Customers Finally Adjusting to Shifting Bank Fee Structures; Mobile Adding Value across the Banking Experience, J.D. Power Study Finds

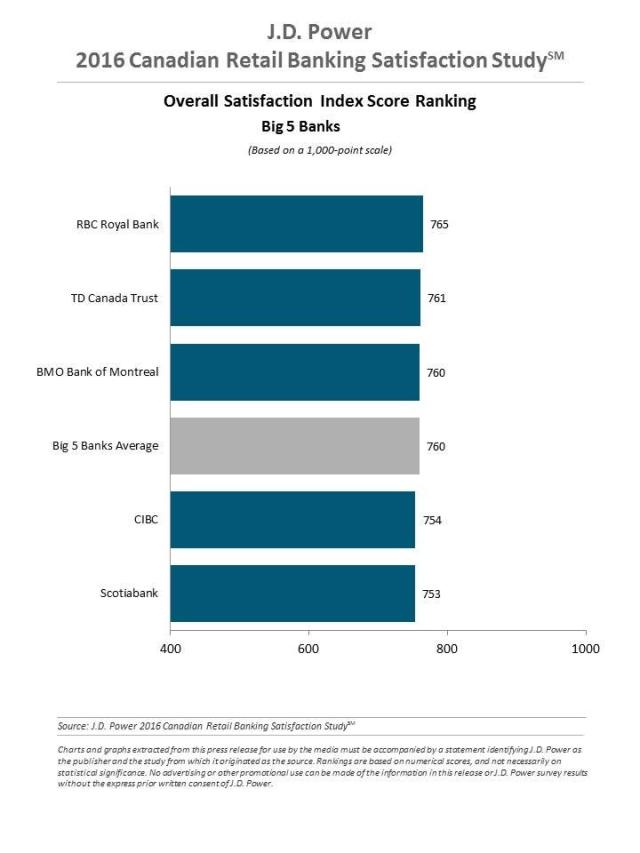

RBC Royal Bank Ranks Highest among Big 5 Banks in Customer Satisfaction in Canada;

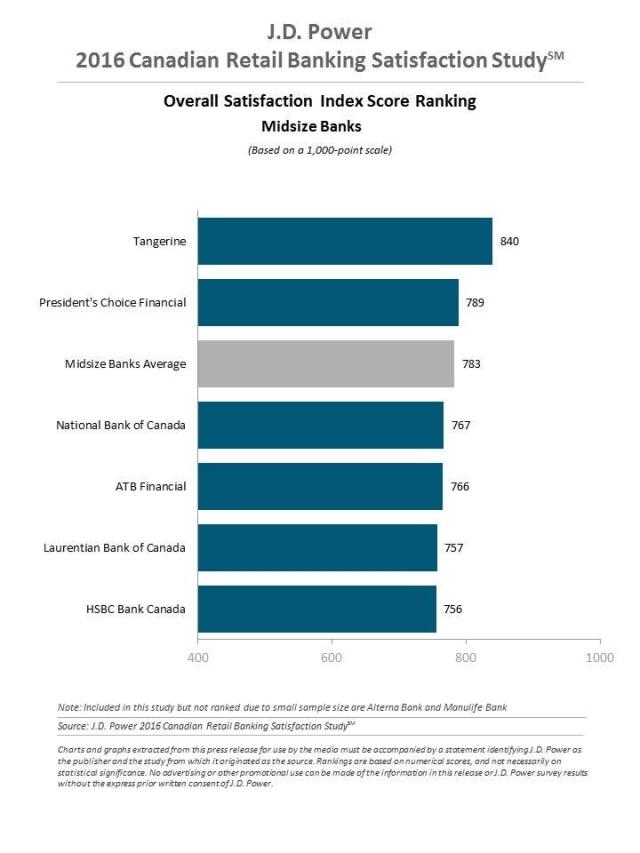

Tangerine Ranks Highest among Midsize Banks for Fifth Consecutive Year

TORONTO: 28 July 2016 — Overall satisfaction with retail banks in Canada improves significantly as customers become more accepting of increased fees incurred during the past two years, according to the J.D. Power 2016 Canadian Retail Banking Satisfaction Study,SM released today.

The study, now in its 11th year, measures customer satisfaction with retail banks in two segments: Big 5 Banks1 and Midsize Banks. In both segments, customer satisfaction is measured in seven factors

(listed in order of importance): product; self-service; personal service; facilities; communication; financial advisor; and problem resolution. Satisfaction is calculated on a 1,000-point scale.

Overall satisfaction improves by 23 points in 2016. Overall satisfaction in the Big 5 Banks segment averages 760, up from 737 in 2015, while satisfaction in the Midsize Banks segment increases to 783 from 759.

The study finds that satisfaction has improved despite ongoing changes in fees. For example, 25% of Big 5 Banks customers in 2016 say they’ve experienced a change in their fee structure and 16% indicate that new fees were introduced, both about the same percentages as in 2015.

“The improvements indicate that customers are becoming less sensitive to new pricing structures, which caused satisfaction to tumble in 2015,” said Paul McAdam, senior director of banking services at J.D. Power. “The banks are doing a better job communicating with their customers, who now are seeing the value they are getting in return for higher fees.”

Satisfaction improves across all factors, with the product and self-service factors being the highest-weighted drivers of the overall industry improvement, increasing by 6 points and 5 points, respectively. Within the product factor, satisfaction in the chequing subfactor increases dramatically year over year, while satisfaction in automated banking machines (ABM) and mobile are the primary drivers of improved satisfaction in the self-service factor.

Mobile Changing the Banking World

The study finds that 34% of bank customers use mobile banking channels in 2016, up from 27% in 2015 and 20% in 2014. Overall satisfaction among customers who use and are satisfied with mobile banking is 836, compared with 760 among those who do not use the channel.

Among the banking channels in 2014, mobile banking generated the lowest satisfaction score (770). In 2016, satisfaction with mobile banking has improved by 34 points to 804, trailing only the in-person branch channel at 807.

“Mobile is changing customer interaction models and forcing banks to transform,” said McAdam. “Banking providers understand that customer expectations of interactivity with mobile devices are different than their expectations of other touch points. The effect of mobile is evident across many aspects of the banking customer experience.”

The impact of mobile goes beyond improving overall satisfaction with the bank. Highly satisfying mobile banking services can mitigate the negative impact of a problem or complaint; help maintain satisfaction with a smaller branch network; improve perceptions of available products and services; and reduce price sensitivity. For example, product satisfaction among customers who use and are satisfied with mobile is 795, compared with 710 among those who do not use mobile. Additionally, facility satisfaction among customers who have two or fewer branch offices nearby averages 788 among satisfied mobile users, compared with 739 among those who do not use mobile.

“Self-service makes banking more convenient for customers, with mobile technology being a key element of self-service,” said McAdam. “Despite the growing number of digital channel interactions, there is more that banks can do to drive customers to self-service channels for routine transactions, which make it easier for the customer and more cost-effective for the bank.”

Emphasizing that opportunity is the fact that 57% of Millennial2 customers still make deposits and 42% make cash withdraws in-person at a branch office.

Additional key findings of the study include:

- Customers Value Proactive Outreach: Proactively reaching out to customers regarding product and service benefits or to provide guidance on financial goals boosts overall satisfaction. Among customers who receive a proactive contact from their bank tailored specifically for their personal needs, overall satisfaction is 837, compared with 746 among customers who are not contacted.

- Problem Prevention Is Critical to Satisfaction: Overall satisfaction averages 773 among the 86% of customers who have not experienced a problem with their bank in the past 12 months. When customers experience one or more problems, satisfaction plummets to 705. Problem incidence is higher among affluent customers3 and those who carry a balance of $10,000 or more, compared with other customers.

- Problem Resolution Can Salvage Satisfaction: Even when customers experience a problem, banks can still keep them happy if they have processes in place to resolve issues quickly and efficiently. Simply resolving a problem increases satisfaction by 89 points, but resolving a problem on the first contact, on the same day and without transferring the customer improves satisfaction by 190 points.

Study Rankings

RBC Royal Bank ranks highest in overall customer satisfaction among Big 5 Banks, achieving a score of 765. RBC Royal Bank performs particularly well in all seven factors, most notably in product. TD Canada Trust ranks second with a score of 761.

Among Midsize Banks, Tangerine ranks highest in overall customer satisfaction for a fifth consecutive year, with a score of 840. Tangerine performs particularly well in product, personal service, self-service and communication. President’s Choice Financial ranks second with a score of 789.

The 2016 Canadian Retail Banking Satisfaction Study is based on responses from more than 13,000 customers who use a primary financial institution for personal banking. The study includes the largest financial institutions in Canada and was fielded from April through May 2016.

For more information about the 2016 Canadian Retail Banking Satisfaction Study, visit http://canada.jdpower.com/resource/canadian-retail-banking-customer-satisfaction-study. See the online press release at http://www.jdpower.com/pr-id/2016137.

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info

1. Big 5 Banks are the largest five banks in Canada (BMO, CIBC, RBC Royal Bank, Scotiabank and TD Canada Trust); Midsize Banks include Alterna Bank, ATB Financial, HSBC Bank Canada, Laurentian Bank of Canada, Manulife Bank, National Bank of Canada, President’s Choice Financial and Tangerine.

2. Millennials are defined as customers who are 22-34 years old.

3. Customers with a household income of $150,000-$500,000 and investable assets between $250,000 and $5 million.