COVID-19 Exacerbates Client Experience Challenges for Canadian Self-Directed Investment Firms, J.D. Power Finds

Questrade Ranks Highest in Overall Customer Satisfaction for First Time

Toronto: 28 May 2020 — Even before the COVID-19 pandemic triggered a spike in trading volume and an influx of new investors in Canada to open do-it-yourself (DIY) investment accounts, investors were experiencing issues with investment firms’ websites, according to the J.D. Power 2020 Canada Self-Directed Investor Satisfaction Study,SM released today. Issues with websites are becoming more prevalent as trading volume and the number of investors increase.

Nearly half (46%) of self-directed investors who cite experiencing a problem with their self-directed investment firm attribute it to the firm’s website. Furthermore, 29% of investors experienced website inaccessibility at least once during the past 12 months. Investors’ satisfaction with their self-directed investment firm declines to 717 (on a 1,000-point scale) from 726 in 2019, despite strong market conditions when the survey was fielded in late 2019. Among younger investors (Millennials1and younger), 26% of those who experienced website inaccessibility say they “probably will” or “definitely will” switch firms in the next year.

“The recent flurry of new account openings and increased trade volumes are obviously good for self-directed firms but have also exacerbated some client experience issues that existed before the pandemic, especially around the availability and navigation of digital platforms,” said Michael Foy, senior director of wealth and lending intelligence at J.D. Power. “This is putting even more strain on already overloaded call centres. With more choices than ever for new investors, including low-cost robo or digital advisors, self-directed firms that want to keep new clients must ensure they are minimizing problems and resolving them quickly and effectively.”

Following are additional key findings of the 2020 study:

- Overlooking the onboarding experience: When it comes to new clients, investment firms are missing a critical opportunity to improve overall satisfaction through digital and mobile engagement during the onboarding process. Website/platform tutorial and explanation about app downloading can elevate investors’ satisfaction by 45 and 40 points, respectively. Yet, 60% of new investors did not receive an online tutorial and 86% were not informed of how to download the app.

- Mobile, Millennials and brand affinity: Among transaction channels, mobile—which has lower satisfaction (735) than online (773) and phone (779)—is the most preferred channel by DIY Millennial investors who average 23 mobile interactions annually with their investment firm. Improvement in the mobile experience is important for investment firms, as Millennial investors are not only a source for future organic business growth but also are vocal brand ambassadors. Among highly satisfied Millennial investors, 59% say they “definitely will” recommend their investment firm.

- Affluent risk exposure: Investment firms have a heightened risk of losing high-value clientele who experience issues more frequently than among clients in other groups. More than one-third (34%) of affluent self-directed investors (those with portfolios of CAD$500,000 and above), cite experiencing problems with their investment firm and, as a result, average satisfaction among these clients is 82 points lower than among those who had no issues (682 vs. 764, respectively).

- Human support critical for problem solving: When problems do occur, 86% of self-directed investors turn to human support channels to solve the problem. Overall satisfaction among those who work with a human to solve a problem is 72 points higher than among those who use self-service digital channels.

Study Rankings

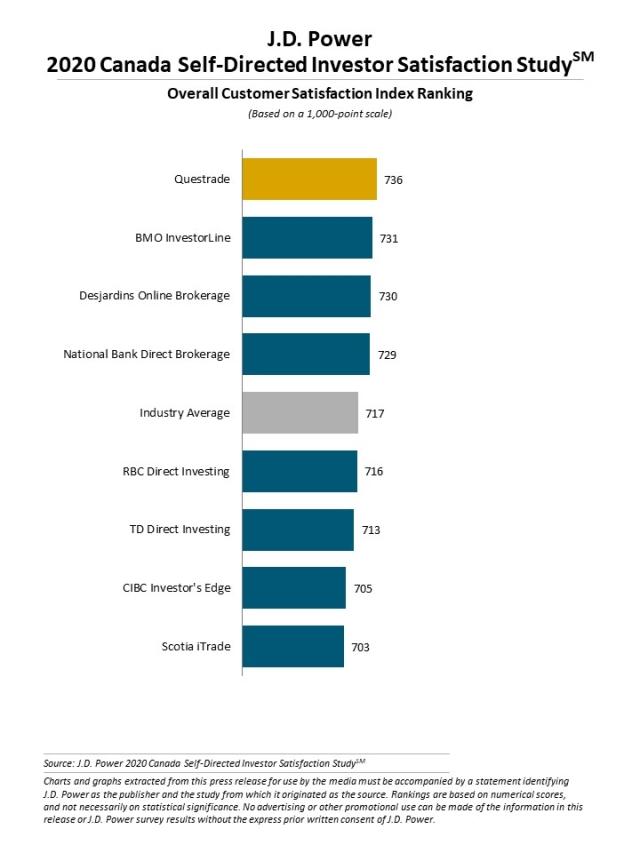

Questrade ranks highest in customer satisfaction with a score of 736. BMO InvestorLine (731) ranks second and Desjardins Online Brokerage (730) ranks third.

The Canada Self-Directed Investor Satisfaction Study, now in its 12th year, evaluates key satisfaction drivers and firm performance for self-directed investors who make all their investment decisions without the counsel of a full-service dedicated financial advisor.

The study measures self-directed investors’ satisfaction with their investment firm based on performance in seven factors (in alphabetical order): account information; commissions and fees; firm interaction; information resources; investment performance; problem resolution; and product and service offerings. The study is based on responses from 2,094 investors and was fielded from November 2019 through January 2020.

For more information about the 2020 Canada Self-Directed Investor Satisfaction Study, visit https://canada.jdpower.com/financial-services/canada-self-directed-investor-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Madelyn Boelhouwer, Cohn & Wolfe; 647-259-3283; madelyn.boelhouwer@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info.

1J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.