Canadian Self-Directed Investment Firms Not Connecting with Investors on Mobile Experience, J.D. Power Finds

BMO InvestorLine Tops Self-Directed Investor Satisfaction Study

TORONTO: 13 Sept. 2018 — Customer satisfaction with self-directed investment firms is lagging among investors in Canada when it comes to mobile experience, according to the J.D. Power 2018 Canadian Self-Directed Investor Satisfaction Study.SM As nearly two-thirds (64%) of investors do not use their firm’s mobile app and fewer than one-third (31%) say they have a complete understanding of available mobile services, overall satisfaction is lowest in this channel (742 on a 1,000-point scale), compared with satisfaction in the online (774) and phone (779) channels.

“Investment firms in Canada in general are significantly behind the curve when it comes to their mobile app offerings, capabilities and customer engagement,” says Mike Foy, Senior Director of the Wealth Management Practice at J.D. Power. “Investors are increasingly looking to mobile platforms, not only for convenient trade execution but also to access account information; do research; transfer funds; use planning tools; and receive customized alerts and notifications from their firms. Firms that can deliver a robust and intuitive experience—ideally integrated across investment and other financial needs such as banking—will have a huge advantage over competitors.”

The low satisfaction level associated with self-directed investment apps is even further evident in comparison with the retail banking sector in Canada, in which 49% of customers have adopted bank mobile services, and the mobile channel has the highest satisfaction level among all channels (832).

“Taking into account how critical mobile is for consumers and considering where the next pool of investors will come from, it is critical for self-directed investment firms to focus and improve their mobile offerings and user experience, as this is the channel Millennials and younger generations will use,” Foy added.

Following are some key findings of the 2018 study:

- Millennials[1] present business risk and opportunity: Nearly one in five (17%) Millennial investors cite a likelihood to switch to another firm during the next year. On the flip side, nearly four in 10 (36%) of investors in this age group also acknowledge plans to increase the amount they invest in the next 12 months.

- Affluent investors more fee-sensitive in firm selection: While more than one-third of mass market[2] and mass affluent investors choose their investment firm based on previous relationships (such as the retail banking arm), fewer than one in five (18%*) of affluent investors do. The latter are much more likely to be influenced by low fees (39%*) and are much more likely than less affluent investors to cite the firm’s reputation for service (13%* vs. 4% respectively).

- Ongoing need for greater fee transparency: While trading fees have decreased significantly in recent years, and CRM2-mandated disclosures have ostensibly increased and improved the fees information available to investors, most investors still don’t understand their fees. Despite four in five (80%) indicating fees have been explained to them, just 44% of investors say they have a complete understanding.

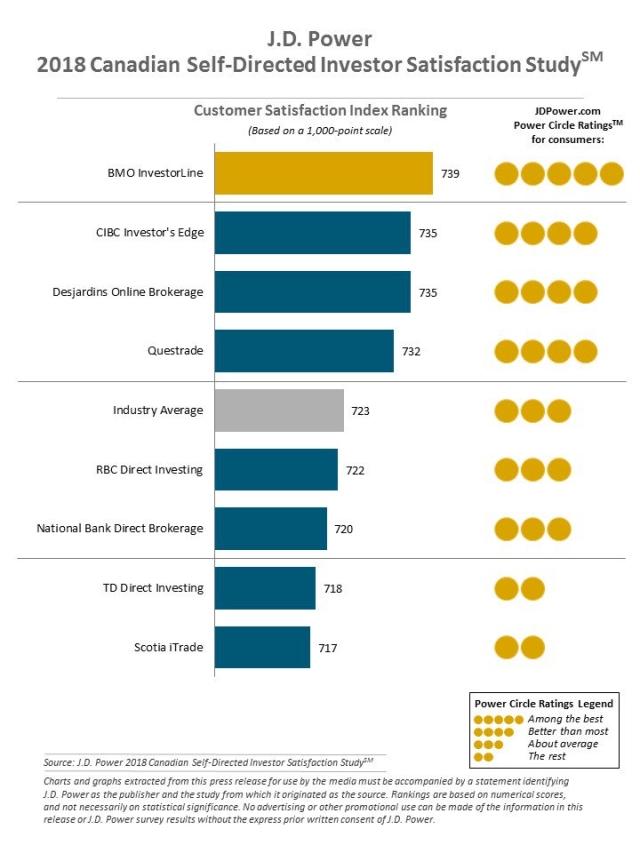

Study Rankings

BMO InvestorLine ranks highest in self-directed investor satisfaction, with a score of 739. Desjardins Online Brokerage and CIBC Investor’s Edge rank second in a tie with a score of 735 each. Questrade ranks fourth with a score of 732.

The 2018 Canadian Self-Directed Investor Satisfaction Study was fielded in May-June 2018 and is based on responses from more than 2,100 investors who do not work with a financial advisor at their primary investment firm.

For information about the Canadian Self-Directed Investor Satisfaction Study, visit http://canada.jdpower.com/resource/canadian-self-directed-investor-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe, Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; Toronto, Canada; 647-259-3288, sandy.caetano@cohnwolfe.ca

Geno Effler; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946 to 1964); Gen X (1965-1976); Gen Y (1977 to 1994); and Gen Z (1995-2004). Millennials (1982-1994) are subsets of Gen Y.

[2] J.D. Power defines investors as mass market (investable assets less than $100,000), mass affluent (investable assets between $100,000-$499,000) and affluent (investable assets of $500,000 and greater).

* Small sample size (n<30)