Satisfaction with Credit Card Issuers in Canada Remains Flat Amid COVID-19, J.D. Power Finds

Tangerine Bank Ranks Highest in Overall Credit Card Customer Satisfaction for Second Consecutive Year

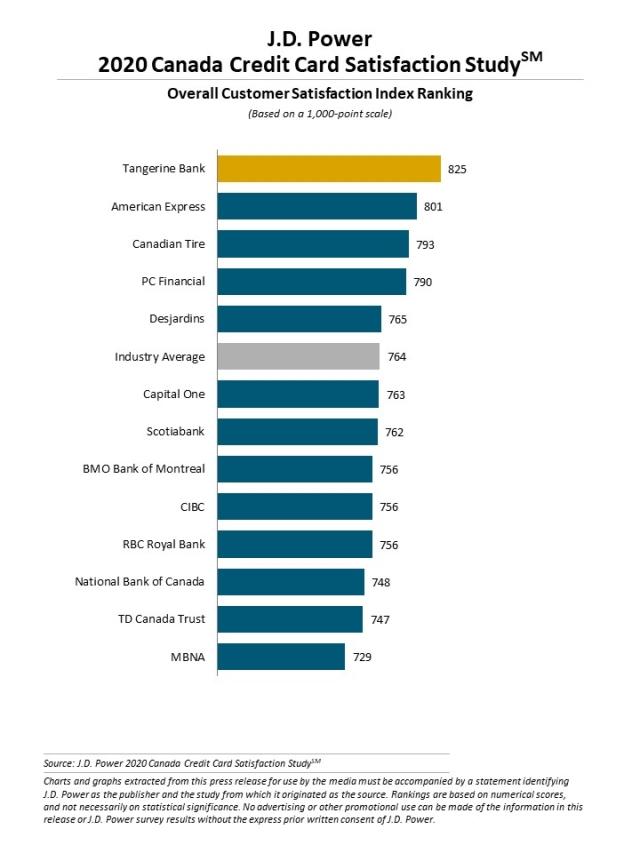

With 73% of credit card customers in Canada saying COVID-19 has negatively affected them financially and 24% who say they are unable to make monthly credit card payments, overall satisfaction with their primary credit card issuer remains relatively flat year over year at 764 (on a 1,000-point scale), according to the J.D. Power 2020 Canada Credit Card Satisfaction Study,SM released today.

“While credit card issuers in Canada are faring somewhat better than their U.S. counterparts in averting the negative effects of COVID-19 on customer satisfaction, they are not out of the woods,” says John Cabell, director of banking and payments intelligence at J.D. Power. “Credit card companies are falling behind in key areas related to the customer experience, especially in factors linked to financial sensitivity and customer support channels, which are crucial during the pandemic.”

According to the study, despite a one-point increase in overall satisfaction from 2019, credit card issuers have experienced a year-over-year decline in key performance indicators (KPIs) related to interactions with credit card customers, such as showing concern for customer needs; appreciating customer business; problem-free experiences; card activation; and reward redemption. As a result, satisfaction is down 12 points in assisted online experience and down 11 points for call centres.

More than half (55%) of cardholders acknowledge COVID-19 has changed their card usage habits, mainly by spending less. Understanding customers’ needs and addressing their changing priorities can help card issuers to mitigate future decline in satisfaction and elevate loyalty. The study shows that offering free or discounted services in response to COVID-19 are the actions driving a more positive impression of the issuer (39% and 35%, respectively), followed by gestures such as employee support (33%); waiving fees (32%); and community support (32%).

“The pandemic presents an opportunity for issuers to align their card services and benefits with customers’ evolving needs,” Cabell said. “Issuers can increase the perceived value of the card and strengthen loyalty. Offering discounted airline tickets or free airport lounge access is probably not as lucrative these days for cardholders as, for example, it would be to extend the duration of annual fees.”

Following are additional key findings of the 2020 study:

- Satisfaction declines with household income: With 29% of cardholders earning less during the pandemic, many are looking for relief from their credit card company and are more critical of card issuers. In fact, credit card satisfaction among customers whose household income has declined due to the pandemic is lower than among those whose income remained unchanged. The largest gaps in satisfaction are in rewards (-12 points); benefits and services (-11); communication (-8); and customer interaction (-8).

- Call centre woes: The pandemic has put a greater strain on call centres, which has negatively affected satisfaction. Caller wait times jumped to more than 12 minutes during the pandemic compared with less than 8 minutes prior to the pandemic. Also, caller satisfaction with the level of courtesy exhibited by call centre representatives declined significantly, which calls out the need for card issuers to restore best practices among their reps and identify better ways to manage customer support.

- Cardholders are digitally savvy: Nearly two-thirds (64%) of cardholders solely rely on digital channels to manage their primary credit card activities, and those cardholders are more likely to say it is easy to understand information about their account and do business with their issuer than do cardholders who do not rely solely on digital channels. In fact, one of the bright spots in the study is improvements in customer satisfaction with mobile and online interaction of 8 points and 7 points, respectively, from 2019.

Study Rankings

Tangerine Bank ranks highest in overall customer satisfaction with a score of 825, which is 61 points higher than the industry average of 764. American Express (801) ranks second and Canadian Tire (793) ranks third.

The Canada Credit Card Satisfaction Study measures satisfaction of cardholders’ primary credit card issuer. The study measures performance in six factors critical to the customer experience (in alphabetical order): benefits and services; communication; credit card terms; customer interaction; key moments; and rewards. The study includes responses from 6,728 cardholders who used a major credit card in the past three months and was fielded in May-June 2020.

For more information about the Canada Credit Card Satisfaction Study, visit https://canada.jdpower.com/financial-services/canada-credit-card-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info