Canada’s Self-Directed Investment Firms at Risk of Losing Millennials, J.D. Power Finds

Desjardins Ranks Highest Among Self-Directed Investment Firms

TORONTO: 19 June 2019 – While overall investor satisfaction with self-directed investment firms in Canada increased slightly in 2019, financial institutions should not rest on their laurels. According to the J.D. Power 2019 Canada Self-Directed Investor Satisfaction Study,SM more than one-fourth (27%) of Millennial1 investors are considering switching providers in the next 12 months.

When it comes to interactions with their financial institution, Millennials are more likely than older investors to rely on mobile technology to engage with investment firms, and to use mobile much differently than older investors. While Boomers favor tablets, Millennials rely on their phones for a wide range of transactions that go well beyond trading and checking account balances.

“Many investment firms are missing the mark with younger investors when it comes to digital, especially in the mobile experience category,” said Michael Foy, Senior Director of Wealth & Lending Intelligence at J.D. Power. “Millennials are expecting a seamless digital experience, regardless of the platform. The expectation of young investors is to have a mobile experience that offers full functionality to do anything they can on the website, whether that means executing trades, transferring funds, reviewing their portfolio, or even using tools. Financial institutions that want to build loyalty with this critical segment need to improve the customer experience to reflect investors’ priorities and expectations.”

Following are key findings of the 2019 study:

- Overall satisfaction increases slightly, despite challenging markets: Overall satisfaction is 726 in 2019, up slightly from 723 in 2018. The survey was fielded in late 2018 when stock markets were closing the year in negative territory and volatility was high, driving down satisfaction with investment performance by 37 points year-over-year, and providing significant headwinds for firms to overcome.

- Millennials and mobile: Millennial investors are less engaged with providers on the web as more activity shifts towards mobile. Millennials averaged just 20 online interactions over the past 12 months vs. 35 interactions among Boomers. Among those using the mobile channel, 80% of Millennials who execute trades use their phone for the transaction vs. just 47% of Boomers. Still, just 30% of Millennials and 29% of overall investors indicate they completely understood what mobile features and services were available to them, representing a big opportunity for firms to drive greater engagement.

- Fee understanding improves, but millennials lag: A key driver of satisfaction is understanding of fees, which has increased considerably since 2015, perhaps in part due to CRM2-mandated disclosures. In 2015, just 34% of self-directed investors in Canada indicated they “completely” understood fees vs. 50% in 2019. Satisfaction with fees is 157 points higher among those who completely understand vs. those with only partial or no understanding. However, there is a significant gap in complete understanding between Millennials (34%) and Boomers (58%) that likely accounts for lower fee satisfaction among Millennials.

- Millennials are aggressive investors, more diverse and more educated: Millennial investors are more likely to be more aggressive with their investments; likely to be female; more likely to have a college degree; less likely to be white; and less likely to be married. Investment firms’ efforts to capture individual client circumstances and preferences to personalize the experience becomes more essential as clients become more diverse and expectations increase based on the personalization that they experience in other industries.

The 2019 Canada Self-Directed Investor Satisfaction Study, now in its 11th year, evaluates key satisfaction drivers and firm performance for true self-directed investors, those who do not interact with professional advisors.

Study Rankings

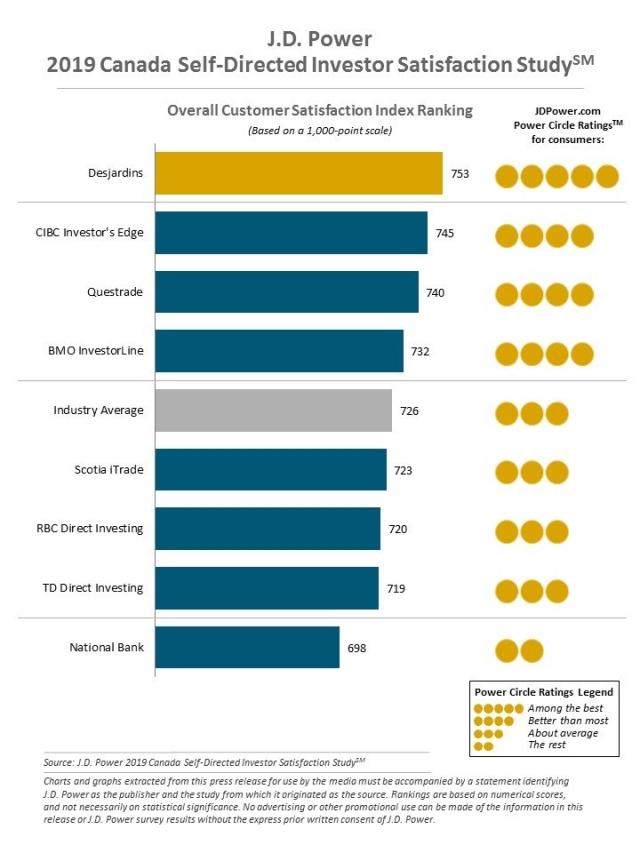

Desjardins ranks highest in self-directed investor satisfaction with a score of 753. CIBC Investor’s Edge (745) ranks second, Questrade (740) ranks third and BMO InvestorLine (732) ranks fourth. Desjardins most recently ranked highest in 2017 and had been top-ranked several times previously under the Disnat brand.

The 2019 Canada Self-Directed Investor Satisfaction Study measures self-directed investors’ satisfaction with their investment firm based on performance in seven factors (in order of importance): interaction; account information; commissions and fees; product offerings; information resources; investment performance; and problem resolution.

The 2019 study is based on responses from 1,744 investors who make all their investment decisions without the counsel of a personal financial advisor. The study was fielded from November 2018 through January 2019.

For more information about the 2019 Canada Self-Directed Investor Satisfaction Study, visit https://canada.jdpower.com/resource/canada-self-directed-investor-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; 647-259-3288: sandy.caetano@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.