Most Self-Directed Investor Companies in Canada Failing to Create Fans, J.D. Power Finds

Desjardins Ranks Highest in Customer Satisfaction

TORONTO: 11 May 2023 — While overall satisfaction with self-directed investor companies in Canada rises to 598 (on a 1,000-point scale)—a 5-point increase from a year ago—the experience is a drag on customer loyalty and advocacy for most brands. According to the J.D. Power 2023 Canada Self-Directed Investor Satisfaction Study,SM released today, the industry average Net Promoter Score® (NPS),1 a measurement that reflects customer loyalty and willingness to recommend a brand to family and friends, is just 7 (on a scale of -100 to +100). This is significantly lower than scores in other areas of financial services in Canada such as full-service investor (31) credit card (28) or banking (23). Interestingly, the low NPS score is prevalent among Canada’s Big 5 banks, while pure do-it-yourself (DIY) investment firms’ average NPS score is four to five times higher than the banks.

“Many DIY investors in Canada initially turn to their banks for their investing needs because of the perceived ease of adding on to their existing relationship,” says Craig Martin, executive managing director and head of wealth and lending intelligence at J.D. Power. “However, a lot of these customers are having an experience that leaves them ambivalent or negative about the brand. A key issue is that many customers say they aren’t getting a seamless experience across channels. This less-than-optimal experience greatly increases the odds of customers being open to starting a relationship with another provider, especially if there is an obvious benefit like reduced or no fees. Firms won’t necessarily see obvious negative effects because customers are not getting rid of their existing account; they’re just adding a new one. The real danger is longer term, as customers shift their primary wealth relationship away and the better experience builds loyalty to the new firm.”

According to the study, 40% of self-directed investors say they have a less-than-seamless experience with their brokerage across channels and contact methods. This shortfall in delivering superb customer experience is affecting loyalty and pushing investors to shop around, with 11% saying they are not committed to remaining with their current investment brokerage in the next year. Customer loyalty is even lower among Millennials2 with only 26% feeling committed to staying with their current investment platform provider and 21% saying they have already decided to switch investment firms or are contemplating the idea.

Following are some key findings of the 2023 study:

- Top pain points: The top three reasons for investors switching firms are high costs/fees (30%); better products, tools and services offered by other providers (17%); and poor service (13%).

- Fee understanding remains a problem: Even after the implementation of CRM2 in Canada, 41% of investors say they do not fully understand their brokerage’s fee structure. More concerning, 56% of Millennials indicate having incomplete understanding of fees. When a customer doesn’t fully understand fees, satisfaction is 107 points lower. Notable, too, is the competitiveness of fees. Nearly one in four (23%) of customers say their firm’s fees are higher than others and only 11% of customers of Big 5 banks say their fees are lower than other firms.

- Millennials are increasingly looking beyond banks: Canada’s Big 5 banks still hold a majority of the DIY investor customer base, with the majority being Pre-Boomers/Boomers (55%), yet pure DIY brokerages are gradually taking a bigger share of the business among younger demographics in which the majority of investors is split between Pre-Boomers/Boomers and Millennials. Among the Big 5, the average NPS for Millennials is 1, while among other firms, the average NPS is 23 for Millennials.

Study Ranking

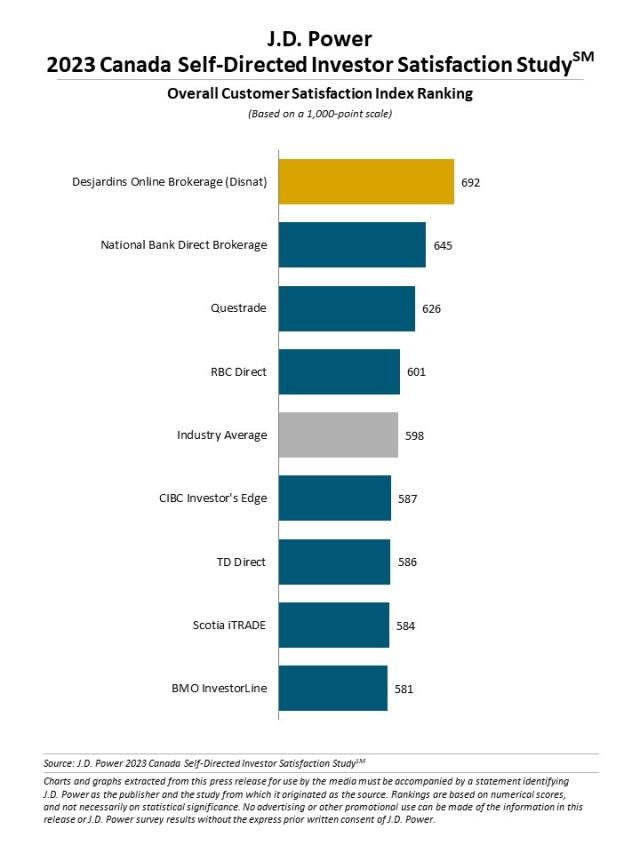

Desjardins Online Brokerage (Disnat) ranks highest among self-directed investor firms with a score of 692. National Bank Direct Brokerage (645) ranks second and Questrade (626) ranks third.

The Canada Self-Directed Investor Satisfaction Study, now in its 15th year, evaluates key satisfaction drivers and firm performance among true do-it-yourself investors (those who do not interact with financial advisors). The study measures satisfaction in seven factors (in order of importance): trust; digital channels; ability to manage wealth how and when I want; products and services; value for fees; people; and problem resolution.

The study is based on responses from 2,243 investors who make all their investment decisions without guidance from a financial advisor. The study was fielded from October 2022 through January 2023.

For more information about the Canada Self-Directed Investor Satisfaction Study, visit https://www.jdpower.com/business/wealth-management-platform.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modelling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

Media Relations Contacts:

Gal Wilder, NATIONAL PR; Toronto, 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1Net Promoter Score, NPS and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

2J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.