Canadian Auto Insurance Customer Satisfaction Climbs despite Premium Increases, J.D. Power Finds

The Co-operators Ranks Highest in Customer Satisfaction in Alberta, Atlantic and Ontario Regions; Industrial Alliance Ranks Highest in Quebec

TORONTO: 15 May 2017 — Customer satisfaction with auto insurance in Canada increases for the second consecutive year despite nationwide premium increases, according to the J.D. Power 2017 Canadian Auto Insurance Satisfaction Study,SM released today.

“It does seem counterintuitive to see customer satisfaction increase as premiums rise, but customers are content to pay more when they believe they’re getting value for their money,” said Valerie Monet, senior director of the insurance practice at J.D. Power. “While low prices can be effective at getting new customers in the door, those customers are ultimately willing to pay higher premiums for exceptional service. Key performance metrics, such as making sure customers understand their policies and providing follow-up calls from customer service interactions, translate into higher satisfaction—regardless of an above-average premium.”

Following are some of the key findings of the 2017 study:

- Satisfaction increases amid double-digit premium growth: Across all study regions, price satisfaction and the median annual premium per vehicle are increasing. Reported premiums are up 17% in Quebec; 16% in the Atlantic region; 11% in Alberta; and 1% in Ontario over the past two years. Notably, the lowest reported premium increases are in Ontario, indicating that these customers may finally be realizing Ontario’s Auto Insurance Rate Reduction Strategy to reduce premiums. While new-vehicle prices and costly options are driving premiums higher, the reduction strategy seems to be slowing premium increases in other provinces.

- Willing to pay for value: Price satisfaction is 63 index points higher (on a 1,000-point scale) among auto insurance customers who are paying premiums above the regional median and who completely understand their policies vs. those who are paying less than the regional median and who do not understand their policies.

- Telematics adoption still low: Of the 32% of auto insurance customers who are aware their insurer offers telematics, just 8% are currently participating in safe driver discount programs that are monitored by in-vehicle computers.

Study Rankings

Overall satisfaction with Canadian auto insurers averages 784,1 up 26 points from 2016. Key drivers of the performance improvement are increased understanding of policy and what is covered and better overall customer service.

Customer satisfaction in the Alberta region averages 762, up 19 points from 2016. The Co-operators ranks highest in satisfaction in Alberta for a fourth consecutive year, with a score of 779. Johnson Insurance ranks second (776).

In the Atlantic region, customer satisfaction averages 790, up 22 points from 2016. The Co-operators ranks highest in satisfaction for a third consecutive year, with a score of 828. Wawanesa ranks second (801).

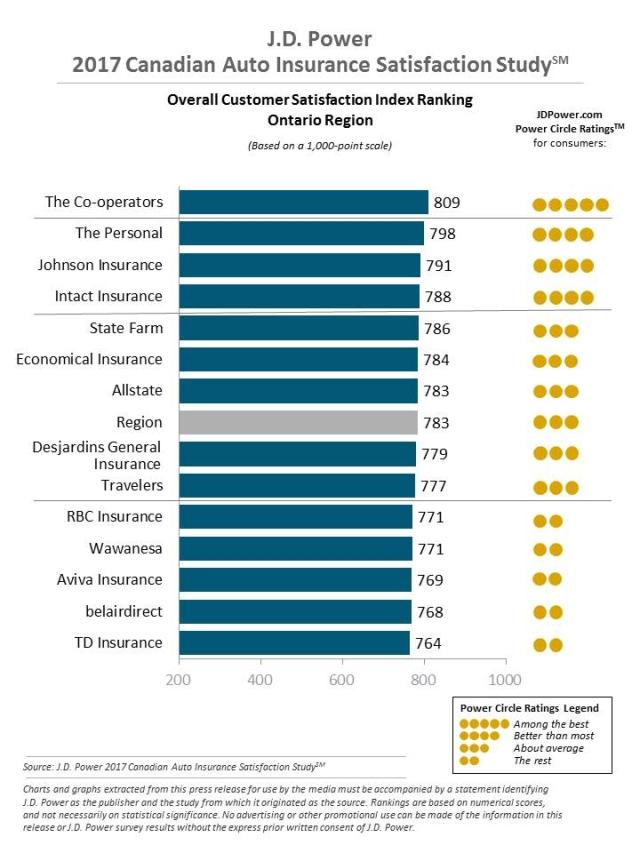

Customer satisfaction in the Ontario region averages 783, up 30 points from 2016. The Co-operators ranks highest in satisfaction for a second consecutive year, with a score of 809. The Personal ranks second (798).

In the Quebec region, customer satisfaction averages 813, up 27 points from 2016. Industrial Alliance ranks highest with a score of 838. Promutuel ranks second (833).

The Canadian Auto Insurance Satisfaction Study, now in its 10th year, measures customer satisfaction with primary auto insurers in Canada. Satisfaction is measured across five factors (in order of importance): non-claim interaction; price; policy offerings; billing and payment; and claims. Insurers are ranked in four regions (in alphabetical order): Alberta, Atlantic, Ontario and Quebec. The study is based on responses from nearly 11,000 auto insurance policyholders. The study was fielded in February-March 2017.

For more information about the Canadian Auto Insurance Satisfaction Study, visit http://canada.jdpower.com/resource/canadian-auto-insurance-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe, Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Geno Effler; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/about-us/press-release-info

----------

1 Excludes government insurers: ICBC (Insurance Corporation of British Columbia), MPI (Manitoba Public Insurance) and SGI (Saskatchewan Government Insurance)

* View the French Version of the press release.