent customers.”

Study Rankings

The study measures customer satisfaction with Canada’s large and midsize banks. The scores reflect satisfaction of the entire retail banking customer bases of these banks, representing a broader group of customers than just the branch-dependent and digital-centric segments.

RBC Royal Bank ranks highest in overall customer satisfaction for a third consecutive year among Big 5 Banks, achieving a score of 788. TD Canada Trust ranks second with a score of 787, followed by BMO Bank of Montreal with a score of 781.

Among Midsize Banks, Tangerine ranks highest in overall customer satisfaction for a seventh consecutive year, with a score of 829. ATB Financial (805) and Simplii (801) rank second and third, respectively.

The Canada Retail Banking Satisfaction Study measures customers’ satisfaction in six factors (listed in alphabetical order): channel activities; communication and advice; convenience; new account opening; problem resolution; and products and fees. Channel activities include seven subfactors (listed in alphabetical order): assisted online service; ABM; branch service; call centre service; IVR/automated phone service; mobile banking; and online banking. The study is based on responses from nearly 14,000 retail banking customers of Canada’s largest and midsized banks regarding their experiences with their retail bank. It was fielded from June 2017 to January 2018.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Stephanie Ronson, Cohn & Wolfe; Toronto, Canada; 647-259-3278, stephanie.ronson@cohnwolfe.ca

Geno Effler; J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); and Gen Y (1977-1994). Xennials (1978-1981) and Millennials (1982-1994) are subsets of Gen Y.