Canada’s Home Insurers Miss the Mark When Addressing Top Customer Issues, J.D. Power Finds

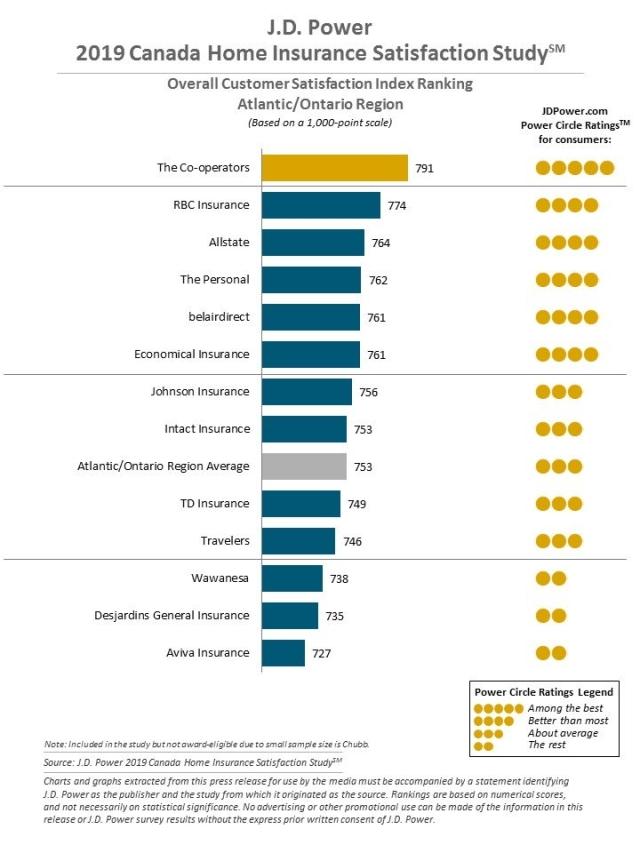

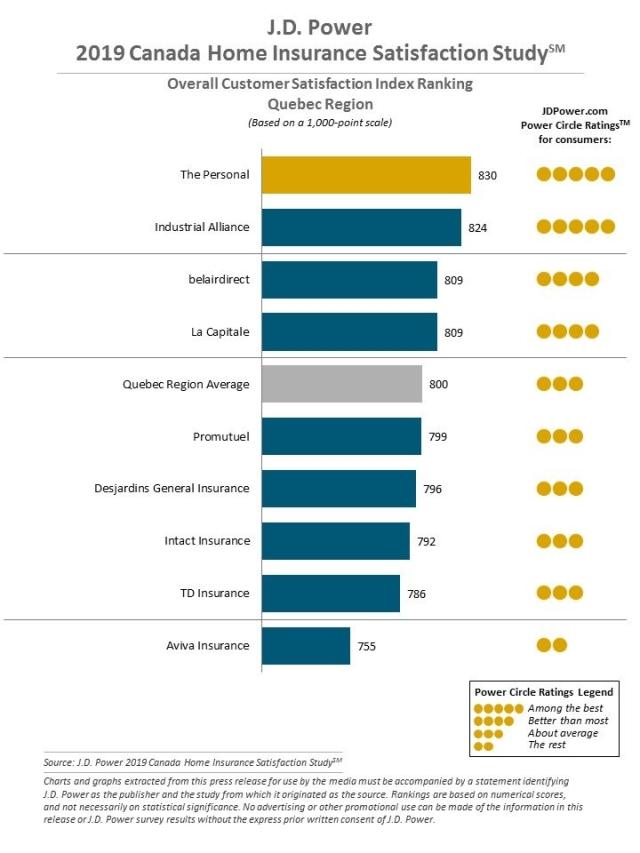

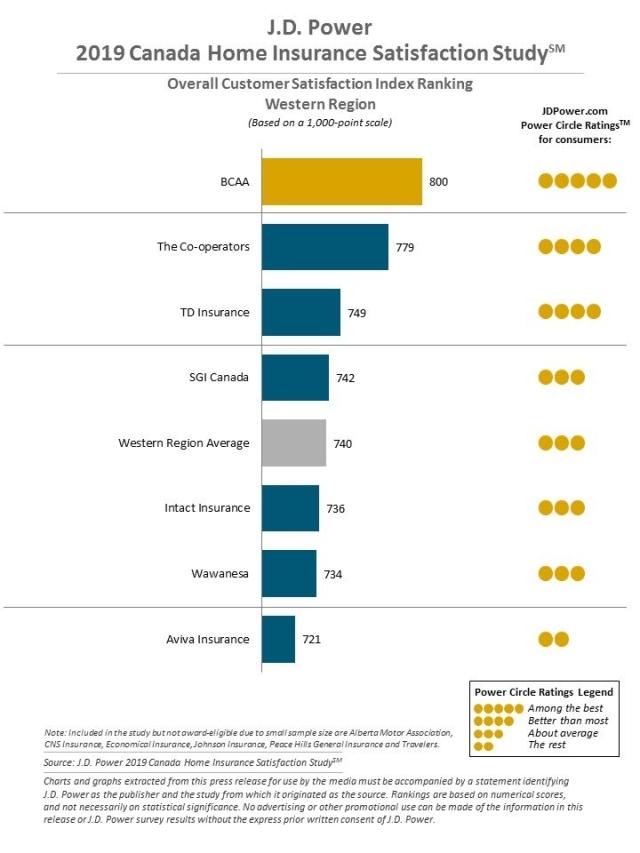

The Co-operators (Atlantic/Ontario), The Personal (Quebec) and BCAA (Western Canada) Rank Highest in Customer Satisfaction

TORONTO: 28 March 2019 – When it comes to addressing insurance pain points of homeowners in Canada, insurance companies are falling short in meeting their expectations, according to the J.D. Power 2019 Canada Home Insurance Satisfaction Study.SM In fact, all seven of the most important attributes that affect customer satisfaction receive lower average scores than those in less-influential areas of customer interaction.

“Insurers who want to increase market share as well as attract and retain customers need to shift focus and improve in areas that most influence customer satisfaction,” said Tom Super, Director of the Insurance Practice at J.D. Power. “Highly satisfied customers have better policy lifetime expectancy (PLE) scores and are much more likely to recommend their insurer to friends or family.”

Additionally, the study finds that more than 50% of customers indicate their insurer failed to deliver on key performance indicators (KPIs) that they rate as most important related to price, policy and service.

Following are some key findings of the 2019 study:

- Improvement in customer satisfaction tied to market share gains: Carrier improvements in customer satisfaction initiatives to better meet customer expectations correlate to more favorable top-line results, such as market share improvements by a number of insurers, year over year.

- Delighted for the long run: Delighted customers (measured as satisfaction scores of 900 and above, on a 1,000-point scale), tend to stay with the same home insurer an average of nearly 13 years. These customers are more likely to act as a brand ambassador and recommend their insurer to family and friends.

- Product improvement presents opportunity: Improvements in product offerings, such as more competitive discounts and more flexible underwriting standards, are areas in which insurers can differentiate themselves and thus improve customer satisfaction. Specifically, satisfaction is higher when customers receive lesser-known discounts for online purchase, association memberships and automatic or full-policy payments than when they receive more common discounts for claim-free records, security systems and fire alarms.

- Digital divide: The largest gap in satisfaction scores between the highest- and lowest-performing insurers is for digital capabilities. The study’s highest-ranked insurer scores 850 for providing digital capabilities for insureds, while the bottom performer scores just 670. This indicates that a large divide exists between insurers that meet their customers’ digital expectations and those that do not.

Nationwide, the median homeowners’ insurance premium during the past year was $1,200. On a regional basis, insureds in the Atlantic/Ontario region paid the highest for homeowners’ insurance coverage ($1,260), followed by the Western ($1,248) and Quebec ($984) regions.

Study Rankings

The Co-operators ranks highest in overall satisfaction in the Atlantic/Ontario region with a score of 791. RBC Insurance (774) ranks second and Allstate (764) ranks third.

In the Quebec region, The Personal ranks highest with a score of 830. Industrial Alliance (824) ranks second, while belairdirect and La Capitale rank third in a tie with 809.

In the Western region, BCAA ranks highest with a score of 800. The Co-operators (779) ranks second and TD Insurance (749) ranks third.

Quebecers are the most satisfied with their homeowners’ insurers, with a region average of 800 points, while their neighbours in the Western region are the least satisfied, with an average score of 740. The Western region also has the lowest score for competitiveness of discounts offered.

The 2019 Canada Home Insurance Satisfaction Study measures customer satisfaction with their homeowners’ insurance company by examining five factors (in order of importance): product/policy offerings; price; billing and payment; interaction (non-claim); and claims. The interaction (non-claim) factor includes three sub-factors: local agent and/or broker; call centre representative; and assisted online.

The 2019 study is based on responses from 5,809 homeowner insurance customers across Canada and was fielded from November 2018 through January 2019.

For more information about the Canada Home Insurance Satisfaction Study, visit https://canada.jdpower.com/resource/canadian-home-insurance-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca|

Sandy Caetano, Cohn & Wolfe; 647-259-3317: sandy.caetano@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com