Retail Banks Play Valuable Role as First Line of Financial Advice for Customers, J.D. Power Finds

Quality of Advice Seen as Key Bank Differentiator, Yet Many Banks Still Miss Opportunity

TORONTO: 26 Feb. 2018 — In a financial services landscape littered with personal finance gurus, mobile finance apps and well-intentioned friends and family, the retail bank is still a valuable first line of financial advice on everything from quick savings tips to retirement strategies, but many banks miss this key opportunity to connect with their customers. According to the J.D. Power 2018 Canada Retail Banking Advice Study,SM 87% of retail bank customers in Canada say they are interested in receiving financial advice or guidance from their bank. However, just 33% of retail bank customers say they receive financial advice.[1] The study also finds that customer satisfaction surges when banks get the advice formula right.

The inaugural study measures retail banking customer satisfaction with the five largest Canadian retail banks as well as best practices related to retail bank-provided advice and account opening processes.

“In recent years, large retail banks in Canada have steadily improved customer satisfaction because of technology investments to provide greater banking convenience and more-consistent products and services,” said Paul McAdam, Senior Director of the Banking Practice at J.D. Power. “The industry’s service improvements have led more customers to view their retail bank as a viable provider of advice. In response, many banks are increasing their emphasis on providing practical advice and guidance to help customers gain greater control over their finances and meet specific financial goals. The challenge for banks is getting the advice formula right and delivering it in a personalized manner across all channels—not only at the branch, but also via the website and mobile app.”

Following are key findings of the new study:

- 87% of retail bank customers want guidance: Among the most common types of advice retail bank customers seek are investment-related advice (47%); quick tips to help improve their financial situation (45%); retirement-related advice (42%); advice to help keep track of spending and household budgets (32%); and in-depth financial review (30%). Nearly three in 10 (29%) customers younger than 40 years old say they are “very interested” in receiving advice from their bank.

- Customers believe they benefit from advice: Among retail bank customers who have received advice/guidance from their bank, 90% believe they have benefited from the information.

- Many banks missing a big opportunity to connect with customers: While there is strong customer interest in receiving advice from their bank and most customers feel they benefit from the advice received, just 33% of customers can recall recently receiving any type of financial advice from their bank.

- Banks struggling to deliver advice digitally: Among retail bank customers who received advice/guidance from their retail bank, 60% of those who received face-to-face advice feel it completely met their needs. That number falls to 37% among customers who received advice digitally (bank’s website or mobile app) and to 35% among those who received advice via email. Moreover, 58% of customers want to receive advice through their bank’s website and mobile app, but only 10% of them have received advice in this manner.

- Advice satisfaction directly linked to trust, retention and advocacy: Among retail bank customers who are highly satisfied with the advice provided by their institution (overall advice satisfaction scores of 900 or higher on a 1,000-point scale), 89% have a high level of trust in their institution; 92% say they “definitely will” reuse their bank for another product; and 85% are identified as Net Promoters.®[2]

“For banks, the key takeaway from this study is that there is a huge opportunity to leverage a combination of in-person and digital interactions to provide advice and guidance that assist customers in their financial journey,” McAdam added. “For customers, these findings shine a light on the valuable role that retail banks can play as a source of trusted financial advice and guidance. Customers should take the opportunity to check out the financial advice and guidance provided by their banks.”

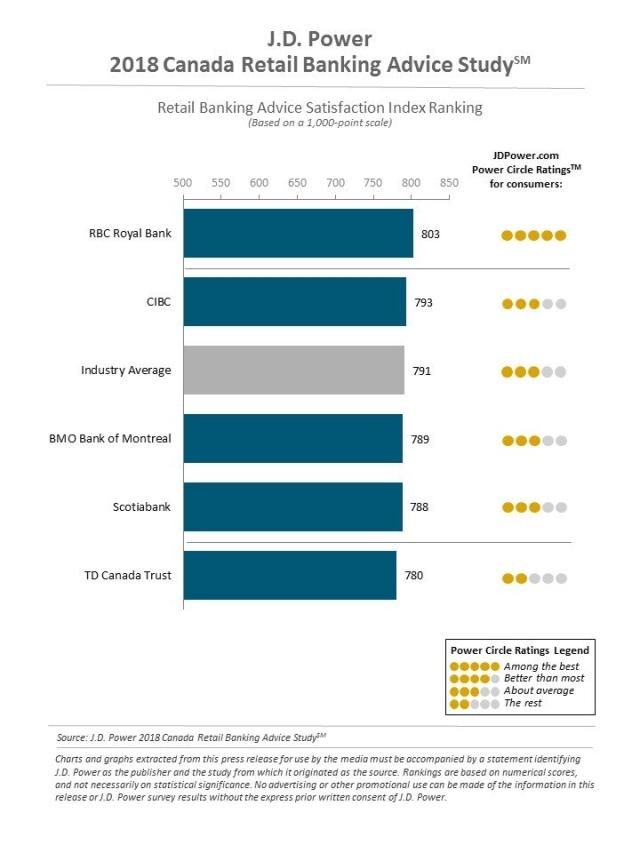

Study Rankings

Among Canadian retail banks, RBC Royal Bank ranks highest in customer satisfaction with retail banking advice with a score of 803. CIBC ranks second with a score of 793, and BMO Bank of Montreal ranks third with a score of 789.

The 2018 Canada Retail Banking Advice Studysurveyed 1,804 retail bank customers in Canada who received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. The study evaluated retail banking advice satisfaction with the five largest Canadian retail banks and was fielded in November-December 2017.

For more information about the Canada Retail Banking Advice Study, visit http://canada.jdpower.com/business/resource/canada-banking-sales-practices-advice-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Stephanie Ronson, Cohn & Wolfe; Toronto, Canada; 647-259-3278, stephanie.ronson@cohnwolfe.ca

Geno Effler; J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Source: J.D. Power 2018 Canadian Retail Banking Satisfaction StudySM

[2] Net Promoter®, Net Promoter System®, Net Promoter Score®, NPS® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.