J.D. Power Study Finds Customer Satisfaction with Homeowners Insurance Improves in Eastern Canada, while Claims Contribute to Drop in the West

belairdirect Ranks Highest in Home Insurance Satisfaction in Two Regions; BCAA Ranks Highest in One

TORONTO: 6 June 2016 — Customer satisfaction with homeowners insurance in Eastern Canada is improving, while catastrophic events contribute to lower satisfaction in the Western provinces, according to the J.D. Power 2016 Canadian Home Insurance Study,SM released today.

The annual study examines customer satisfaction with their homeowners insurance company by examining five factors (in order of importance): non-claim interaction; policy offerings; price; billing and payment; and claims. The non-claim interaction factor includes three subfactors: local agent or broker; call centre service representative; and website. Satisfaction is calculated on a 1,000-point scale.

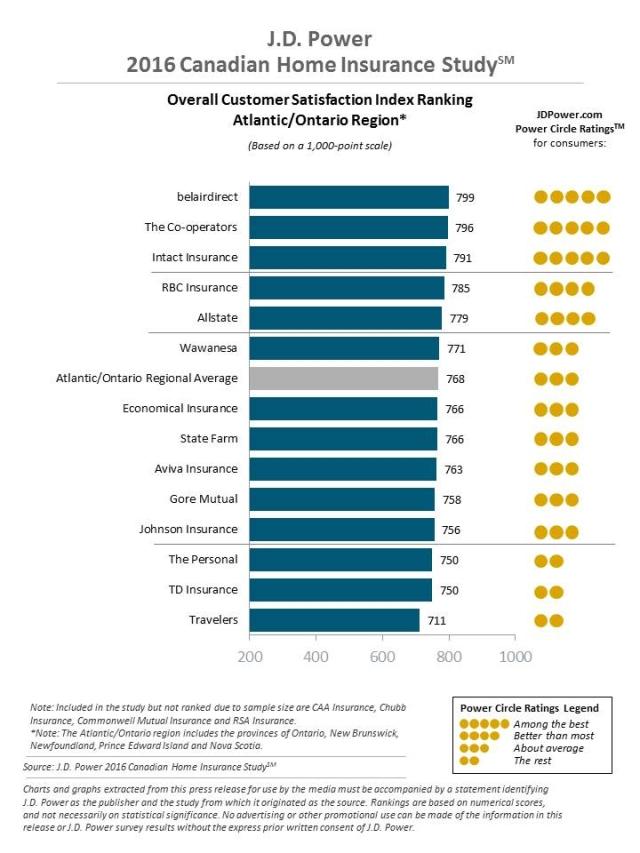

Overall satisfaction in the Atlantic/Ontario region improves to 768 in 2016 from 759 in 2015, while satisfaction in the Quebec region jumps to 797 from 777. Satisfaction in both regions improves significantly in all factors, with the only exception being price in the Atlantic/Ontario region, which improves by a modest 1 point.

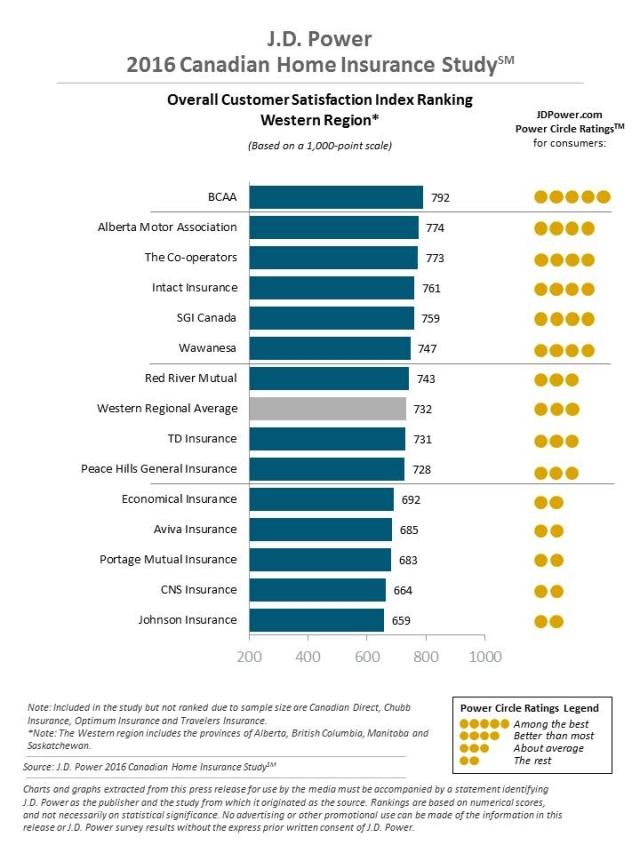

In contrast, overall satisfaction in the Western region drops to 732 in 2016 from 745 a year ago. Price is the leading cause of the drop in satisfaction, suffering a 23-point year-over-year decline.

Contributing to the decline in satisfaction is that home insurers in the Western provinces have been challenged with significant losses resulting from catastrophic events. While fire-related claims have decreased to 5% of claims in 2016 from 6% in 2013, storm-related claims have increased to 44% from 37% over the same period. The Western provinces are still being impacted by the wind and thunderstorm event that took place in the summer of 2015 in Alberta and Saskatchewan, resulting in $56 million CAD in insured losses[1].

“The Western provinces have had some very severe events in recent years, like the current Fort McMurray wildfire, which have caused significant financial losses for insurers,” said Valerie Monet, director of the insurance practice at J.D. Power. “When insurers are managing losses, rate increases are common and cost control is a frequent focus. From a customer perspective, price satisfaction hasn’t improved over the years, and data suggests that many insurers have not had time to focus their efforts on improving the customer experience after the upheaval these claims events have had on their business.”

Monet noted that improving the customer experience is a primary area of differentiation for insurers. In most instances, the product purchased at a given price point is similar, if not exactly the same. The way insurers improve is by communicating the value of the product, ensuring customers understand what is and is not covered, and generally being easy to work with. Insurers that understand how to operate at the convergence of these three principles are making the most improvement.

Intended Loyalty Drops: The Quebec region has the highest intended loyalty , with 37% of customers saying they “definitely will” renew with their current provider, while 31% of customers in both Atlantic/Ontario and Western regions indicate the same.

High Satisfaction Increases Loyalty: Delighted customers (overall satisfaction scores of 900 or greater) are less likely to shop for new homeowners insurance; are more likely to renew; and are more likely to recommend their insurer than less satisfied customers. For example, 71% of delighted customers say they “definitely will” renew with their current insurer and 69% “definitely will” recommend their insurer to family and friends. In comparison, only 37% of pleased customers (scores of 750 through 899) say they “definitely will” renew with their current insurer and only 27% “definitely will” recommend.

Study Rankings

belairdirect ranks highest in the Atlantic/Ontario region with a score of 799 and in the Quebec region with a score of 814, while BCAA ranks highest in the Western region with a score of 792.

belairdirect is followed in the Atlantic/Ontario region by The Co-operators (796) and Intact Insurance (791), and in the Quebec region by Promutuel (809) and Desjardins General Insurance, Intact Insurance and La Capitale in a tie (806 each). BCAA is followed in the Western region by Alberta Motor Association (774) and The Co-operators (773).

The 2016 Canadian Home Insurance Study is based on responses from 7,438 homeowners insurance customers. The survey data was collected from March through April 2016.

For more information about the 2016 Canadian Home Insurance Study, visit http://canada.jdpower.com/resource/canadian-home-insurance-study

See the online press release at http://www.jdpower.com/press-releases/2016-canadian-home-insurance-study

Media Relations Contacts

Stephanie Ronson, Cohn & Wolfe, Toronto, Canada; 647-259-3278, stephanie.ronson@cohnwolfe.ca

Jennifer McCarthy, Cohn & Wolfe, Toronto, Canada; 647-259-3305, jennifer.mccarthy@cohnwolfe.ca

John Tews, J.D. Power, Troy, Michigan; 248-680-6218, media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info

[1] Source: http://www.verisk.com/press-releases-verisk/2015/july-2015/quiet-catastrophe-year-continues.html