Record Catastrophic Claims in Western Canada Stress Home Insurers, J.D. Power Finds

Portage Mutual Insurance, The Co-operators, RSA Insurance Emerge from Tough Year for Canadian Insurers with Highest Customer Satisfaction Scores

TORONTO: 5 June 2017 — A record year for catastrophic disasters, from the Fort McMurray fire to floods in Quebec, have put Canadian home insurers to the test in 2017. According to the J.D. Power 2017 Canadian Home Insurance Study,SM released today, a spike in major claims has created significant challenges for insurance carriers, with Western regional carriers as a group experiencing a 10-point year-over-year decline in customer satisfaction with the claims process.

“Catastrophic claims on the scale of what we’ve been seeing over the past few years in Western Canada, and over the past several weeks in Quebec, have put a tremendous strain on insurance carrier resources, affecting everything from longer than average claim payment cycles to customers experiencing greater annual premium increases,” said Valerie Monet, director of the insurance practice at J.D. Power. “Though the immediate effect of these spikes in claims is felt most by regional carriers, some leaders in the industry have found ways to buck that trend by providing truly great customer experiences even in periods of significant operational stress.”

In the overall relationship customers have with their insurer, claims represent a small component of customer satisfaction since not every customer files a claim. So, while claims satisfaction may be slightly down for regional carriers as a result of increased claim volume in the West, customer satisfaction still has improved overall by 37 points (on a 1,000-point scale) due to insurers significantly improving non-claims interactions through their website; local agent/broker; and customer service representatives.

The annual study examines customer satisfaction with their homeowners insurance company by examining five factors (in order of importance): non-claim interaction; policy offerings; price; billing and payment; and claims. The non-claim interaction factor includes three subfactors: local agent or broker; call center service representative; and website. Satisfaction is calculated on a 1,000-point scale.

Key Findings

- Western regional carriers challenged by Fort McMurray fire: While smaller, regional insurers typically outperform national carriers, claim satisfaction among Western regional carriers as a whole declines 10 points in 2017 to 796 from 806 last year. Conversely, claim satisfaction for national carriers in the Western region has increased 22 points year over year to 805. These changes in satisfaction may reflect capacity constraints put on regional carriers operating in Western Canada stemming from the Fort McMurray fire, which was the largest insured disaster in Canadian history.

- Disconnect between perceived and actual coverage: It is too soon to assess exactly how the recent floods in Quebec will affect customer satisfaction, but the study does find a disconnect between perceived and actual coverage for flood damage. Nearly half (48%) of respondents in Quebec say they have overland flood coverage; however, the Insurance Bureau of Canada estimates only 10-15% of Canadian homeowners actually have such coverage.

- One key is to manage expectations: While overall satisfaction among those in the Western region who have had to make a claim is lower compared to those in the Atlantic/Ontario region and Quebec (773, 789 and 812, respectively), average satisfaction scores for carriers in the West that provided a timeline for the claim process and met that timeline is 823.

“When dealing with losses on the scale of the Fort McMurray fire, the logistical challenges faced by carriers can be overwhelming,” Monet said. “But those companies that follow best practices for proactive customer communications can still achieve superior levels of customer satisfaction. This has huge implications for carriers currently dealing with an influx of calls stemming from the flooding in Quebec—regardless of whether the customer is covered.”

Study Rankings

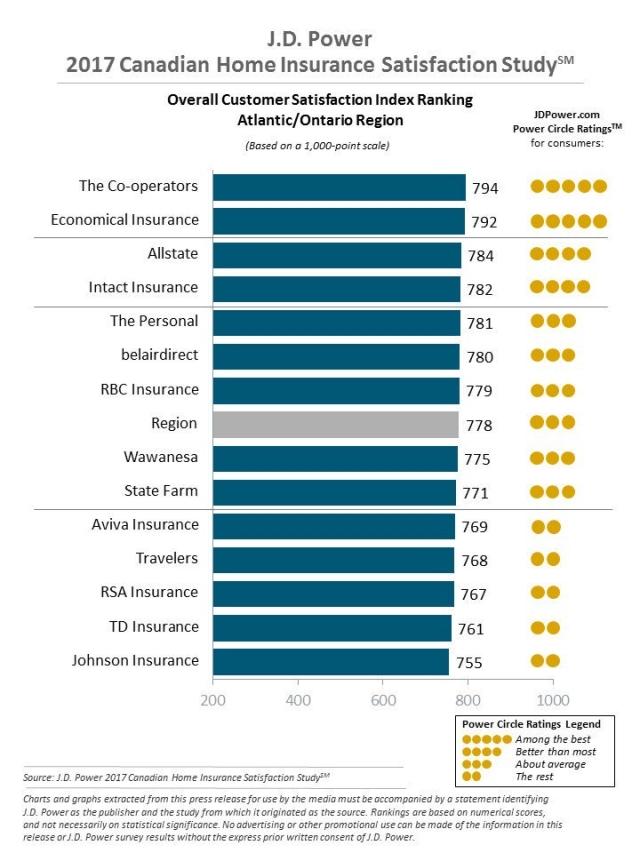

The Co-operators ranks highest in the Atlantic/Ontario region with a score of 794, followed by Economical Insurance (792) and Allstate (784).

RSA Insurance ranks highest in Quebec with a score of 842, followed by La Capitale (832) and The Personal (828).

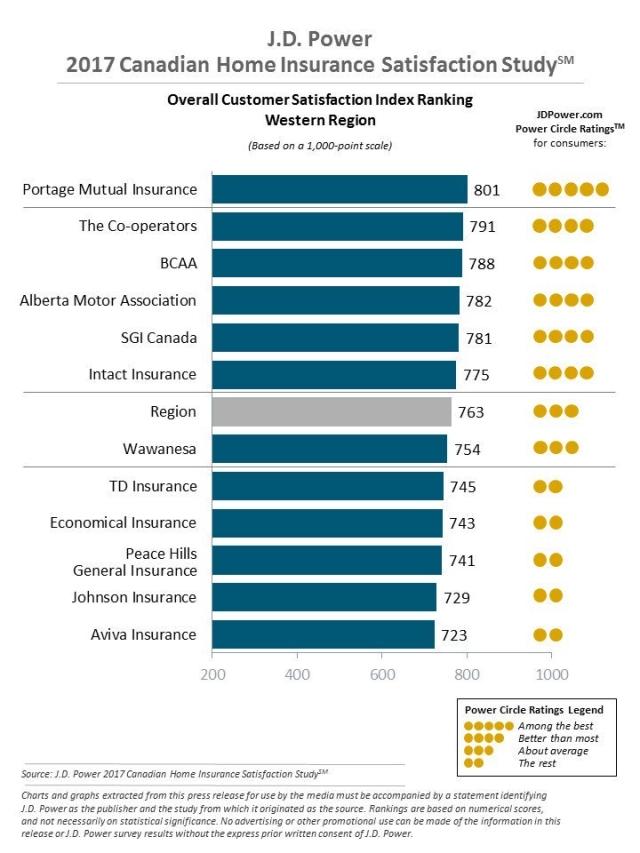

Portage Mutual Insurance ranks highest in the Western region with a score of 801, followed by The Co-operators (791) and BCAA (788).

The 2017 Canadian Home Insurance Study is based on responses from 7,422 homeowners insurance customers. The study was fielded in February-March 2017.

See the online press release at http://www.jdpower.com/pr-id/2017076.

Media Relations Contacts

Gal Wilder, Cohn & Wolfe, Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Jennifer McCarthy, Cohn & Wolfe, Toronto, Canada; 647-259-3305, jennifer.mccarthy@cohnwolfe.ca

Geno Effler; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe.

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info