Fees, Fraud and Declining Branch and Online Experiences Erode Satisfaction with Banks in Canada, J.D. Power Finds

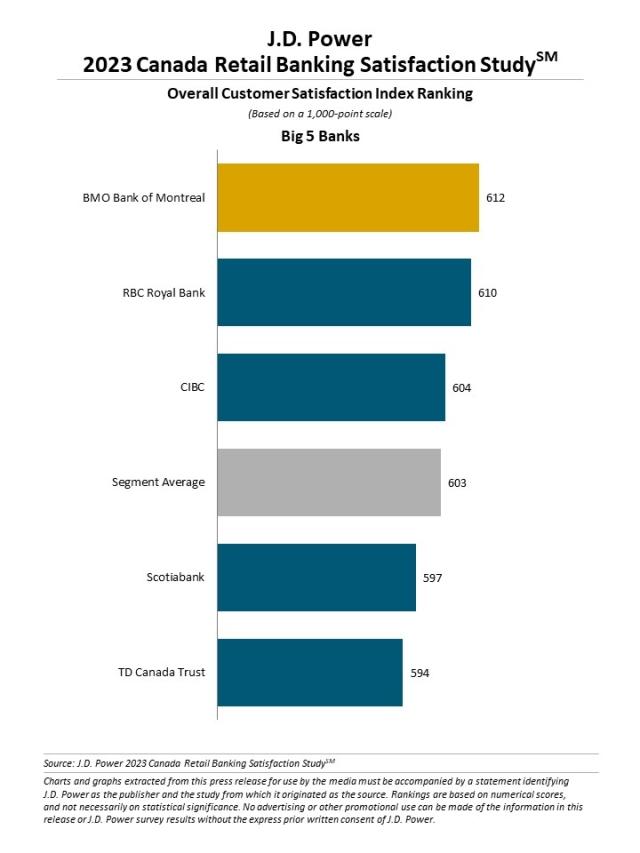

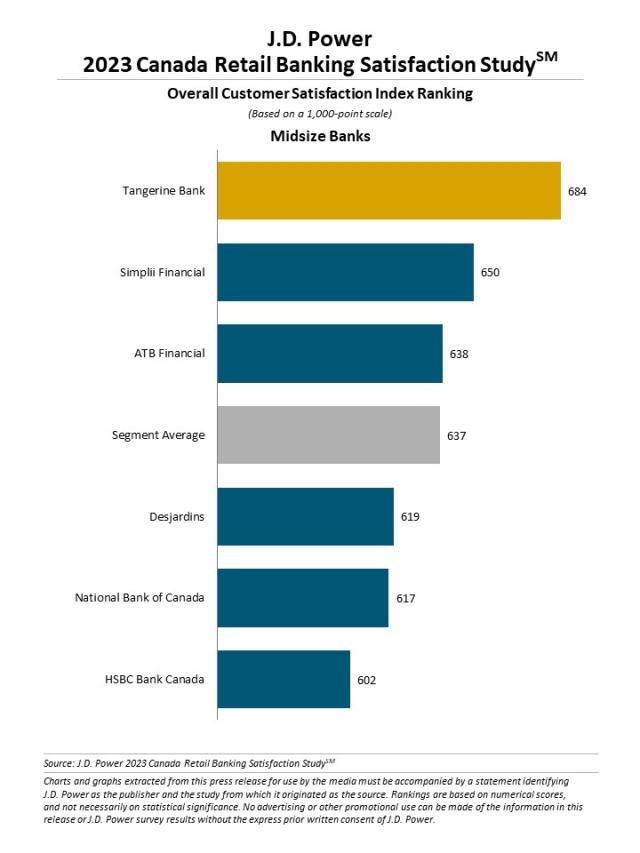

BMO Bank of Montreal and Tangerine Bank Rank Highest in Respective Segments

TORONTO: 19 Oct. 2023 — Higher interest rates, inflationary pressure and mounting debt continue to weigh on the wallets of bank customers in Canada, with 28% of them feeling worse off financially than they were a year ago.1 This financial reality, coupled with unexpected or unexplained banking fees and unsatisfactory customer experiences, have significantly driven down overall satisfaction with banks, according to the J.D. Power 2023 Canada Retail Banking Satisfaction Study,SM released today. Overall, customer satisfaction among Canada’s largest banks (Big 5) has declined 10 points (on a 1,000-point scale) year over year to 603 and has declined 7 points to 637 among mid-size banks.

According to the study, more customers have been paying banking fees during the past year mainly for account maintenance/minimum balance (18%); overdraft or insufficient funds (14%); and ABM fees (12%). However, nearly 80% of these customers say the banks can do a better job at communicating how to avoid those fees. Additionally, the study finds a strong correlation between higher satisfaction and fees-related communications, indicating it is not necessarily the fees that are upsetting customers, but the surprise when they show up on an account statement.

“Customers are under increasing economic stress and express a declining feeling that banks are addressing their concerns and financial challenges,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. “Customers want banks to communicate how to avoid paying fees; provide advice on how to build savings and reduce debt; and resolve problems efficiently—especially when it comes to tackling fraud on a chequing account. The financial institutions that rank highest are those that effectively communicated about fees, fraud and savings; that provided tools and information about budgeting and debt reduction; and addressed security and fraud problems in a timely manner.”

In 2023, fraud/unauthorized account activity has increased to 14% of the total problem volume experienced by customers, an increase of 3 percentage points from 2022. Customer satisfaction with how the banks handled fraud-related problem resolution has declined sharply year over year—by 32 points—a trend that has continued since 2021.

Following are some key findings of the 2023 study:

- Financial health continues to decline: Half (50%) of Canada’s banking customers are considered financially vulnerable or stressed, an increase from 44% a year ago. These customers decreasingly feel their banks’ account offerings meet their needs, which contributes to the overall decline in satisfaction.

- Service channels under pressure: Customers’ satisfaction with their bank’s branch service, online banking and mobile app have declined. Satisfaction with the ease of navigating bank websites and mobile apps also has declined. With branch service, customer wait times have increased and satisfaction has declined for the bank’s concern for customer needs and for courtesy of staff.

- Not brand ambassadors: While customers broadly express that they have no plans to switch from their current bank and are likely to reuse the same financial institution for a new account or product, these customers say they are not likely to act as a brand ambassador or recommend their bank to family or friends, as evidenced by a 3-point decline (on a scale of -100 to 100) in Net Promoter Score®.2

- How banks can better assist their customers: The top three areas that customers expect greater support from their bank are alerts about suspicious account activity (56%); information on how to reduce fees (50%); and advice on ways to save money and earn more interest (35%).

Study Rankings

BMO Bank of Montreal ranks highest in satisfaction among Big 5 Banks with a score of 612. RBC Royal Bank (610) ranks second and CIBC (604) ranks third.

Tangerine Bank ranks highest among midsize banks for a 12th consecutive year, with a score of 684. Simplii Financial (650) ranks second and ATB Financial (638) ranks third.

The Canada Retail Banking Satisfaction Study, now in its 18th year, measures customer satisfaction with Canada’s large and mid-size banks. The scores reflect satisfaction among the entire retail banking customer pool of these banks, representing a broader group of customers than solely the branch-dependent and digital-centric segments. The study measures satisfaction across seven factors (in order of importance): trust; people; account offerings; allowing customers to bank how and when they want; saving time and money; digital channels; and resolving problems or complaints.

The study is based on responses from 13,960 retail banking customers of Canada’s large and mid-size retail banks regarding their experiences with the financial institutions. The study was fielded in two waves from January through February 2023 and from July through August 2023.

For more information about the Canada Retail Banking Satisfaction Study, visit https://www.jdpower.com/business/retail-banking-study-1.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

Media Relations Contacts

Gal Wilder, NATIONAL PR; 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

2Net Promoter,® Net Promoter System,® Net Promoter Score,® NPS,® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.