Satisfaction with Auto Insurers at Risk as Record-Level Claims Drive Premiums Higher, J.D. Power Finds

The Co-operators Ranks Highest in Atlantic, Ontario Regions; The Co-operators and Alberta Motor Association Rank Highest in Tie in Alberta Region; The Personal Ranks Highest in Quebec Region

TORONTO: 14 Feb. 2019 — Fueled by a rising frequency and severity of insurance claims and repair costs, vehicle owners in Canada are seeing auto insurance premiums soar and, as a result, customer satisfaction levels are suffering, according to the J.D. Power 2019 Canada Auto Insurance Satisfaction Study,SM released today.

To offset rising costs, auto insurers have been pushing premiums upward to where the national average premium has risen $298. Insureds in Alberta have seen the highest spike in auto insurance costs ($326), followed by those in Ontario ($311), Atlantic ($286) and Quebec ($213).

“With such a dramatic increase in premiums, price sensitivity becomes an issue to which insurers should be very mindful,” said Tom Super, Director of the Insurance Practice at J.D. Power. “While we have seen pockets of claims frequency begin to stabilize, carriers continue to face profitability challenges in the auto sector, especially for those carriers that lagged the market on rate action.”

The study finds that providing clarity and transparency when an insurer initiates a premium increase could help limit the negative effect on satisfaction. Satisfaction is higher among customers who experienced an insurer-initiated increase once they discussed discount options (688 on a 1,000-point scale) and also completely understood their bill (722). For customers who discussed discount options, completely understood their bill and completely understood their policy, satisfaction increases to 741. Satisfaction among those customers who say they did not understand their policy offerings and only saw their insurance cost going up, is much lower at 619.

“There are multiple ways to help customers realize the value of their policy,” Super added. “Providing easy access to policy information via digital channels and having at least one annual touch point to review customers’ changing needs can go a long way in increasing satisfaction and loyalty.”

Nearly two-thirds (62%) of customers who can access their policy online and were contacted by their insurer during the past year intend to keep their business with their current insurer and recommend it to others. In stark contrast, fewer than half (45%) of customers who neither had personal contact nor access to their policy plan to continue with the same insurer and are not likely to recommend it.

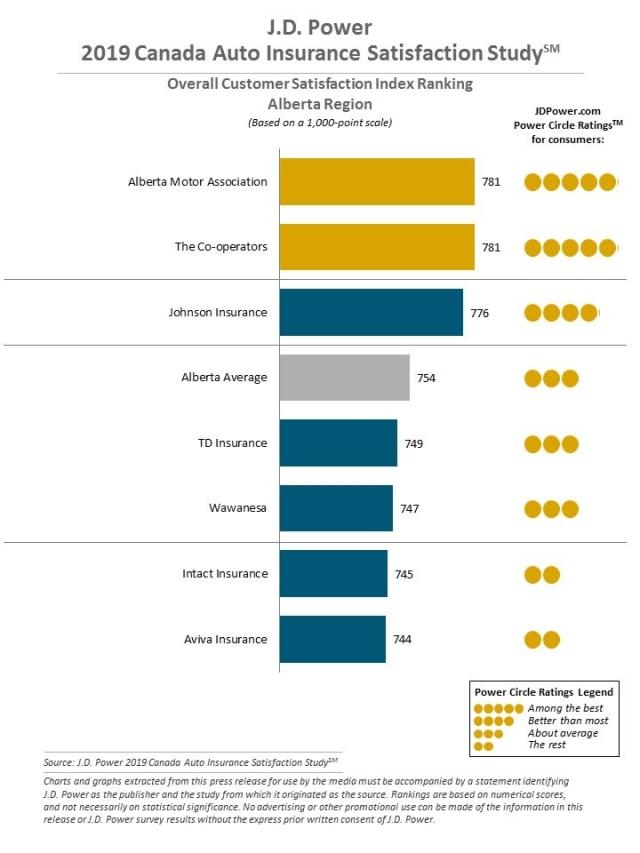

Study Rankings by Region

Alberta Motor Association and The Co-operators share the top rank for the highest satisfaction in Alberta, each with a score of 781. For The Co-operators, this is the sixth consecutive year the company leads auto insurance customer satisfaction in the region. Of note is that among all four regions included in the study, customer satisfaction is lowest among drivers in Alberta, at 754 points.

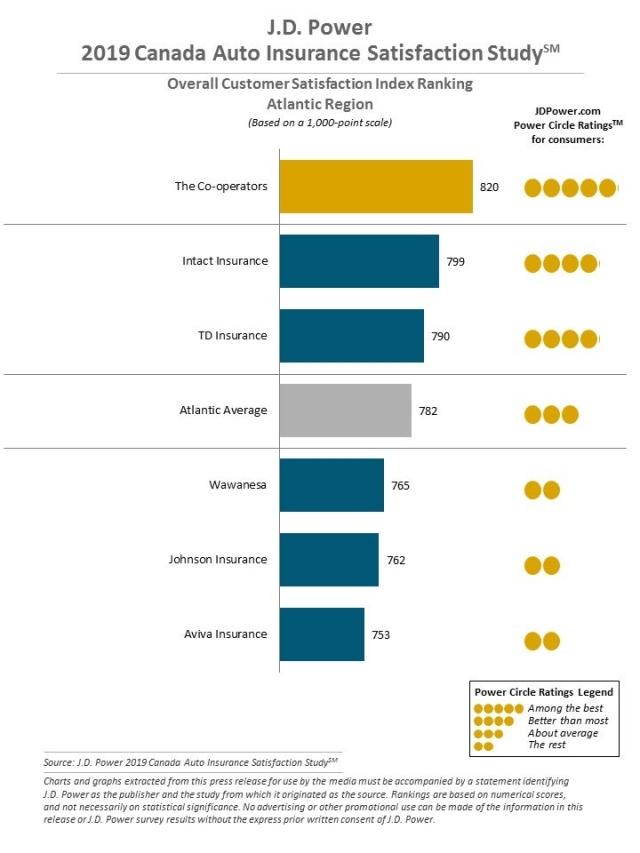

In the Atlantic region, The Co-operators ranks highest with a score of 820 and is followed by Intact Insurance (799).

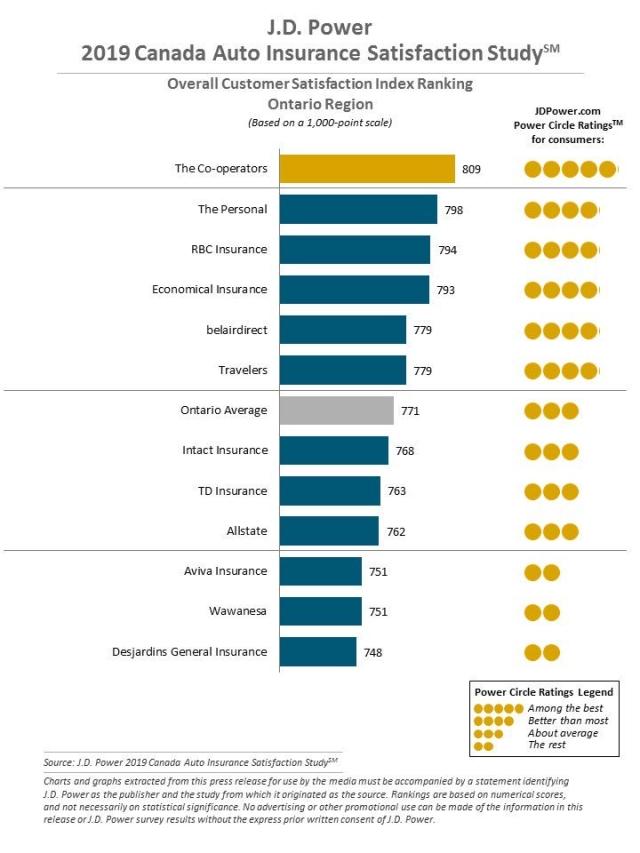

The Co-operators ranks highest in the Ontario region with 809 points. The Personal ranks second with 798.

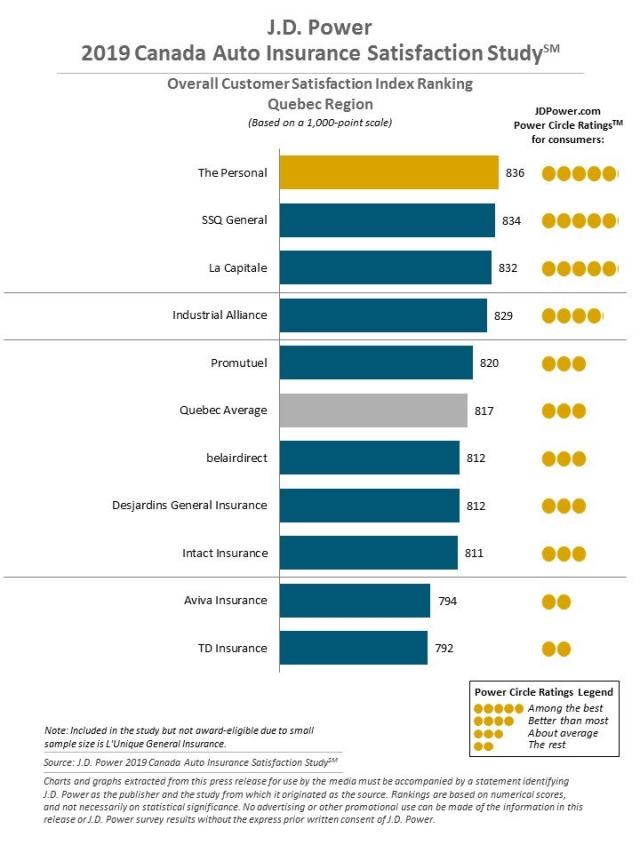

The province of Quebec experiences the highest level of customer satisfaction with an average score of 817. The Personal ranks highest with a score of 836. SSQ ranks second with a score of 834.

The Canada Auto Insurance Satisfaction Study, now in its 12th year, measures customer satisfaction with primary auto insurers in Canada. Satisfaction is measured across five factors (in order of importance): product/policy offerings; price, billing and payment; interaction (non-claims); and claims. Insurers are ranked in four regions (in alphabetical order): Alberta, Atlantic, Ontario and Quebec. The study is based on responses from 8,688 auto insurance policyholders. The study was fielded From October to December 2018.

For more information about the Canada Auto Insurance Satisfaction Study, visit https://canada.jdpower.com/resource/canada-auto-insurance-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; 647-259-3288; sandy.caetano@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info