Canadian Online Brokerage Firms Struggle to Support Increased Volume, J.D. Power Finds

Trading Experience Degrades as Problem Incidence Almost Doubles

With the pandemic proving to be a boon for Canadian online investment firms with more do-it-yourself (DIY) investors flocking to this segment than ever before, a greater strain is being placed on their online brokerage systems. According to the J.D. Power 2021 Canada Self-Directed Investor Satisfaction Study,SM released today, the result is that online brokerages are struggling to deliver a seamless trading experience.

In addition to the influx of new DIY investors taking advantage of the early 2020 market correction, 40% of existing investors increased their investments as well as trading activity (25 trades, on average, vs. 15 in 2020). However, with this boost in investment activity, 24% of self-directed investors say they had at least one problem with their firm during the past 12 months—an increase from 14% in 2020 and more than double that of U.S. DIY investors (11%) during the same period.

“Canadian self-directed investment firms have had a great year, with many new and existing clients ramping up trading volumes and funneling more money into their portfolios,” said Michael Foy, senior director and head of wealth intelligence at J.D. Power. “But this has come with challenges to the stability of platforms as well as the capacity of firms to quickly respond to and resolve client problems. Especially for newer clients, those who have not yet developed strong loyalty with these firms, who are more likely to leave if they have a bad experience. Investors today have more choices and firms need to raise the bar on the experience they deliver.”

Following are some key findings of the 2021 study:

- Problems exacerbate investors' departure: One-fifth (20%) of investors who experienced a problem with their investment firm say they are considering switching providers, which is more than three times the number of investors without issues (6%) who say they plan to switch. Furthermore, investors who experienced an issue with their self-directed wealth management firm are more likely to become brand detractors than are those who did not experience an issue.

- Young and impatient: With 47% of self-directed investors using a phone to engage with customer service, wait time is an issue in this communication channel, especially among younger investors. The study shows a significant perception gap between Millennials1 and younger investors and Boomer/Pre-Boomer investors. Only 16% of Millennial and younger investors say they had phone wait times of one minute or less compared with 28% of Boomer/Pre-Boomer investors, reflecting a much lower tolerance among younger investors for waiting.

- Mobile lags and chat still underutilized: DIY investors have an average satisfaction of 644 (on a 1,000-point scale) with their wealth management firm’s website, which is higher than other channels. Satisfaction with the firm’s app is 604 and satisfaction with the phone channel is 587. Interestingly, chat as a communications channel is underutilized by investors—just 13% use chat—yet those who use it have higher satisfaction with the channel (627) than with the app or phone.

The 2021 Canada Self-Directed Investor Satisfaction Study, now in its 13th year, evaluates key satisfaction drivers and firm performance among true do-it-yourself investors (those who do not interact with professional advisors).

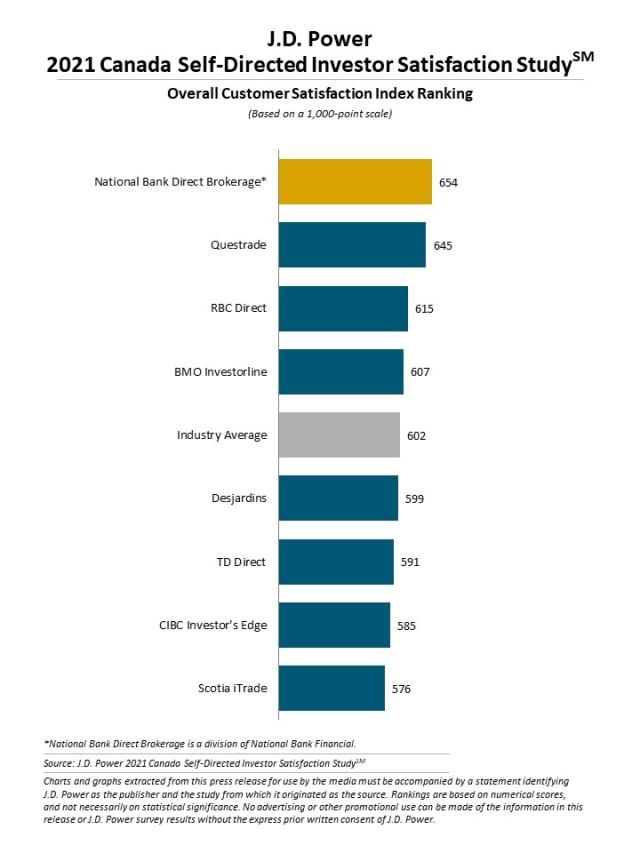

Study Ranking

National Bank Direct Brokerage ranks highest among self-directed investor firms with a score of 654. Questrade (645) ranks second and RBC Direct (615) ranks third.

The Canada Self-Directed Investor Satisfaction Study, which was redesigned for 2021, measures self-directed investors’ satisfaction with their investment firm based on performance in seven factors (in order of importance): trust; digital channels; ability to manage wealth how and when I want; products and services; value for fees; people; and problem resolution.

The 2021 study is based on responses from 2,011 investors who make all their investment decisions without the counsel of a full-service dedicated financial advisor. The study was fielded from December 2020 through February 2021.

For more information about the Canada Self-Directed Investor Satisfaction Study, visit https://canada.jdpower.com/financial-services/canada-self-directed-investor-satisfaction-study.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modelling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 416-602-4092; gal.wilder@cohnwolfe.ca

Nicole Herback, Cohn & Wolfe; 403-200-1187; nicole.herback@cohnwolfe.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.