Banking App Satisfaction in Canada Decreases with Migration to Digital Channels, J.D. Power Finds

Growing Ranks of Digitally Centric Banking, Credit Card Customers Making Digital User Experience Key Driver of Customer Loyalty

TORONTO: 27 June 2019 — With approximately 90% of retail bank customers in Canada saying they’ve had at least one digital interaction with their banks in the past three months1 and 70% of credit card customers interacting with their provider’s digital offerings2, online and mobile apps have become a critical component to overall customer experience. According to four studies of bank and credit card online and mobile app users, released today, J.D. Power finds that customer satisfaction levels with these digital channels have been increasing, with mobile apps in particular driving increased loyalty among banking customers.

The studies—J.D. Power 2019 Canada Banking Mobile App Satisfaction StudySM, 2019 Canada Online Banking Satisfaction StudySM, 2019 Canada Credit Card Mobile App Satisfaction StudySM and 2019 Canada Online Credit Card Satisfaction Study—track overall customer satisfaction with banking and credit card providers’ digital offerings.

“Canada’s leading banks now have more than half of their customers interacting with them in a digitally centric manner,” said Bob Neuhaus, Vice President of Financial Services Intelligence at J.D. Power. “In fact, nearly 40% of banking customers conduct all of their interactions digitally without ever setting foot in a bank branch. As more banking and credit card customers interact more frequently with their providers’ digital channels, these digital experiences will become a fundamental part of the overall brand. It is critical that banks and credit cards get the formula right, delivering the resources customers need, but also organizing it in a way that it is user-friendly.”

Following are some key findings of the 2019 studies:

- Bank mobile app satisfaction decreases: The overall customer satisfaction score for retail banking mobile apps is 821 (on a 1,000-point scale), down 3 points from 2018. Online banking satisfaction is 813. When customers say they have complete understanding of the mobile app, there is a 110-point improvement in overall satisfaction for banking apps and a 101-point improvement for online banking.

- Simplicity and appearance of credit card apps are appealing to consumers: The overall customer satisfaction score for credit card mobile apps is 822. Online credit card satisfaction is 809. In both cases, customers indicate strong levels of understanding of features and offer high marks for mobile app appearance. The higher overall satisfaction scores for credit card mobile apps are attributable to a more tailored visual user experience that limits content to pertinent information and key functionality.

- Familiarity breeds loyalty: Banking mobile apps have the highest percentage of customers accessing the app 12 or more times a month. Higher usage of 8 or more times a month on either online or mobile platform substantially increases overall satisfaction. Overall, 77% of bank mobile app users say their bank’s mobile app is either “somewhat important” or “very important” channel in preventing them from switching to a different bank.

- Personalization, curation of content become next frontier for digital channels: The bulk of spending and design activity in the banking and credit card online and mobile app space has been focused on creating rich feature sets and improving usability. As the technologies evolve, the focus needs to shift to personalization, creating a curated user experience that delivers both convenience and streamlined usability.

Study Rankings

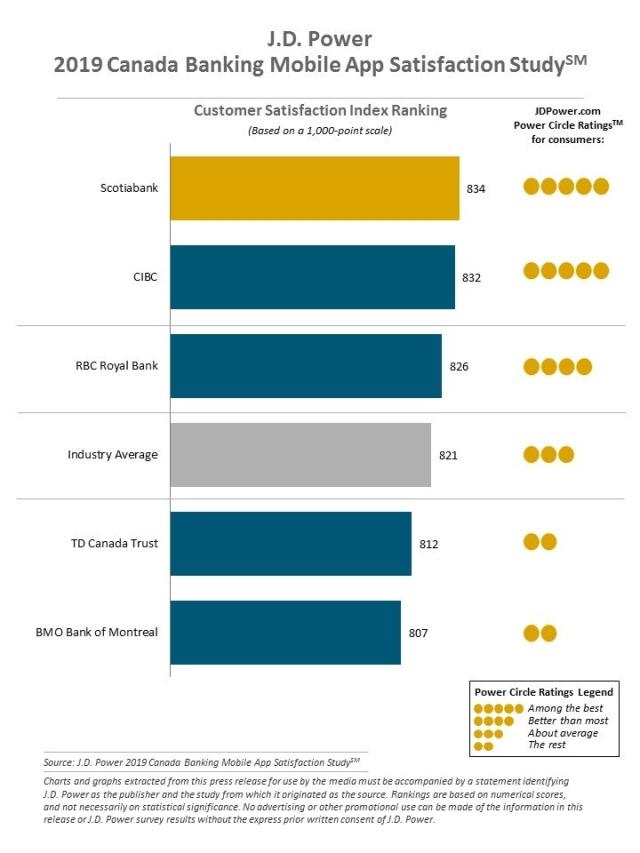

Scotiabank ranks highest in overall satisfaction among Canada banking mobile apps, with a score of 834. CIBC (832) ranks second and RBC Royal Bank (826) ranks third.

TD Canada Trust ranks highest in overall satisfaction for Canada online banking, with a score of 821. CIBC and Scotiabank rank second in a tie with 813.

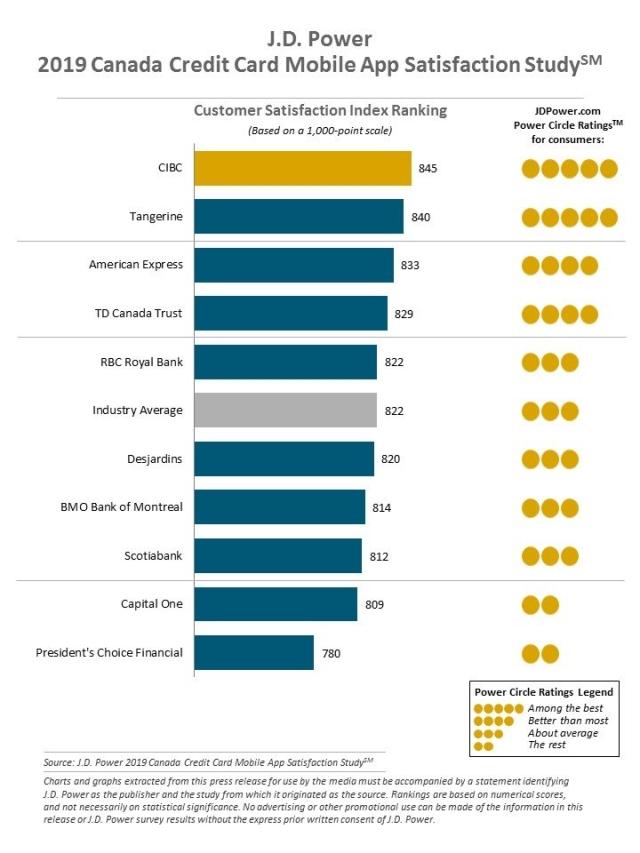

CIBCranks highest in overall satisfaction among Canada credit card mobile apps, with a score of 845. Tangerine (840) ranks second and American Express (833) ranks third.

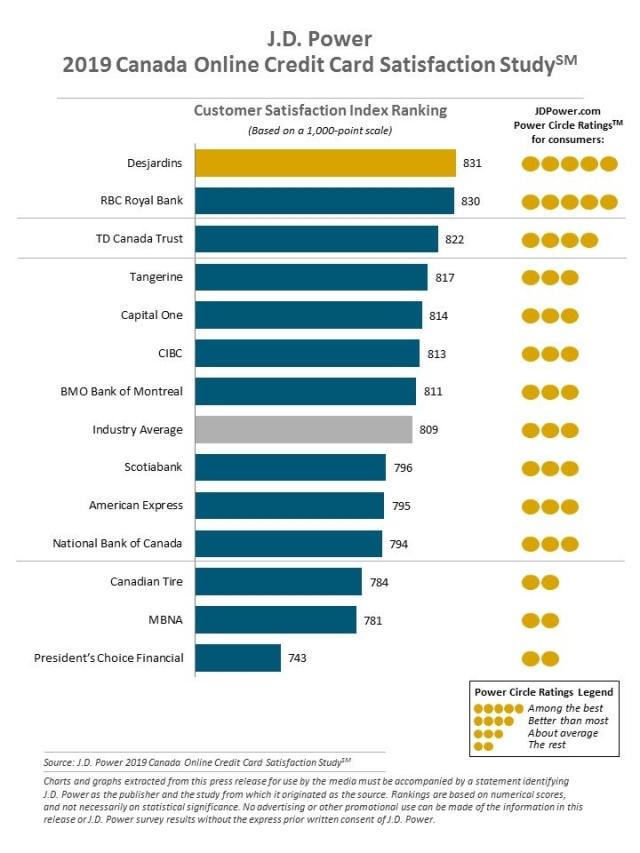

Desjardins ranks highest in overall satisfaction for Canada online credit card, with a score of 831. RBC Royal Bank (830) ranks second and TD Canada Trust (822) ranks third.

The 2019 Canada Banking App Satisfaction, Canada Online Banking Satisfaction, Canada Credit Card App Satisfaction and Canada Online Credit Card Satisfaction studies measure overall satisfaction with mobile banking and credit card applications based on five factors: ease of navigation; appearance; clarity of information; range of services; and availability of key information. The studies are based on responses from 8,409 retail bank and credit card customers nationwide. Both studies were fielded in March-April 2019.

To learn more about these studies, visit https://canada.jdpower.com/business/resource/canadian-banking-mobile-app-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; 647-259-3288: sandy.caetano@cohnwolfe.ca

Geno Effler; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1J.D. Power 2019 Canada Retail Banking Satisfaction Study