What is PIN?

As the largest source for retail transaction data, PIN has the broadest and deepest electronic point-of-sale data from dealerships describing the sale, the vehicle, the buyer and the deal. This solution leverages industry leading sales pricing and analytics, thereby providing the timeliest source of real-time buyer behavior.

As the largest source for retail transaction data, PIN has the broadest and deepest electronic point-of-sale data from dealerships describing the sale, the vehicle, the buyer and the deal. This solution leverages industry leading sales pricing and analytics, thereby providing the timeliest source of real-time buyer behavior.

16,000+ PARTICIPATING FRANCHISES that together covers 42% of all U.S. and 25% of Canadian retail transactions

12M+ NEW- & USED-RETAIL TRANSACTIONS PER YEAR examines 250+ metrics per vehicle transaction

REAL TIME DATA transactions are aggregated daily with results reflected in next business day reports

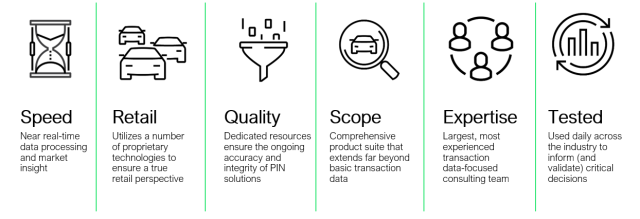

Why PIN?

PIN enables manufacturers, financial organizations, media/marketing and suppliers to leverage the foundational benefits of near-real-time transactional data through a set of tailored solutions that address critical business needs.

PIN’s proprietary analytics are based on actual customer transactions (not self-reported or lagged third party data), therefore creating an ecosystem of data that aligns retail sales demand, pricing and consumer behavior for each given period.

PIN enables manufacturers, financial organizations, media/marketing and suppliers to leverage the foundational benefits of near-real-time transactional data through a set of tailored solutions that address critical business needs.

PIN’s proprietary analytics are based on actual customer transactions (not self-reported or lagged third party data), therefore creating an ecosystem of data that aligns retail sales demand, pricing and consumer behavior for each given period.

Market Diagnostics

On-demand analytics delivered through sophisticated BI tools

PIN Explorer®

A dynamic reporting tool that enables users to perform competitive analyses; track new-product introductions; conduct market comparisons; and isolate weaknesses and strengths. PIN Explorer® data covers over 250 key data observations for each new- and used-vehicle transaction, including:

- Vehicle: segment, origin, make, model, model year, trim, engine, odometer, days to turn, etc.

- Buyer: gender, age, census-block info including education, ethnicity, household income, etc.

- Transaction: amount financed, trade equity, APR, MSRP, vehicle price, total down, etc.

- Dealer: vehicle cost, gross, profit margin, etc.

- History: five years of historical data (archive to 2001)

Ability to quickly and intuitively assess OEM data to help make informed and timely decisions

Keep track of the composition of market transactions on a weekly basis

Collaborate between different OEM functions using common data

Access to dashboard and reporting capabilities for highly efficient workflow

PIN Navigator®

A reporting tool that combines credit scores, new- and used-vehicle sales data, and financial transaction data on a weekly basis by market and by nameplate. PIN Navigator® is designed to support the needs of the sales, marketing, pricing, risk and insurance departments of automotive finance lenders.

PIN Navigator provides lenders with 24/7 access to the most timely data available in the market and includes more than 70 contract, dealer, and lender variables updated weekly. This is a “must have” in today’s competitive automotive financial marketplace.

Compare your auto finance offerings to any competitor in customizable segments

Optimize your price offerings to maximize volume and profitability

Understand areas of opportunity to expand your footprint into new segments or locations

Monitor the market in which you compete and alerts you to any pricing changes

Set scheduled reports that will send updated customizable report outputs to your email on a weekly basis

PowerDealer®

A highly accurate and free online source for analytical tools and decision-support products that enable your dealership to compare your operation to your market region, improve your dealership profitability, and help you make effective business decisions.

PowerDealer® is available to dealers enrolled in PIN. In addition to access to a full suite of dealer-specific and market-comparison reports designed by J.D. Power, PowerDealer® includes new and used vehicle sales tools as well as fixed operations tools.

For a free demo, visit PowerDealer and use the following to access the site:

Login: pindemo

Password: pindemo

Data beats instinct every time

Stock only what is selling in your market today and cut your risk factors

Transactional data is the only ‘true’ data. Don’t rely on speculation

Get a competitive edge. Know how your competition is stocking and selling new- and used-vehicles in your market

On-demand analytics delivered through sophisticated BI tools

PIN Explorer®

A dynamic reporting tool that enables users to perform competitive analyses; track new-product introductions; conduct market comparisons; and isolate weaknesses and strengths. PIN Explorer® data covers over 250 key data observations for each new- and used-vehicle transaction, including:

- Vehicle: segment, origin, make, model, model year, trim, engine, odometer, days to turn, etc.

- Buyer: gender, age, census-block info including education, ethnicity, household income, etc.

- Transaction: amount financed, trade equity, APR, MSRP, vehicle price, total down, etc.

- Dealer: vehicle cost, gross, profit margin, etc.

- History: five years of historical data (archive to 2001)

Ability to quickly and intuitively assess OEM data to help make informed and timely decisions

Keep track of the composition of market transactions on a weekly basis

Collaborate between different OEM functions using common data

Access to dashboard and reporting capabilities for highly efficient workflow

PIN Navigator®

A reporting tool that combines credit scores, new- and used-vehicle sales data, and financial transaction data on a weekly basis by market and by nameplate. PIN Navigator® is designed to support the needs of the sales, marketing, pricing, risk and insurance departments of automotive finance lenders.

PIN Navigator provides lenders with 24/7 access to the most timely data available in the market and includes more than 70 contract, dealer, and lender variables updated weekly. This is a “must have” in today’s competitive automotive financial marketplace.

Compare your auto finance offerings to any competitor in customizable segments

Optimize your price offerings to maximize volume and profitability

Understand areas of opportunity to expand your footprint into new segments or locations

Monitor the market in which you compete and alerts you to any pricing changes

Set scheduled reports that will send updated customizable report outputs to your email on a weekly basis

PowerDealer®

A highly accurate and free online source for analytical tools and decision-support products that enable your dealership to compare your operation to your market region, improve your dealership profitability, and help you make effective business decisions.

PowerDealer® is available to dealers enrolled in PIN. In addition to access to a full suite of dealer-specific and market-comparison reports designed by J.D. Power, PowerDealer® includes new and used vehicle sales tools as well as fixed operations tools.

For a free demo, visit PowerDealer and use the following to access the site:

Login: pindemo

Password: pindemo

Data beats instinct every time

Stock only what is selling in your market today and cut your risk factors

Transactional data is the only ‘true’ data. Don’t rely on speculation

Get a competitive edge. Know how your competition is stocking and selling new- and used-vehicles in your market

Analytical Solutions

Analytics delivered at specified intervals

PIN Retail Share

A weekly report that tracks changes in sales and market share in near real time to benchmark sales performance by segment, manufacturer, nameplate, and model against the previous year, month, or week. The report also includes forecasts of retail and fleet industry sales.

Data includes:

- Retail share and sales volumes

- Weekly and MTD market share

- National and regional market share

- Preformatted charts describing industry performance

- and market composition

Helps OEM keep track of sales and share compared to internal projections and targets throughout the month

Enables OEM to track the effectiveness of incentive and sales strategies aimed to increase sales or share

Provides competitive insight and perspective of relative performance within the industry

PIN Incentive Spending & Customer-Facing Transaction Price

A weekly report that merges take rates with program offerings and provides complete transparency regarding how OEMs are spending money for incentive offers, as well as take rates and contribution to spend detailed for every incentive on every model in the industry.

Data includes:

- 260 columns of data offering complete transparency into offers, take rates, and costing methodology

- Vehicle price, customer-facing transaction price and incentive spending per unit at multiple granularity levels

- Incentive offers, take rates, and weighted spend for 22 common incentive types, flexibility for 10 non-core incentive types

- Finance & lease details, type of sale & incentive, spending offers and take rates by type of incentive, visible vs. non-visible, core vs. non-core spending offers, take rates and more

Allows multiple datasets (share and trade-in data) to be merged to understand contribution to share from loyalty and conquest

Helps an OEM keep track of performance of incentives targeting loyal or conquest customers

Provides competitive insight and perspective of relative performance within the industry

Loyalty/Conquest

A PIN-exclusive weekly report combines the Model Level Share report with the actual vehicles traded in by new-vehicle buyers, providing an understanding of loyalty and conquest behavior.

Data includes:

- Share weighted counts by purchase month indicating:

- OEM, nameplate, model and segment purchased

- OEM, nameplate, model and segment traded-in

Allows multiple datasets (share and trade-in data) to be merged to understand contribution to share from loyalty and conquest

Helps an OEM keep track of performance of incentives targeting loyal or conquest customers

Provides competitive insight and perspective of relative performance within the industry

PIN Market Timer

A report that leverages lease maturity dates for sold vehicles and the characteristics of new-vehicle purchases to estimate when a given buyer or lessee will return to market.

Data includes:

- Volume of returning customers on a monthly basis by sale type and term group

- Average monthly payment of returning customers

- Data offered at model, nameplate and segment levels

- Return volumes and monthly payments forecasted for current year plus two years into future

Enhanced tactical marketing activities = improved incentive efficiency

Enhance plan/forecast accuracy for new and used operations = improved operating efficiency

PIN Portfolio Age

An Excel-based interactive tool that describes past, present and future product activity. Included is an Excel flat file with age metrics exported from the interactive tool.

Data includes:

- Past, present and future product activity

- Age metrics

- Sales data

- Core product metrics such as number of entries, replacement rate and sales per entry

Provides the data needed to plan product activity

Allows a manufacturer to identify competitive product actions and strategize how best to minimize any negative effects

Offers a way to determine the future strength or weakness of a segment

CFTP Frequency Distribution

This report provides insight into sales volumes by transaction price band, providing invaluable intelligence in answering key business questions

Data includes:

- Retail sales volume and percent of retail sales distributed across $500, $1,000, and $2,000 Customer-Facing Transaction Price bands

- Vehicle granularity levels include industry, OEM, nameplate, series, model, segment by model year

- Transaction type granularity includes cash, finance, and lease types of sale

Describe sales volume distribution across the price spectrum using CFTP which is negotiated vehicle price less customer-facing incentives

Establish market size opportunity for new entries

Understand competitiveness of in-market prices and offers

Helps an OEM keep track of sales volume across the competitive pricing landscape using true customer-facing prices

Enables OEM to track the competitiveness of incentive and sales strategies aimed to increase sales or share

Certified Pre-Owned Insights

Allows manufacturers to benchmark the performance of their certified pre-owned (CPO) and non-CPO used-vehicle sales relative to the industry in entirety and by specific competitors. Delivered by J.D. Power Valuation Services.

Understand market share of CPO and Used sales. Determine if CPO and used unit sales and gross profits are competitive

Learn where CPO buyers come from and where do CPO disposers go

Understand how model year mix has varied in the past and if the variation is consistent between CPO and Used

Analytics delivered at specified intervals

PIN Retail Share

A weekly report that tracks changes in sales and market share in near real time to benchmark sales performance by segment, manufacturer, nameplate, and model against the previous year, month, or week. The report also includes forecasts of retail and fleet industry sales.

Data includes:

- Retail share and sales volumes

- Weekly and MTD market share

- National and regional market share

- Preformatted charts describing industry performance

- and market composition

Helps OEM keep track of sales and share compared to internal projections and targets throughout the month

Enables OEM to track the effectiveness of incentive and sales strategies aimed to increase sales or share

Provides competitive insight and perspective of relative performance within the industry

PIN Incentive Spending & Customer-Facing Transaction Price

A weekly report that merges take rates with program offerings and provides complete transparency regarding how OEMs are spending money for incentive offers, as well as take rates and contribution to spend detailed for every incentive on every model in the industry.

Data includes:

- 260 columns of data offering complete transparency into offers, take rates, and costing methodology

- Vehicle price, customer-facing transaction price and incentive spending per unit at multiple granularity levels

- Incentive offers, take rates, and weighted spend for 22 common incentive types, flexibility for 10 non-core incentive types

- Finance & lease details, type of sale & incentive, spending offers and take rates by type of incentive, visible vs. non-visible, core vs. non-core spending offers, take rates and more

Allows multiple datasets (share and trade-in data) to be merged to understand contribution to share from loyalty and conquest

Helps an OEM keep track of performance of incentives targeting loyal or conquest customers

Provides competitive insight and perspective of relative performance within the industry

Loyalty/Conquest

A PIN-exclusive weekly report combines the Model Level Share report with the actual vehicles traded in by new-vehicle buyers, providing an understanding of loyalty and conquest behavior.

Data includes:

- Share weighted counts by purchase month indicating:

- OEM, nameplate, model and segment purchased

- OEM, nameplate, model and segment traded-in

Allows multiple datasets (share and trade-in data) to be merged to understand contribution to share from loyalty and conquest

Helps an OEM keep track of performance of incentives targeting loyal or conquest customers

Provides competitive insight and perspective of relative performance within the industry

PIN Market Timer

A report that leverages lease maturity dates for sold vehicles and the characteristics of new-vehicle purchases to estimate when a given buyer or lessee will return to market.

Data includes:

- Volume of returning customers on a monthly basis by sale type and term group

- Average monthly payment of returning customers

- Data offered at model, nameplate and segment levels

- Return volumes and monthly payments forecasted for current year plus two years into future

Enhanced tactical marketing activities = improved incentive efficiency

Enhance plan/forecast accuracy for new and used operations = improved operating efficiency

PIN Portfolio Age

An Excel-based interactive tool that describes past, present and future product activity. Included is an Excel flat file with age metrics exported from the interactive tool.

Data includes:

- Past, present and future product activity

- Age metrics

- Sales data

- Core product metrics such as number of entries, replacement rate and sales per entry

Provides the data needed to plan product activity

Allows a manufacturer to identify competitive product actions and strategize how best to minimize any negative effects

Offers a way to determine the future strength or weakness of a segment

CFTP Frequency Distribution

This report provides insight into sales volumes by transaction price band, providing invaluable intelligence in answering key business questions

Data includes:

- Retail sales volume and percent of retail sales distributed across $500, $1,000, and $2,000 Customer-Facing Transaction Price bands

- Vehicle granularity levels include industry, OEM, nameplate, series, model, segment by model year

- Transaction type granularity includes cash, finance, and lease types of sale

Describe sales volume distribution across the price spectrum using CFTP which is negotiated vehicle price less customer-facing incentives

Establish market size opportunity for new entries

Understand competitiveness of in-market prices and offers

Helps an OEM keep track of sales volume across the competitive pricing landscape using true customer-facing prices

Enables OEM to track the competitiveness of incentive and sales strategies aimed to increase sales or share

Certified Pre-Owned Insights

Allows manufacturers to benchmark the performance of their certified pre-owned (CPO) and non-CPO used-vehicle sales relative to the industry in entirety and by specific competitors. Delivered by J.D. Power Valuation Services.

Understand market share of CPO and Used sales. Determine if CPO and used unit sales and gross profits are competitive

Learn where CPO buyers come from and where do CPO disposers go

Understand how model year mix has varied in the past and if the variation is consistent between CPO and Used

Advisory Services

The power of PIN data combined with J.D. Power automotive experts and data scientists

Incentives Planning Services

An on-demand solution that provides marketers with insights into what drives business performance by determining the impact of alternative incentive amounts, structures, and price points.

Capabilities include:

- Sales/share lift, incentive spending, take rate, and profitability estimates for:

- Any vehicle (client or competitor)

- Any time (past, present, future)

- National or client regions

More efficient incentive planning strategies

Decreased incentive spending

Higher share gain per incentive dollar

Quicker response time to competitive actions

Better understanding of incentive budget necessary to hit sales objectives

Volume Planning

An on-demand service that leverages the full array of PIN and J.D. Power data to assess future sales and price performance for a given model or portfolio

Receive a data and industry expertise driven, quantitative assessment of expected performance with full transparency for the drivers of the analysis

The power of PIN data combined with J.D. Power automotive experts and data scientists

Incentives Planning Services

An on-demand solution that provides marketers with insights into what drives business performance by determining the impact of alternative incentive amounts, structures, and price points.

Capabilities include:

- Sales/share lift, incentive spending, take rate, and profitability estimates for:

- Any vehicle (client or competitor)

- Any time (past, present, future)

- National or client regions

More efficient incentive planning strategies

Decreased incentive spending

Higher share gain per incentive dollar

Quicker response time to competitive actions

Better understanding of incentive budget necessary to hit sales objectives

Volume Planning

An on-demand service that leverages the full array of PIN and J.D. Power data to assess future sales and price performance for a given model or portfolio

Receive a data and industry expertise driven, quantitative assessment of expected performance with full transparency for the drivers of the analysis

Experts You Can Count On

Matthew Racho

Managing Director

Matthew's Bio