Homeowners in Canada More Satisfied with Insurers, Driven by Channel Improvements, J.D. Power Finds

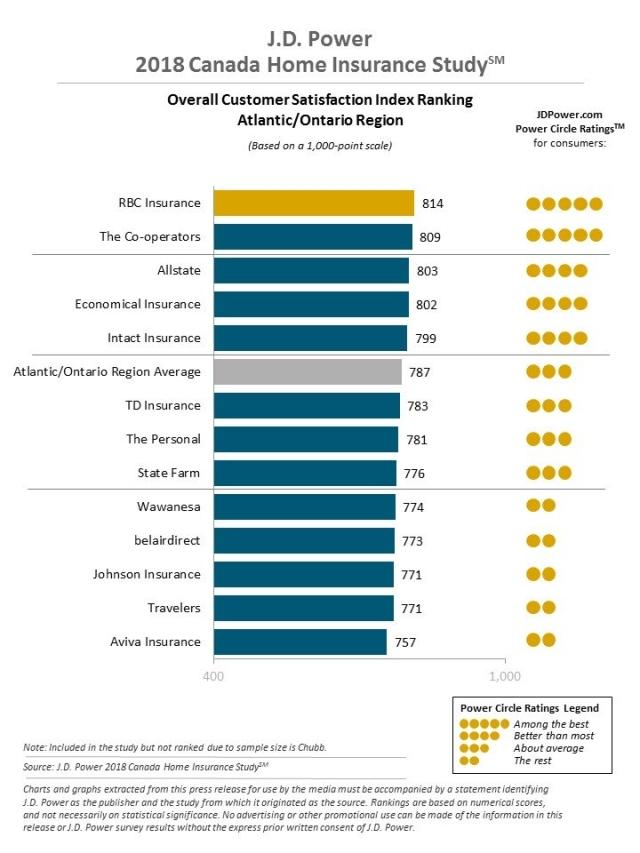

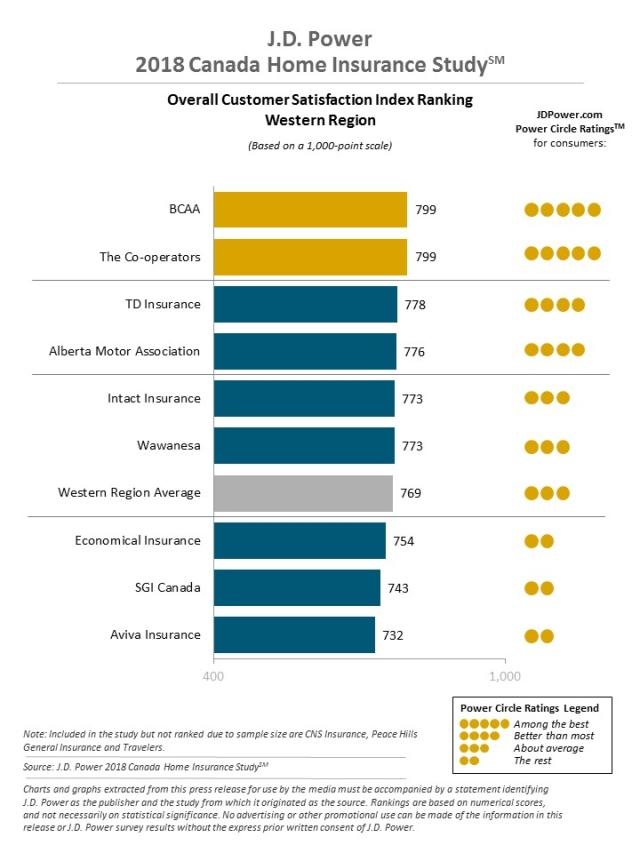

RBC Insurance, The Personal, BCAA and The Co-operators Rank Highest in Canadian Regions

TORONTO: 28 June 2018 — Homeowners in Canada are more satisfied with their insurance providers, although premiums have been on the rise, according to the J.D. Power 2018 Canada Home Insurance Study.SM Overall satisfaction has risen for the third consecutive year, now at 786 (on a 1,000-point scale).

Rising customer satisfaction can be attributed to step-change improvements in channel performance. Higher levels of satisfaction are driven by the industry’s collective focus on improving the way customers interact with their brands, particularly local agent and online relationships.

“Insurers understand the important role channels play in shaping customer satisfaction,” said Tom Super, Director of the Insurance Practice at J.D. Power. “Within an environment that has experienced both premium increases and several large CAT events, an effective channel strategy can help mitigate the negative effects of those events if managed properly.”

On the issue of rate action, the study finds that homeowners’ satisfaction with price is driven more by perception rather than actual dollar value. Customers who pay above their regional median average premium and do not receive an insurer-initiated premium increase are more satisfied than those who pay below the regional median premium and receive an insurer-initiated premium increase (753 vs. 672, respectively). The upshot of this finding is that the negative perception of receiving a premium increase affects satisfaction levels more than the actual price homeowners are paying.

“Transparency is the best strategy when it comes to rate action,” Super added. “Insurers that do a better job of proactively communicating an increase to customers are more effective in retaining quality-driven insurance customers than those insurers that are less forthright.”

Following are some key findings of the 2018 study:

- Highs and lows of premiums: Although experiencing the highest price increase since 2016 (13%), customers in the Quebec region still pay the lowest annual home insurance premiums ($960), followed by those in the Western region ($1,200). Homeowners in the Atlantic/Ontario region have the highest median annual premiums ($1,284).

- A spotlight on Fort McMurray wildfire: The Fort McMurray wildfire that devastated the city in 2016-17 reportedly generated 60,000 insurance claims totaling $3.8 billion in losses. Of those claims, more than 900 remain unsettled, elevating residents’ frustration. While satisfaction has steadily improved among customers in the Alberta province over the past three years, the province average is still lower than the national average (769 vs. 786, respectively), indicating that insurers have room for improvement.

- The factors in which insurers excel the most: The year-over-year improvement in customer satisfaction can be attributed to insurers’ improvements in the following three factors: billing and payment (+10 points); non-claim interaction (+9); and policy offerings (+7).

Study Rankings

In the Atlantic/Ontario region, RBC Insurance ranks highest in overall satisfaction with a score of 814. The Co-operators (809) ranks second and Allstate (803) ranks third.

In the Quebec region, The Personal ranks highest with a score of 823, followed by La Capitale (818) and Intact Insurance (816).

In the Western region, BCAA and The Co-operators rank highest in a tie with a score of 799. TD Insurance (778) ranks third and Alberta Motor Association (776) ranks fourth.

Homeowners in the Quebec region are the most satisfied with their home insurance company, with a region satisfaction average of 810. Homeowners in the Western region have the lowest satisfaction level, averaging 769.

The 2018 Canada Home Insurance Study examines customer satisfaction with their homeowners’ insurance company by examining five factors (in order of importance): non-claim interaction; policy offerings; price; billing and payment; and claims. The non-claim interaction factor includes three subfactors: local agent or broker; call centre service representative; and website.

The study is based on responses from 5,676 homeowner insurance customers across Canada and was fielded from March-May 2018.

For more information about the Canada Home Insurance Study, visit http://canada.jdpower.com/business/resource/canadian-home-insurance-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe, Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; Toronto, Canada; 647-259-3288, sandy.caetano@cohnwolfe.ca

Geno Effler; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info