In Highly Competitive Auto Financing Market, Relationships Are Differentiators, J.D. Power Finds

Mercedes-Benz Financial Services and TD Auto Finance Rank Highest in Dealer Financing Satisfaction

TORONTO: 23 May 2018 — For the second consecutive year, auto dealers in Canada continue to stress the importance of the dealer-lender relationship and are more satisfied with lenders that not only understand their needs, but also consistently exceed their expectations, according to theJ.D. Power 2018 Canadian Dealer Financing Satisfaction Study,SM released today.

As the auto retail financing industry becomes more commoditized, dealers cite “people relationships” and “ease of doing business” as the top two reasons for their selection of a financing provider. The importance of these two reasons are echoed both by captive and non-captive lenders. Factors such as dealer compensation and competitive rates are also relevant in the provider selection decision, but are of secondary importance to customer service-related reasons.

“The marketplace in Canada continues to be strong, yet highly competitive, so relationships are what make the difference,” said Jim Houston, Senior Director of Automotive Finance at J.D. Power. “Lenders can adjust their credit policy, interest rate or dealer compensation plans, but it’s how they interact with dealers and resolve issues when they arise that have the greatest effect on satisfaction. When overall satisfaction increases, dealers are more willing and able to deepen the business relationship with lenders.”

The study, now in its 20th year, finds that problem resolution and the speed with which an issue is rectified significantly affect dealer satisfaction levels. Moreover, it’s the credit department that bears the load and acts as the first port of call when things go sour. Six in 10 (60%) auto dealers indicate that credit desk personnel are the first point of contact for any problems or concerns. Additionally, 76% of dealers say they were able to engage with credit staff when needed.

“While both captive and non-captive lenders’ credit departments perform well in making themselves available, lenders should not rest on their laurels,” Houston said. “Instead, they should maintain a sense of urgency when responding to dealers, as satisfaction levels plummet when the credit department is not readily available. Leveraging various communication channels and technology coupled with adequate credit department staffing are some measures in which lenders can demonstrate their commitment and differentiate themselves to increase satisfaction.”

Following are additional findings of the 2018 study:

- Lender selection influenced by more than just relationships: Beyond the relationship influence, dealers have different views of satisfaction depending on the type of lender with which they are doing business. Dealers who work with captive lenders place higher importance on the lender’s customer loyalty rebates (27%) than those who work with non-captive lenders (4%). In contrast, dealers that choose to do business with non-captive lenders place a greater importance on dealer compensation (13%), compared with those that choose to work with captive lenders (4%).

- Sales performance requires improvement: In a highly competitive and fragmented market, exceeding expectations becomes a paramount differentiator. The study finds that dealers hold their lender sales representatives to a higher set of standards, yet sales representatives exceed expectations less than half of the time.

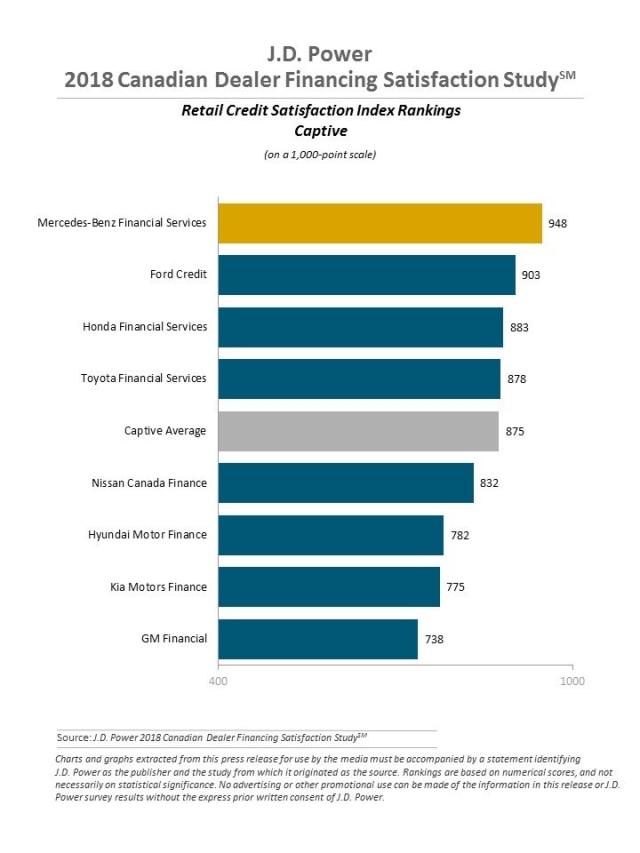

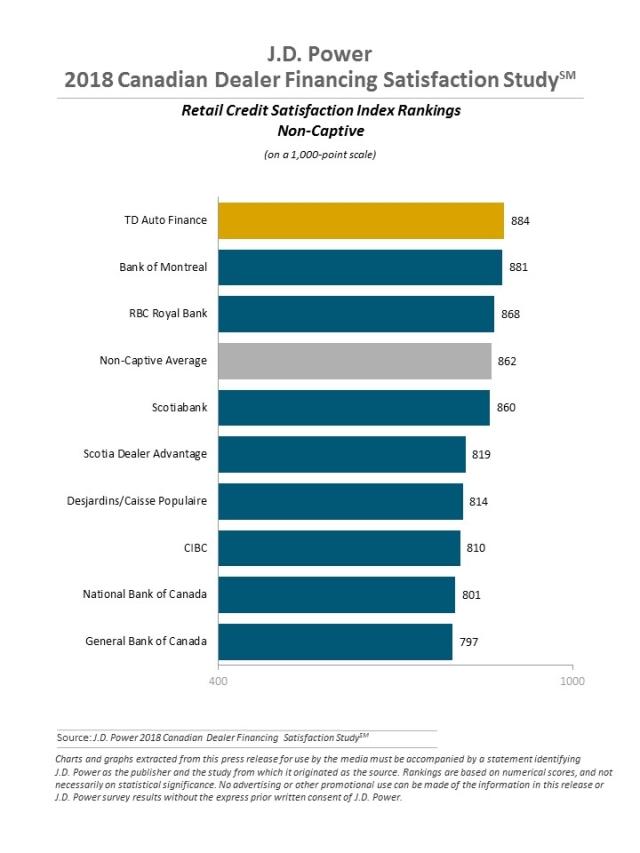

Lender Rankings

Overall dealer satisfaction in the captive segment is 875 (on a 1,000-point scale), a 7-point increase from 2017. Overall satisfaction in the non-captive segment is 862, a 4-point decrease from 2017.

Mercedes-Benz Financial Services ranks highest in the captive lender segment with a score of 948. Ford Credit (903) ranks second; Honda Financial Services (883) ranks third; and Toyota Financial Services (878) ranks fourth.

Among non-captive lenders, TD Auto Finance ranks highest with a score of 884. Bank of Montreal (881) ranks second and RBC Royal Bank (868) ranks third.

The 2018 Canadian Dealer Financing Satisfaction Study captures 4,861 finance provider evaluations across the two segments from new-vehicle dealerships in Canada. The study was fielded in February-March 2018.

For information about the Canadian Dealer Financing Satisfaction Study, visit http://www.jdpower.com/business/resource/canadian-dealer-financing-satisfaction-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe; Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Sandy Caetano, Cohn & Wolfe; Toronto, Canada; 647-259-3288, sandy.caetano@cohnwolfe.ca

Geno Effler; J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info