Dealers Lag Aftermarket Shops in Capturing Canada’s Auto Service Market Share, J.D. Power Finds

NAPA AUTOPRO Ranks Highest in Customer Satisfaction

TORONTO: Sept. 12, 2019 – Although auto dealers in Canada receive 54% of revenue spent on servicing vehicles 4-12 years old, they continue to lag aftermarket service facilities in share of visits (48% vs. 52%), according to the J.D. Power 2019 Canada Customer Service Index Long-Term Study (CSI-LT).SM

In an industry estimated to generate $10 billion annually, dealerships average $323 per visit vs. $222 at an aftermarket facility but customer visits to dealerships remain flat in 2019 (1.3 visits) compared with an increase in visits to aftermarket facilities (1.6 in 2019 vs. 1.5 in 2018).

“Considering the sheer size of the auto service market for maintenance and repair, any fraction gained in market-share translates into millions in potential revenue that auto dealers are leaving on the table,” says Virginia Connell, Automotive Research and Consulting Manager at J.D. Power Canada. “As vehicles age and require more complex and costly repairs, aftermarket service is doing a better job at attracting and retaining customers, especially as warranties start to expire, consequently capitalizing on the more revenue lucrative repair work.”

According to the study, owners start to favour aftermarket shops over dealers when their car is between 4-7 years old. Furthermore, while dealers have a slight advantage in customer satisfaction when it comes to pure maintenance (787 vs. 782, on a 1,000-point scale), aftermarket service facilities have higher overall satisfaction than dealers (783 vs. 775) and higher satisfaction with repairs (791 vs. 759).

“Dealers have this window of opportunity to up their game, ensuring they retain customers even after the warranty expires by providing a better experience—a key factor for driving satisfaction both for repair and maintenance,” Connell said. “For auto dealers, satisfied customers not only translate into repeat service visits but their intent to purchase or lease new vehicles from the dealer increases.”

Following are additional key findings of the 2019 study:

- Two simple tasks that drive improvement in customer satisfaction: Two areas that can drive noticeable satisfaction increase are greeting customers immediately as they enter the shop and returning the car cleaner than when it arrived. Overall, aftermarket providers do a better job of greeting customers immediately than do dealers (51% vs. 35%), but dealers are more likely to return vehicles cleaner (33% vs. 9%).

- Word of mouth important for aftermarket providers: Recommendations from friends or relatives are much more important when customers choose an aftermarket shop compared with a dealer. Aftermarket customers “definitely will” recommend their facility 52% of the time after maintenance work, compared with 39% for dealers. The gap for repair work is even wider (57% vs. 34%, respectively).

- Service work recommendations drive satisfaction, increased revenue: Satisfaction is highest when customers receive and accept recommendations for additional service work from their service advisor. Customers are much more likely to accept additional work recommendations when tablets are used to list details of the service. Tablets boost acceptance rates of work recommendations when used in the following ways: list specific details of the issue (59%); provide a cost estimate (57%); access service history (57%); and show a menu of available options (56%).

Study Rankings

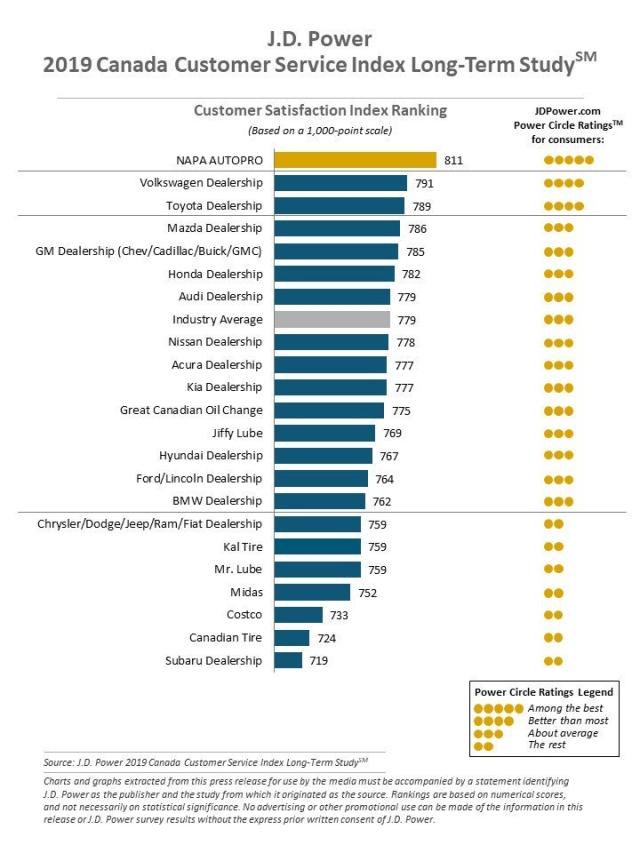

NAPA AUTOPRO ranks highest in overall customer satisfaction with a score of 811. Volkswagen Dealership (791) ranks second and Toyota Dealership (789) ranks third.

The Canada Customer Service Index Long-Term (CSI-LT) Study measures satisfaction and intended loyalty among owners of vehicles that are 4-12 years old and analyzes the customer experience in both warranty and non-warranty service visits. Overall satisfaction is based on five factors (in order of importance): service initiation (24%); service quality (23%); service advisor (20%); service facility (17%); and vehicle pick-up (16%). The study is based on responses of 8,815 owners and was fielded from March through June 2019.

To learn more about the Canada Customer Service Index Long-Term (CSI-LT) Study, visit

https://canada.jdpower.com/resource/canada-customer-service-index-long-term-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe, Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; Toronto, Canada; 647-259-3288, sandy.caetano@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules:www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: One chart follows.