Dealer-Lender Relationships Play Critical Role as Vehicle Sales in Canada Keep Sliding, J.D. Power Finds

Ford Credit and TD Auto Finance Rank Highest in Respective Segments

TORONTO: 21 May 2019 – Against a backdrop of declining auto sales in Canada, dealers are expecting their lenders to go shoulder to shoulder with them in weathering the tightening market, and are looking for lenders to foster a dealer-lender relationship focusing on ease of doing business, according to the J.D. Power 2019 Canada Dealer Financing Satisfaction Study,SM released today. The top two reasons cited by dealers for sending business to a lender are people/relationships and easy to work with.

“The constricting market presents both risk and opportunity for lenders,” said Patrick Roosenberg, Director of Automotive Finance at J.D. Power. “As dealers face headwinds, the pressure on lenders mounts not only to be price competitive but also to provide a high level of service. Every dealer-lender communication touch point, from the credit analysts to the sales representative, must be a value-add. Lenders who are engaged with their dealer partners are poised to protect market share and even grow it over the long-term.”

The study also finds that dealers will seek the path of least resistance. Dealers who gave high marks (9 or 10 on a scale of 1-10) on the reasonableness of the lender’s stipulation process, are twice as likely to increase their business with the lender compared with those who rated the process 8 or lower.

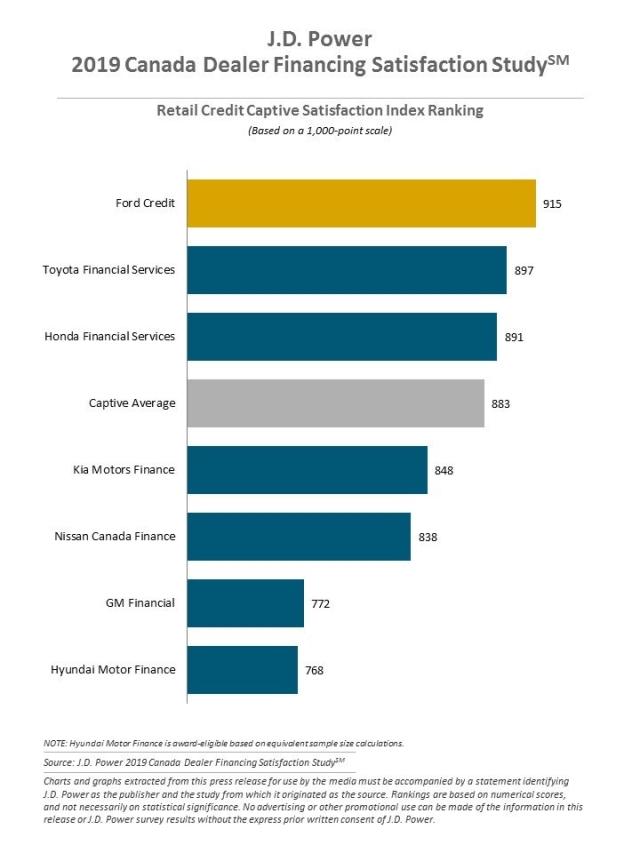

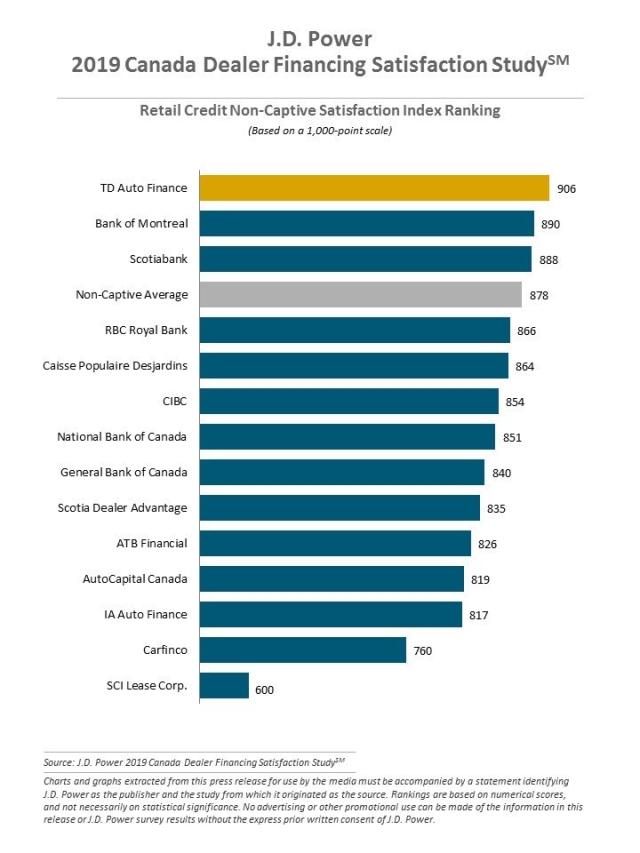

Lender Rankings

Ford Credit ranks highest in the captive lender segment with a score of 915. Toyota Financial Services (897) ranks second and Honda Financial Services (891) ranks third.

Among non-captive lenders, TD Auto Finance ranks highest for the second consecutive year, with a score of 906. Bank of Montreal (890) ranks second and Scotiabank (888) ranks third.

Overall satisfaction in the captive segment improves to 883 (on a 1,000-point scale), up from 875 in 2018. In the non-captive segment, overall satisfaction rises to 878, a 16-point improvement over 2018.

The 2019 Canada Dealer Financing Satisfaction Study, now in its 21st year, captures 5,572 finance provider evaluations across the two segments from new-vehicle dealerships in Canada. The study was fielded in February 2019.

For more information about the Canada Dealer Financing Satisfaction Study, visit

https://canada.jdpower.com/business/resource/canada-dealer-financing-satisfaction-study

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; 647-259-3288: sandy.caetano@cohnwolfe.ca

Geno Effler; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info