Against a Backdrop of Volatile Markets and Poor Returns Canada’s Full-Service Investment Firms See Investor Satisfaction Tumbling, J.D. Power Finds

Edward Jones Ranks Highest in Investor Satisfaction for Seventh Consecutive Year

TORONTO: 15 April 2019 — Following a rocky 2018 in capital markets and negative investment yields, investors in Canada who are edgy about their financial holdings have less satisfaction with their investment firm, according to the J.D. Power 2019 Canada Full Service Investor Satisfaction Study,SM released today. For the first time since the 2008 financial crisis, customer satisfaction has declined, dropping to 778 (on a 1,000-point scale) from 785 in 2018.

“There’s a belief in the industry that challenging market conditions are when financial advisors most demonstrate their value to clients,” said Mike Foy, Senior Director of Wealth Intelligence at J.D. Power. ”But what we see is that many advisors are not consistently having the sometimes difficult conversations necessary to manage client expectations and navigate through market volatility and downturns.”

According to the study, nearly one-third (32%) of investors say their advisor did not take the time to explain their portfolio performance during the past year. Investors not receiving an advisor explanation are almost twice as likely as those who receive an explanation (36% vs. 19%, respectively) to indicate their financial performance was “worse than expected” and were significantly less satisfied with both that performance and their advisor.

The study also finds that the largest declines in performance satisfaction are among affluent investors (those with assets greater than $500,000), dropping 38 points year over year. More than one-fourth (28%) of affluent investors indicate performance was “worse than expected” and, among that group, 16% intend to decrease their investments during the next 12 months vs. just 4% among affluent investors who say performance was “as expected” or “better than expected.”

“Market conditions may be outside the control of investment firms and advisors, but they do have a significant ability to control how investors react to those conditions, and they need to be providing that transparency to help clients stay focused on long-term goals,” Foy said.

Following are some of the key findings of the 2019 study:

- Older investors much more concerned about financial wellness: About one in six (16%) of Pre-Boomers1 and Boomers indicate they are “worse off” financially than they were a year ago, up from 9% in 2018. Among Millennials and Gen X, 8% perceive they are “worse off” in 2019 vs. 6% in 2018.

- Fee understanding still elusive: Despite nearly half (48%) of investors indicating they have noticed changes in the information provided by their firm due to CRM2, the percentage of those who say they have “complete” understanding of fees remains stubbornly low at just 31%, down slightly from 32% last year and significantly trailing the 40% among U.S. full service investors, according to the J.D. Power 2019 Full Service Investor Satisfaction Study.SM

- Mobile Matters: Among Boomers and Pre-Boomers, just 29% interacted with their investment firm via mobile, but that number jumps to 68% among Millennials and younger investors. Millennial mobile usage also skews much more toward phone usage than tablet usage, suggesting firms need to ensure their mobile apps are evolving to meet the different needs and expectations of younger-generation investors.

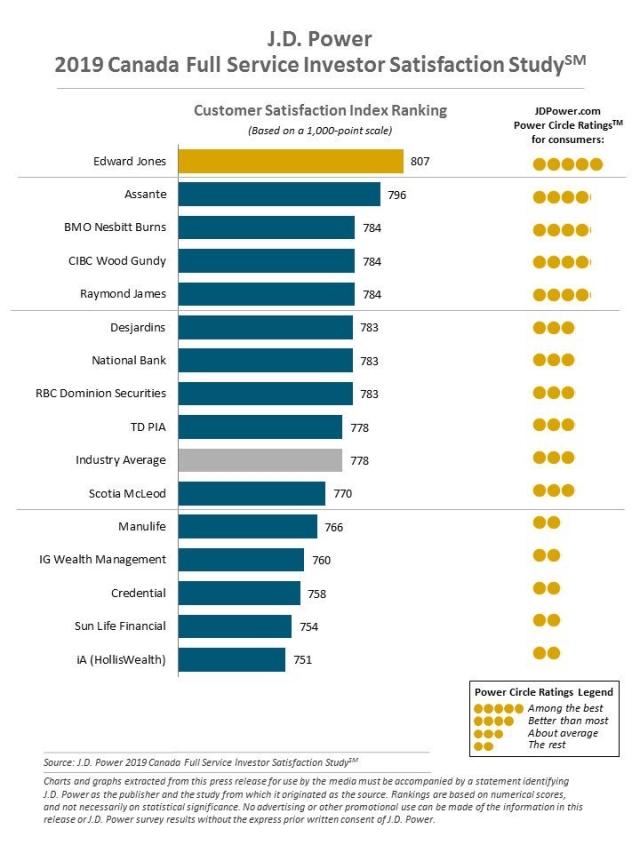

Study Rankings

Edward Jones (807) ranks highest in overall investor satisfaction for a seventh consecutive year and Assante (796) ranks second. BMO Nesbitt Burns, CIBC Wood Gundy and Raymond James rank third in a tie with 784.

The Canada Full Service Investor Satisfaction Study measures overall investor satisfaction with full-service investment firms in eight factors (in order of importance): financial advisor; firm interaction; account information; information resources; product offerings; investment performance; commissions and fees; and problem resolution.

The 2019 study is based on responses from 3,947 investors who make some or all of their investment decisions with a financial advisor regarding their primary investment account. It was fielded from November 2018 through January 2019.

For more information about the 2019 Canada Full Service Investor Satisfaction Study, visit https://canada.jdpower.com/resource/canadian-full-service-investor-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; 647-259-3288: sandy.caetano@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1J.D. Power defines the generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.