Canadian Cable TV at Risk for Cord-Cutting as Alternative Video Service Use Grows, J.D. Power Finds

SaskTel, Videotron Rank Highest in Both Television and Internet Satisfaction for Fifth Consecutive Year

TORONTO: 8 June 2017 — As alternative video services continue to proliferate, more than one-fourth of Canadian cable and satellite television subscribers are deemed to be potential cord cutters (viewers who stop subscribing to cable television services), according to the J.D. Power 2017 Canadian Television Provider Customer Satisfaction StudySM and J.D. Power 2017 Canadian Internet Service Provider Customer Satisfaction Study,SM released today.

The studies find that a total of 27% of subscribers are either unsure or plan to drop (19% and 8%, respectively) their pay TV service within the next 12 months, while 73% say they plan to keep their television service. Younger pay TV customers appear more at risk of canceling, with 14% of those ages 18-34 indicating they plan to cut the cord in the next 12 months vs. 3% of those over 65 years old.

“While our data does not signify a mass exodus over the short term, TV subscribers are increasingly experimenting with—and liking—alternative streaming video options,” said Adrian Chung, director at J.D. Power. “The biggest concern for the cable industry should be the highly favorable customer satisfaction scores that alternative video services are receiving relative to traditional pay TV. The availability of faster network speeds stands to further fuel this shift in viewing preferences.”

Following are additional findings of the 2017 study

- Alternative video service adoption rising: More than half (53%) of pay TV subscribers have used an alternative video service in the past year, up from 49% in 2016 and 42% in 2015. Among customers who’ve tried alternative video services, Netflix is by far the most widely used platform (73%).

- Satisfaction higher for alternatives than traditional: Customers rate their alternative video service higher than their traditional pay TV service for overall experience (7.58 vs. 7.04 on a 10-point scale). This is driven primarily by higher ratings for overall cost (7.84 vs. 5.97).

- Faster, faster, faster: Satisfaction with internet service providers is highest when customers have download speeds of 500 Mbps or higher. Satisfaction levels decline in lock-step with declining internet speeds.

- Usability is key: When asked to rate alternative video services on a scale of 1-10 for ease of use, customers gave Netflix a rating of 8.11 vs. the average of 7.91.

Study Rankings

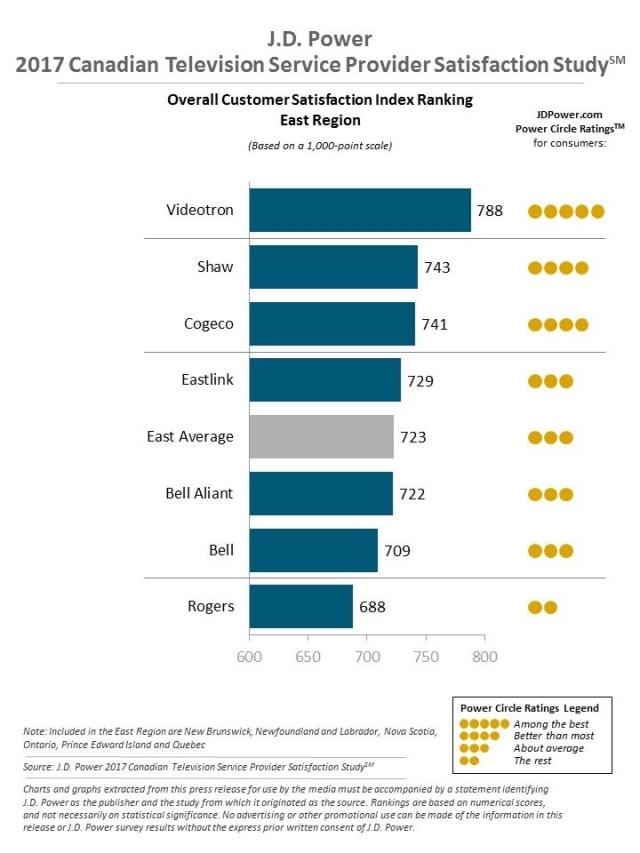

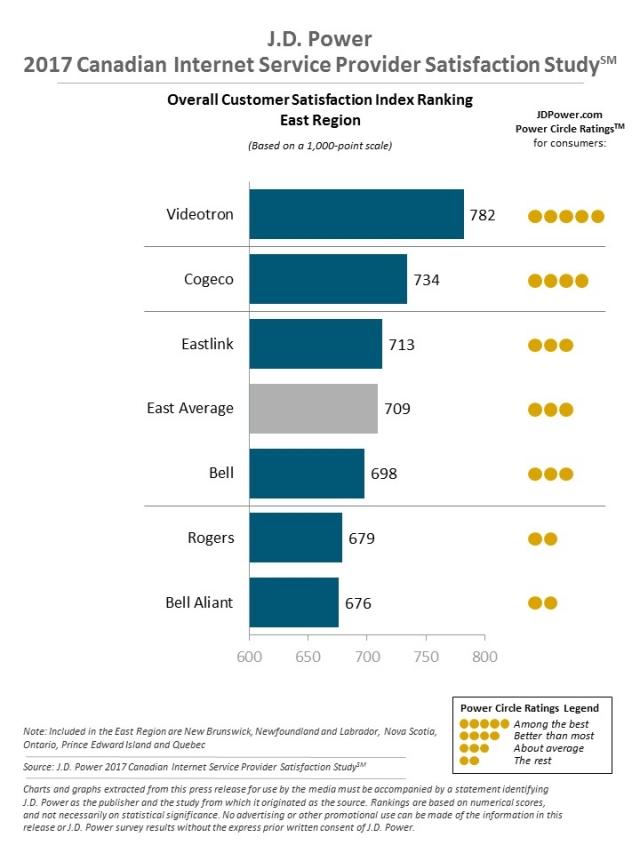

In the East region, Videotron ranks highest in both television (788) and internet service satisfaction (782) for a fifth consecutive year. In television, Shaw ranks second (743) and Cogeco (741) ranks third. In internet service, Cogeco ranks second (734) and Eastlink (713) ranks third.

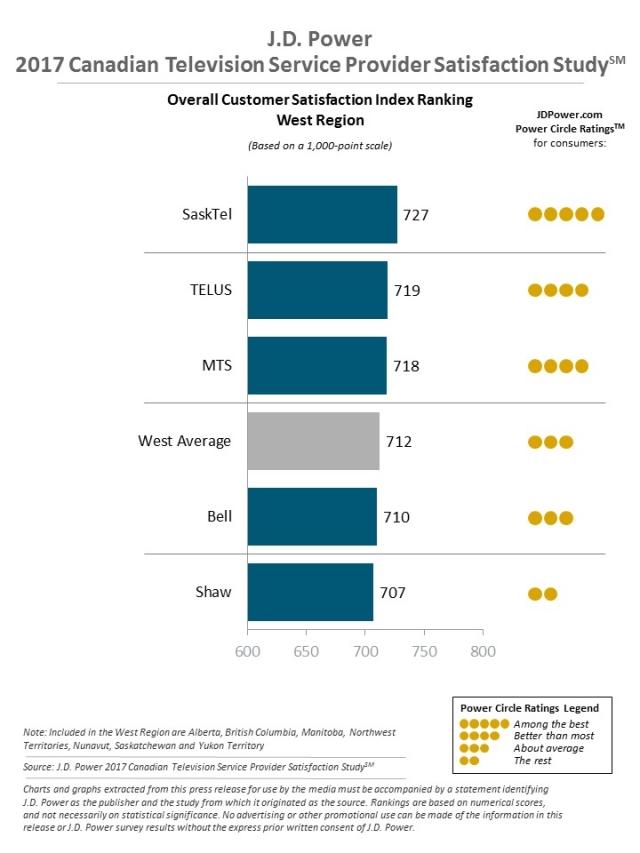

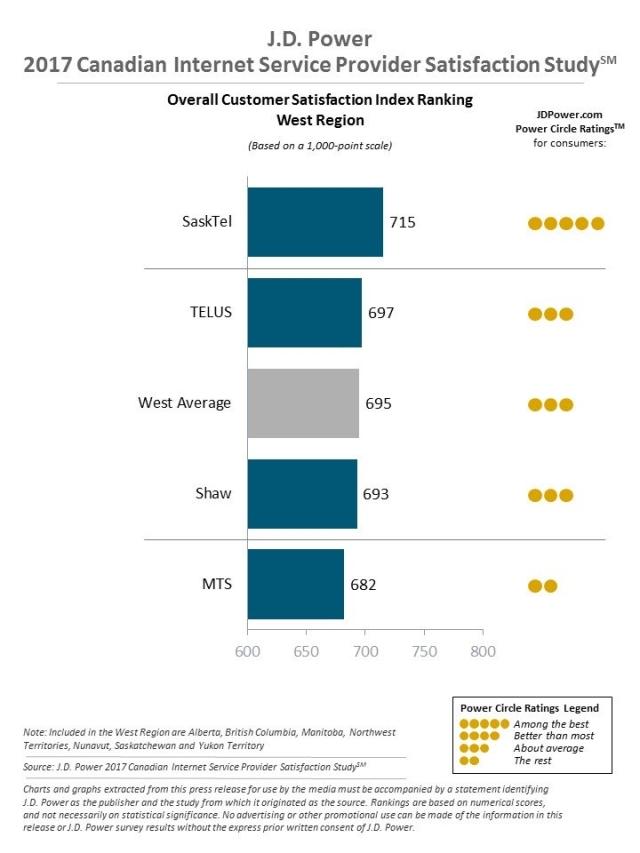

In the West region, SaskTel ranks highest in both television (727) and internet service satisfaction (715) for a fifth consecutive year. In television, TELUS ranks second (719) and MTS ranks third (718). In internet service, TELUS ranks second (697).

The Canadian Television Provider Customer Satisfaction Study measures overall satisfaction with television service providers based on six factors (in order of importance): performance and reliability; cost of service; programming; communication; billing; and customer service. The Canadian Internet Service Provider Customer Satisfaction Study is based on five factors (in order of importance): performance and reliability; cost of service; communication; billing; and customer service.

The studies are based on responses from 9,308 TV customers and 9,207 internet customers in Canada. Both studies were fielded in September-October 2016 and March-April 2017.

See the online press release at http://www.jdpower.com/pr-id/2017079.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe, Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Jennifer McCarthy, Cohn & Wolfe, Toronto, Canada; 647-259-3305, jennifer.mccarthy@cohnwolfe.ca

Geno Effler; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info