Overall Customer Satisfaction Dips among Canadian Banking App Users, J.D. Power Finds

RBC Royal Bank Ranks Highest in Overall Satisfaction for Second Consecutive Year

TORONTO: 8 June 2018 — Although nearly half of customers of Canadian retail banks are now considered “digital-centric” frequent users of mobile banking apps,[1] customer satisfaction with the mobile banking experience has significantly declined this year. According to the J.D. Power 2018 Canada Banking App Satisfaction Study,SM overall customer satisfaction with banking apps decreases 11 points (on a 1,000-point scale) this year as more customers adopt digital as their primary interaction channel.

“The large-scale push toward digital transformation by Canadian banks has had the desired effect of moving more customers onto more cost-effective digital channels but, in some cases, that transition is coming at the expense of customer satisfaction,” said Bob Neuhaus, Senior Director of Financial Services at J.D. Power. “As mobile apps rapidly become the primary interaction channel for retail bank customers, it’s become critical for banks to make sure their customers completely understand all of the features their apps include and continue to add value through the digital channel. Currently, fewer than 70% of customers in North America indicate they have a complete understanding of the feature-rich apps being offered by their banks.”

Following are some key findings of the 2018 study:

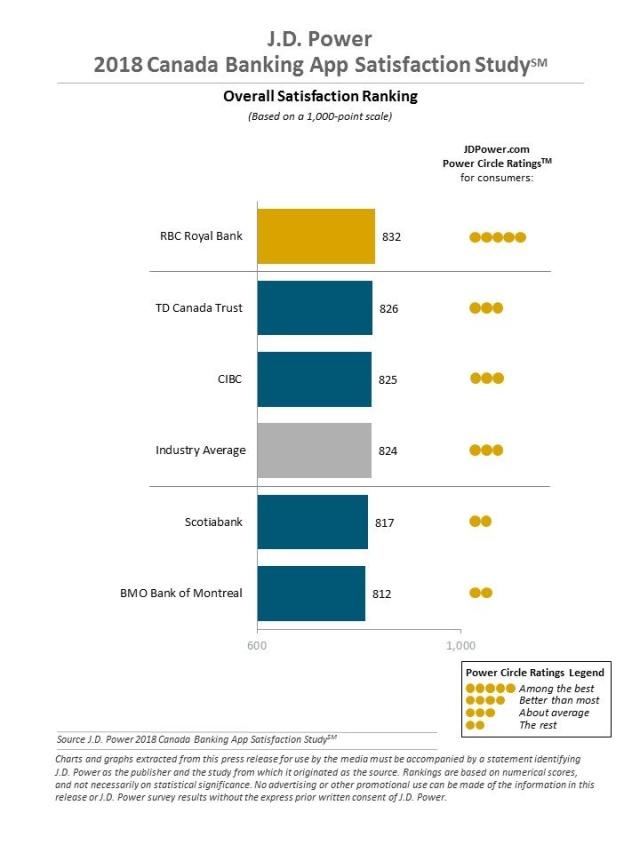

- Bank app satisfaction declines as mobile adoption grows: The overall customer satisfaction score for retail bank mobile apps is 824, which is 11 points lower than last year. Each bank profiled in the 2018 study has declined in overall satisfaction. With 43% of bank customers using their mobile apps in the past three months, mobile has become a critical interaction channel for the industry1.

- Understanding feature-laden apps is important: The ability to completely understand all app features has the greatest effect on overall satisfaction among banking app users. Complete customer understanding of their mobile apps is associated with an 84-point improvement in overall satisfaction with banking apps. Despite this significant influence, fewer than 68% of customers in North America—less in Canada—indicate a complete understanding of all features in their banking and credit card apps.

- Frequent users have higher levels of satisfaction: Overall satisfaction increases by 61 points among customers who utilize their apps 12 or more times per month when compared with those using their apps three or fewer times per month.

- Highest-performing apps have rich feature set: The highest-performing apps in the study have a combination of high functionality and high performance, which means they have features such as multiple security login options, built-in chat functionality and account management functions, all of which are user-friendly and well-designed.

Study Rankings

RBC Royal Bank ranks highest in overall satisfaction for a second consecutive year, with a score of 832. TD Canada Trust ranks second with a score of 826 and CIBC ranks third with a score of 825. Illustrating the tight competition in the mobile app space, just 20 points separates the highest-ranked and lowest-ranked performers in the study.

The 2018 Canada Banking App Satisfaction Study measures overall satisfaction with mobile banking applications based on five factors (in order of importance): ease of navigation; appearance; clarity of information; range of services; and availability of key information. The study is based on responses from 1,741 retail bank customers nationwide. It was fielded in April-May 2018.

The Canada Banking App Satisfaction Study, visit http://canada.jdpower.com/business/resource/canadian-banking-mobile-app-satisfaction-study

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; Toronto, Canada; 647-259-3288, sandy.caetano@cohnwolfe.ca

Geno Effler; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules /business/about-us/press-release-info

[1] J.D. Power 2018 Canadian Retail Banking Satisfaction StudySM