Investors Still Do Not Understand Fees, Despite CRM2 Disclosures, J.D. Power Finds

Full-Service Advisors Face Increased Challenges as Millennials Embrace Robo-Advisors

TORONTO: 17 Aug. 2017 — One full year after sweeping regulatory reforms went into effect requiring investment advisory firms in Canada to disclose more information about their fees to clients, most investors still do not understand these fees. According to the J.D. Power 2017 Canadian Full Service Investor Satisfaction Study,SM released today, fewer than one-fourth of investors report having a complete understanding of the fees they pay to their investment advisors.

“Disclosure is not the same as transparency,” said Mike Foy, Senior Director of the Wealth Management Practice at J.D. Power. “Yes, investment firms in Canada have to disclose more information about their fees in line with the new Client Relationship Model (CRM2) requirements, but our data shows that the message is not always getting through clearly enough. Establishing a clear link between fees charged and value provided is very important for full-service advisors, especially now as they confront new threats coming from generational and technological changes that have put a large chunk of customer assets at risk of attrition.”

Following are some of the key findings of the study:

- Fees still a mystery: Fewer than one-fourth (23%) of investment advisory clients noticed any change during the past year in how fees and performance information was communicated by their advisory firm. The number of investors reporting complete understanding of fees is just 24%, down from 27% in 2016. Investors with complete understanding of fees are much more likely to recommend their firm, with 55% identified as Promoters[1] vs. just 36% among those with less than complete understanding.

- Advisors missing the mark: More than one-third (36%) of clients report that their financial advisor did not clearly communicate the reasons for the performance of their investments and 41% report that their advisor did not explain fees. Even among clients who were aware of the new disclosure requirements and did have a conversation about the subject with their advisor, just 35% say they fully understand their fees.

- Millennial money in motion as robo-advisors gain foothold: Although they currently represent just 5% of all full-service investors, 21% of affluent Millennials (those born between 1982 and 1994 with $100,000+ in investable assets) say they either “definitely will” or “probably will” leave their current firm in the next 12 months. Millennials also are most likely to have used a robo-advisor (23%), suggesting even investors who want to retain a traditional advisor may be open to reallocating some assets to alternative, less expensive advice channels.

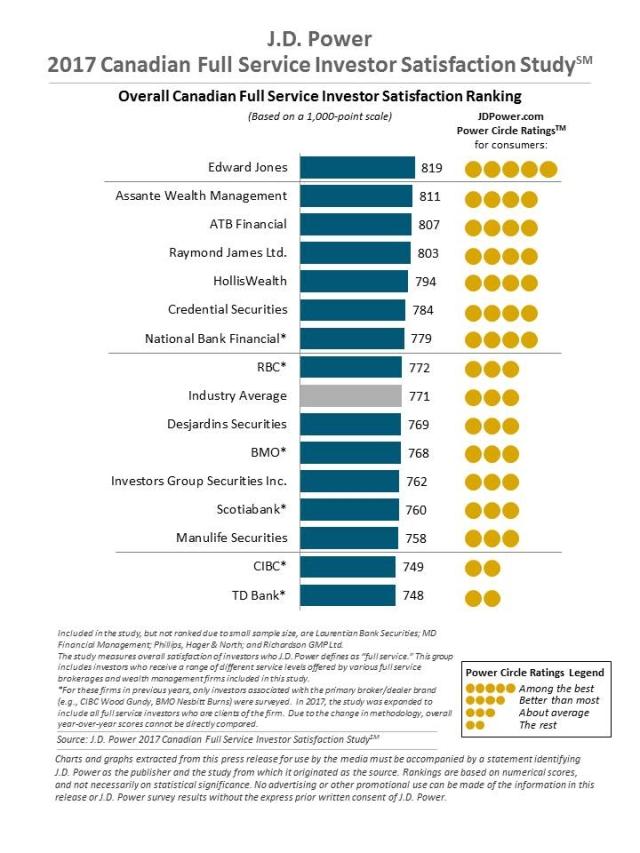

Study Rankings

Edward Jones ranks highest in investor satisfaction with full-service investment firms in Canada for a fifth consecutive year, with a score of 819 on a 1,000-point scale. Edward Jones ranks highest among all firms in two of the six key factors driving satisfaction: financial advisor and investment performance. Following in the rankings are Assante Wealth Management (811) and ATB Financial (807).

The 2017 Canadian Full Service Investor Satisfaction Study measures overall investor satisfaction with full-service investment firms and financial institutions that offer wealth management and private banking services in seven factors (in order of importance): financial advisor (33%); account information (18%); investment performance (18%); product offerings (14%); commissions and fees (10%); website (5%); and problem resolution (3%).

The study is based on responses from 4,903 investors who use advice-based investment services from financial institutions in Canada and was fielded in May-June 2017.

For information about the Canadian Full Service Investor Satisfaction Study, visit http://canada.jdpower.com/resource/canadian-full-service-investor-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; Toronto, Canada; 647-259-3261; gal.wilder@cohnwolfe.ca

Jennifer McCarthy, Cohn & Wolfe; Toronto, Canada; 647-259-3305, jennifer.mccarthy@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info

[1] Net Promoter®, Net Promoter System®, Net Promoter Score®, NPS® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.