Bank Customers in Canada Still Feel Economic Pinch, Look to Banks for Financial Advice, J.D. Power Finds

New Immigrants More Likely to Recall Financial Advice from Their Bank

TORONTO: 27 June 2024 — Although interest rates and inflation have started to trend downward, many bank customers in Canada are still feeling the economic squeeze and the majority of them express interest in receiving financial advice from their bank, according to the J.D. Power 2024 Canada Retail Banking Advice Satisfaction Study,SM released today. Nearly two-thirds (65%) of bank customers are experiencing some level of financial distress1 and 80% indicate interest in receiving advice from their financial institution.

“Bank customers’ appetites for financial advice is high and an increase in quality advice will only increase their customer satisfaction,” said Jennifer White, senior director for banking and payments intelligence at J.D. Power. “Therefore, providing personalized advice is mutually beneficial as customers who receive it are taking actions and benefitting financially, while banks are experiencing strong engagement and brand advocacy.”

Following are some key findings of the 2024 study:

- Advice recall high, especially among new immigrants and younger customers: More than half (52%) of all bank customers remember receiving financial advice from their bank. Specifically, immigrants who have lived in Canada for less than two years are more inclined to recall receiving financial advice from their bank (79%) than those who have lived in Canada longer (51%). Additionally, customers under the age of 40 also remember getting financial advice from their bank at a higher rate (61%) than do those in older age groups (47%).

- Most bank customers act on advice: More than three-fourths (77%) of customers who receive financial advice follow through and act on it. The most frequent actions taken in response to advice include shifting funds between accounts (29%); updating account settings (21%); downloading the mobile app (20%); and scheduling a meeting with a bank rep (20%).

- Satisfaction increases when customers take action: Overall satisfaction with retail banking advice increases 142 points (on a 1,000-point scale) when customers act based on specific advice from their bank.

- Banks still miss the mark on advice topics: The study finds gaps exist in nearly every category and topic when it comes to the advice delivered by the bank and the advice that customers are most interested in. The widest gap exists in the financial planning category, as the difference between those who are currently receiving that type of advice and those who want more is 16 percentage points, specifically, looking for more advice around tax reduction.

Study Ranking

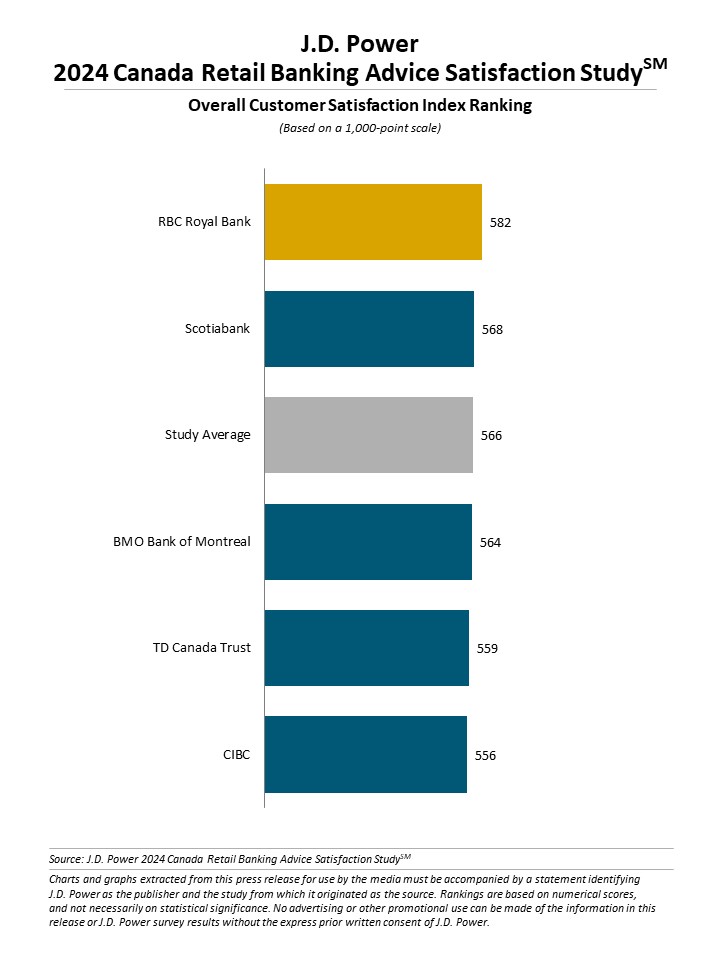

RBC Royal Bank ranks highest in customer satisfaction for a fourth consecutive year, scoring 582 points. Scotiabank (568) ranks second and the segment average is 566.

The Canada Retail Banking Advice Satisfaction Study was redesigned this year. The 2024 study includes responses from 2,822 retail bank customers across Canada who received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. It measures customer satisfaction with retail bank advice/guidance based on performance in five core dimensions on a poor-to-perfect rating scale. Individual dimensions measured are (in order of importance): clarity; concern for needs; relevancy; quality; and frequency. The study was fielded from January through March 2024.

In addition to bank financial advice ratings, the study also provides financial health support index benchmarking data that evaluates proficiency of banks and credit card issuers in delivering financial support to customers doing such things as helping customers make better financial decisions or help customers meet savings, creditworthiness, or budgeting goals. The study also captures responses from customers about their satisfaction with the financial health support provided by their financial partners. Top-performing banks in the banking financial health support index are (in alphabetical order): BMO Bank of Montreal and RBC Royal Bank. Top-performing credit card providers in the credit card financial support index are (in alphabetical order): Desjardins, RBC Royal Bank and Scotiabank.

For more information about the Canada Retail Banking Advice Satisfaction Study, visit https://www.jdpower.com/business/financial-health-and-advice-satisfaction-study.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modelling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business.

Media Relations Contacts

Gal Wilder, NATIONAL; 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power, West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.