Retail Bank Customers in Canada Seek Advice as Most are Financially Unhealthy, J.D. Power Finds

BMO Bank of Montreal and RBC Royal Bank Rank Highest in a Tie in Customer Satisfaction with Retail Banking Advice

TORONTO: 30 June 2022 — A full 59% of retail bank customers in Canada are now classified as financially unhealthy[1] as the strain of rising household costs and record levels of personal debt push many to seek financial guidance from their financial institutions. According to the J.D. Power 2022 Canada Retail Banking Advice Satisfaction Study,SM released today, 50% of banking customers expect their financial institutions to help them improve their financial health.

"The role financial institutions play as trusted sources of guidance and financial advice cannot be overstated, particularly in a challenging economic environment like the one we’re in now," said Jennifer White, senior director for banking and payments intelligence at J.D. Power. “Despite the growing importance of financial advice, however, many banks are missing the mark by under-delivering when it matters most. Key performance indicators, such as providing an in-depth review of customers’ financial situations or providing tips to help customers stay on budget, are met less than 50% of the time."

Following are key findings of the 2022 study:

- Targeted, personalized financial advice drives gains in customer satisfaction: Overall customer satisfaction increases 229 points (on a 1,000-point scale) when customers are offered advice/guidance that they say completely meets their needs. Banks manage to achieve this 53% of the time, and 72% of customers who receive advice from their banks act on it.

- Bank customers feeling financially vulnerable: Using respondent-cited data on spending/savings ratio, credit worthiness and safety-net items such as insurance coverage, J.D. Power creates a measure of customer financial health, placing customers on a continuum from healthy to vulnerable. Just 47% of bank customers who have received advice fall into the financially healthy category. The remaining 53% are categorized as either vulnerable (28%), overextended (15%) or stressed (10%).

- Advice is expected, but not always received: Half (50%) of retail bank customers say they expect their financial institutions to help improve their financial health. The percentage of bank customers who say they recall two or more instances of receiving advice from their institution is 56%, down from 61% a year ago.

- Moving forward: Retail bank customers want advice and guidance. When two or more instances of advice are recalled by customers, overall satisfaction increases 75 points. But a cookie-cutter approach will not suffice. Advice and guidance must be personalized to the specific customer and delivered to the right person at the right time. When advice is tailored to meet customers’ specific needs, satisfaction is even higher. Satisfaction rises to 667 when customers receive advice just once that is personalized compared with lower satisfaction (561) among customers who receive advice on five or more topics that is not personalized.

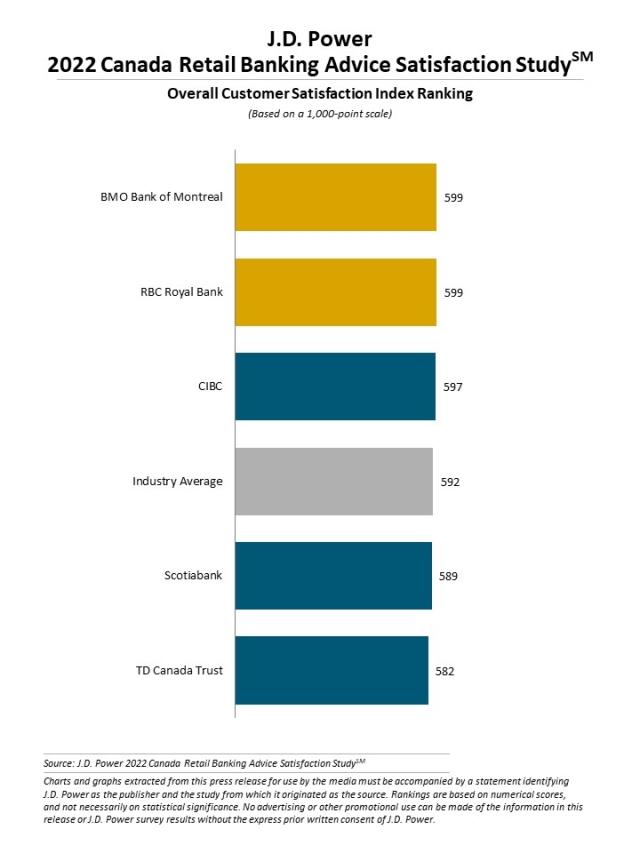

Study Ranking

BMO Bank of Montreal and RBC Royal Bank rank highest, in a tie, in customer satisfaction with retail banking advice, each with a score of 599. CIBC (597) ranks third. The industry average is 592.

The 2022 Canada Retail Banking Advice Satisfaction Study includes responses of 2,351 retail bank customers in Canada who received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. The study was fielded in January-February 2022. In addition to bank financial advice ratings, the study also provides financial health support index benchmarking data evaluating banks and credit card issuers’ proficiency in delivering financial support to customers.

Top-performing banks in the banking financial health support index are (in alphabetical order): CIBC and RBC Royal Bank. Top-performing credit card providers in the credit card financial support index are (in alphabetical order): CIBC, RBC Royal Bank and Scotiabank.

For more information about the Canada Retail Banking Advice Satisfaction Study, visit

https://canada.jdpower.com/financial-services/canada-banking-advice-satisfaction-study.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

Media Relations Contacts

Gal Wilder, NATIONAL; 416-602-4092; gwilder@national.ca

Nicole Herback, NATIONAL; 403-200-1187; nherback@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

[1] J.D. Power measures the financial health of consumers as a metric combining their spending/savings ratio, credit worthiness and safety net items such as insurance coverage. Consumers are placed on a continuum metric ranging from healthy to vulnerable.