Satisfaction Rises among Bank Customers in Canada, J.D. Power Finds

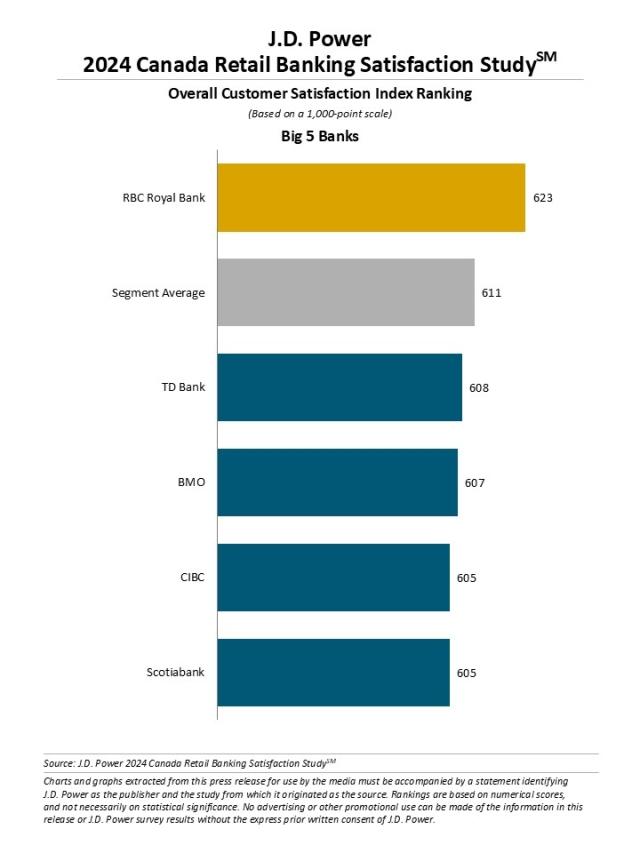

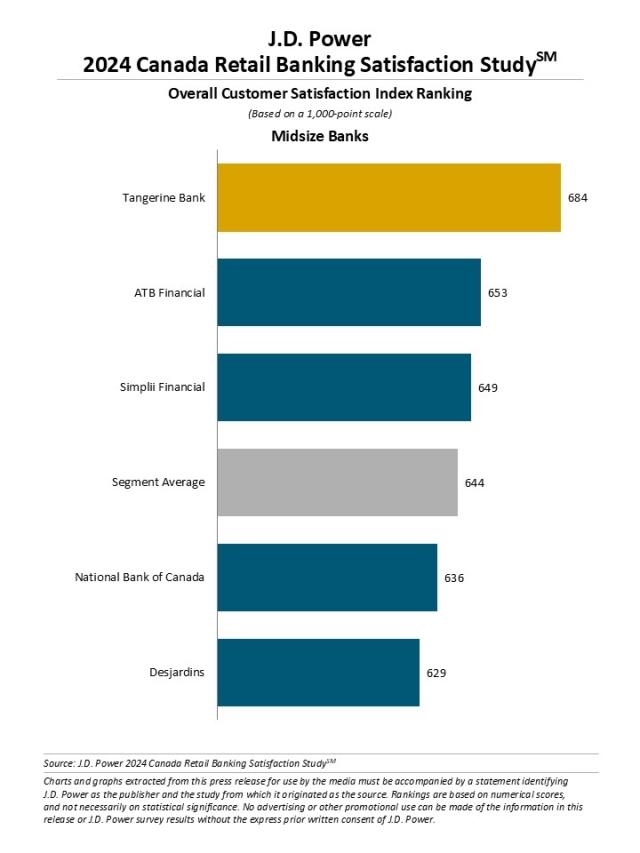

RBC Royal Bank and Tangerine Bank Rank Highest for Customer Satisfaction in Respective Segments

TORONTO: 17 Oct. 2024 — After a few years of decline and stagnation, it appears that customer satisfaction with banks in Canada is on the upswing, according to the J.D. Power 2024 Canada Retail Banking Satisfaction Study,SM released today. The study finds that customer satisfaction with Canada’s largest banks (Big 5) has improved 8 points to 611 (on a 1,000-point scale) this year. Similarly, Canada’s mid-size banks experienced a 7-point increase.

The improvement in satisfaction comes against a backdrop of cautious optimism among bank customers about the outlook of both their personal finances and the economy. According to the study, bank customers are a bit more positive about the future of their personal finances, with their confidence level inching up to 5.78 (on a 10-point scale) from 5.68 a year ago. Their outlook on the economy is even more bullish, up to 5.02 from 4.84 in 2023.

“The improvement in customer satisfaction is great news for the Canadian banking industry, but it’s important that the industry focuses on leveraging the momentum,” said Jennifer White, senior director of banking and payments intelligence at J.D. Power. “With 63% of customers also having deposit relationships with at least one other financial institution, the risk of losing deposits to a competitive institution still lingers. Banks need to find ways to elevate their client relationships from transaction-based to more meaningful value-add offerings that build trust and enable seamless services.”

Following are some key findings of the 2024 study:

- Key Satisfaction Driver: Trust is the most influential element of customer satisfaction, and every small occurrence that dents it, opens the door a bit wider for customers to switch banks. The study shows that the top three actions that damage trust are unexpected fees (54%); blaming the customer for an error (32%); and bad banking practices reported in the media (27%).

- Branch experience lagging: Although banks and customers are adopting online and mobile banking at a rapid pace, 49% of bank customers opt to use both digital and branch services. With such a significant proportion of customers visiting the branch, only 10% receive all four service-related best practices at the branch: greeting by name; offering to assist with other financial issues and needs; mentioning other ways the bank can help; and genuinely thanking them for their business. The study finds that delivery of branch service best practices can lift customer satisfaction by 109 points.

- Fees and poor service facilitate attrition: Among customers who intend to switch banks, the top two reasons are charged too many/high fees (32%) and poor service experience (30%). Customers also cited promotional offers from other banks (27%) as a leading driver of customer attrition, meaning that, despite customers’ potentially high overall satisfaction, they are often keeping an eye on alternative banks.

Study Rankings

RBC Royal Bank ranks highest among Big 5 banks with a score of 623.

Tangerine Bank ranks highest among mid-size banks for a 13th consecutive year, with a score of 684. ATB Financial (653) ranks second and Simplii Financial (649) ranks third.

The Canada Retail Banking Satisfaction Study, now in its 19th year, measures customer satisfaction with Canada’s large and mid-size banks. The scores reflect satisfaction among the entire retail banking customer pool of these banks, representing a broader group of customers than solely the branch-dependent and digital-centric segments. The study measures satisfaction across seven factors (in order of importance): trust; people; account offerings; allowing customers to bank how and when they want; saving time and money; digital channels; and resolving problems or complaints.

The study is based on responses from 14,460 retail banking customers of Canada’s large and mid-size retail banks regarding their experiences with the financial institutions. The study was fielded in two waves in January-February 2024 and in June-July 2024.

For more information about the Canada Retail Banking Satisfaction Study, visit https://www.jdpower.com/business/retail-banking-study-1.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business.

Media Relations Contacts

Gal Wilder, NATIONAL PR; 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info