Satisfaction with Full-Service Financial Advisors in Canada Plummets as Markets Fall, J.D. Power Finds

Lack of Comprehensive Advice and Personalized Financial Planning Allows Market Volatility to Dictate Client Satisfaction

TORONTO: 2 May 2023 — High interest rates, inflationary pressure and volatile capital markets that saw U.S. economic indices and Canada’s S&P/TSX post negative returns (8.7% for the TSX) in 2022 have wreaked havoc on investors’ returns. That abysmal performance led to a significant drop in overall investor satisfaction with their financial advisor relationships, according to the J.D. Power 2023 Canada Full-Service Investor Satisfaction Study,SM released today. The study finds that satisfaction with investors’ wealth management professionals is 652 (on a 1,000-point scale), down 17 points from a year ago.

“Advisors don’t control the ups and downs of the market but too often clients give them credit and blame for investment returns,” said Craig Martin, executive managing director and global head of wealth & lending intelligence at J.D. Power. “This misguided view of the advisor’s role and value is a key risk for full-service firms in the future. If the main value provided is investment performance, investors may increasingly look for less costly ways to achieve similar returns. That said, some advisors and firms have recognized that delivering a differentiated experience pays off. Instead of providing a transactional-style service, which puts advisors at risk of client churn, J.D. Power sees leaders focusing on delivering value through comprehensive advice that shines through the market’s ebb and flow and helps clients achieve their life goals. This level of advisory insulates these firms and advisors from the elevated risks of negative markets and creates evangelists in the good times.”

The following are key findings of the 2023 study:

- Only a fraction of investors receives comprehensive advice: The study shows that only 6% of investors in Canada are receiving a comprehensive level of service and advice from their wealth management professionals. Comprehensive advice is defined as personalized guidance from an advisor that addresses all financial and wealth management needs; demonstrates an intimate understanding of the client’s lifestyle and goals; puts the client’s best interests first; includes a financial plan; ensures clients understand the fees they pay; and is an integral part of the client’s life.

- Comprehensive advice promotes advocacy: Investors who receive comprehensive advice from their financial advisors are more than three times as likely as those who receive transactional advice to recommend their financial advisor to friends or family.

- Just more than half of full-service wealth clients have financial plans: Only 57% of full-service wealth management clients say they have a financial plan and, within that group, 43% do not agree that their advisor’s recommendations are in their best interests. Surprisingly, 38% of investors who say they have a plan don’t think their advisor understands their financial goals and needs.

- Younger clients already voting with their feet: Millennials1 are the most likely to switch firms in the next 12 months and are most likely to already be working with a secondary investment firm. One in five (20%) Millennials say they “definitely will” or “probably will” switch firms, and 33% say they are working with a secondary investment firm.

Study Ranking

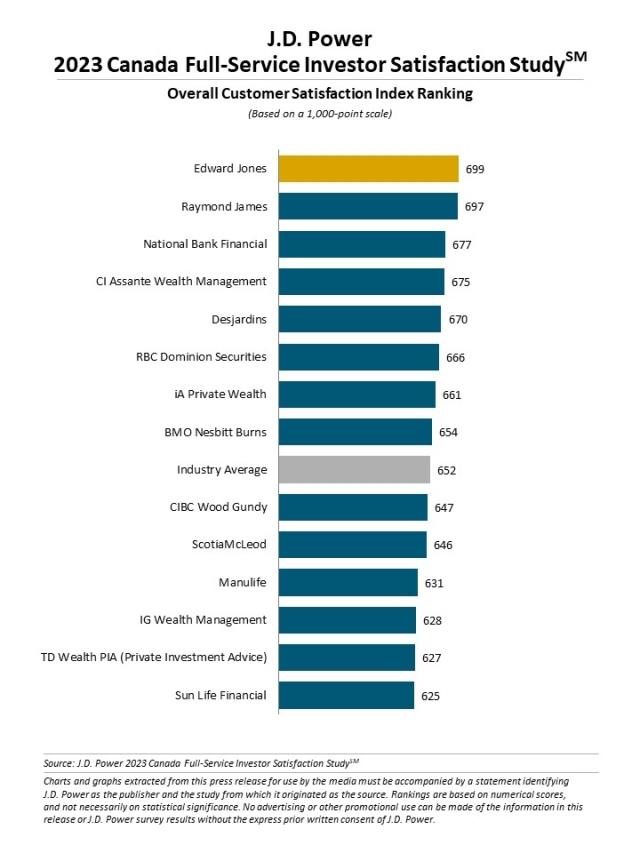

Edward Jones ranks highest in overall investor satisfaction with a score of 699. Raymond James (697) ranks second and National Bank Financial (677) ranks third.

The Canada Full-Service Investor Satisfaction Study, now in its 18th year, measures overall investor satisfaction with full-service investment firms in seven factors (in order of importance): trust; people; products and services; value for fees; ability to manage wealth how and when I want; problem resolution; and digital channels.

The study is based on responses from 4,803 investors who work directly with a dedicated financial advisor or team of advisors. The study was fielded from October 2022 through January 2023.

For more information about the Canada Full-Service Investor Satisfaction Study, visit https://www.jdpower.com/business/wealth-management-platform.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modelling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

Media Relations Contacts

Gal Wilder, NATIONAL PR; Toronto, 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.