Service Improvements Uplift Small Business Satisfaction with Canada’s Largest Banks, J.D. Power Finds

CIBC Ranks Highest in Small Business Banking Satisfaction

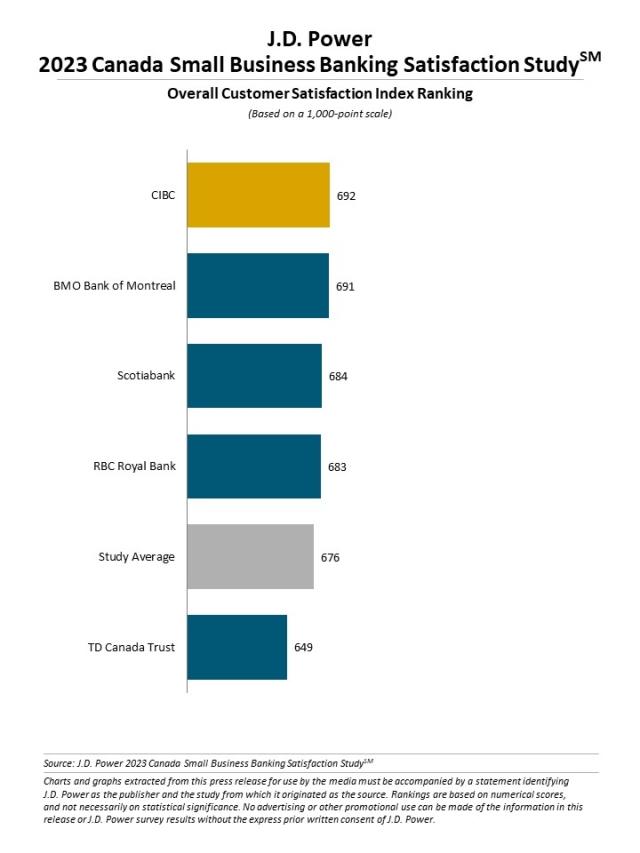

TORONTO: 31 Oct. 2023 — In a stark contrast to the retail banking segment, satisfaction with Canada’s largest banks has grown significantly among their business clients, according to the J.D. Power 2023 Canada Small Business Banking Satisfaction Study,SM released today. Small business owners’ satisfaction with their primary financial institution increases 23 points (on a 1,000-point scale) this year to 676. This significant increase is attributed mainly to customer experience improvements in digital channels (online banking and mobile app); people (courtesy, promptness, and attention to client’s needs); and efficient problem resolution.

“Canadian banks are effectively catering to the needs of small businesses in day-to-day servicing, in interactions with the business’ assigned relationship manager and in high-value activities like new account opening,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. “As small businesses become more confident about the future, it also presents an opportunity for the banks to deepen business relationships beyond transactional-level services by providing targeted financial advice during both in-person and digital interactions.”

In addition to an increase in overall satisfaction, the study also finds that small businesses are showing an increase in deposit balances, more manageable debt and fewer businesses being classified as financially vulnerable. With the improved financial state of the country’s small businesses, more are saying they can pay all their bills on time, have a strong credit rating; and have improved access to affordable funding and timely credit to meet their business needs.

Study Ranking

CIBC ranks highest in small business banking customer satisfaction with a score of 692. BMO Bank of Montreal (691) and Scotiabank (684) rank second and third, respectively.

The 2023 Canada Small Business Banking Satisfaction Study, now in its fifth year after having been published from 2012 to 2014, measures satisfaction across seven factors (in order of importance): people; account offerings; allowing me to bank how and when I want; helping me save time or money; level of trust; digital channels; and resolving problems or complaints. The study includes responses from 2,356 small business owners of—or financial decision-makers at—small businesses that use business banking services. The study was fielded from June through August 2023.

For more information about the Canada Small Business Banking Satisfaction Study, visit https://www.jdpower.com/business/financial-services/canada-small-business-banking-satisfaction-study.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

Media Relations Contacts

Gal Wilder, NATIONAL PR; 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info